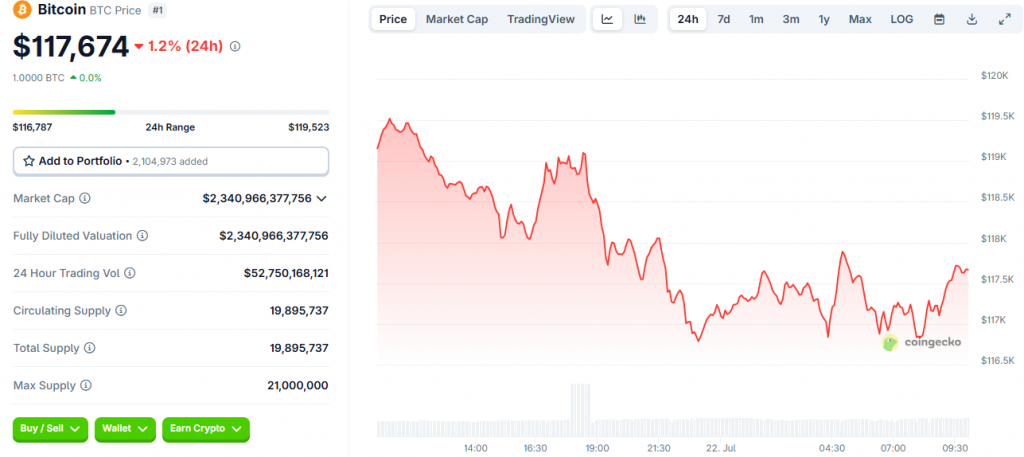

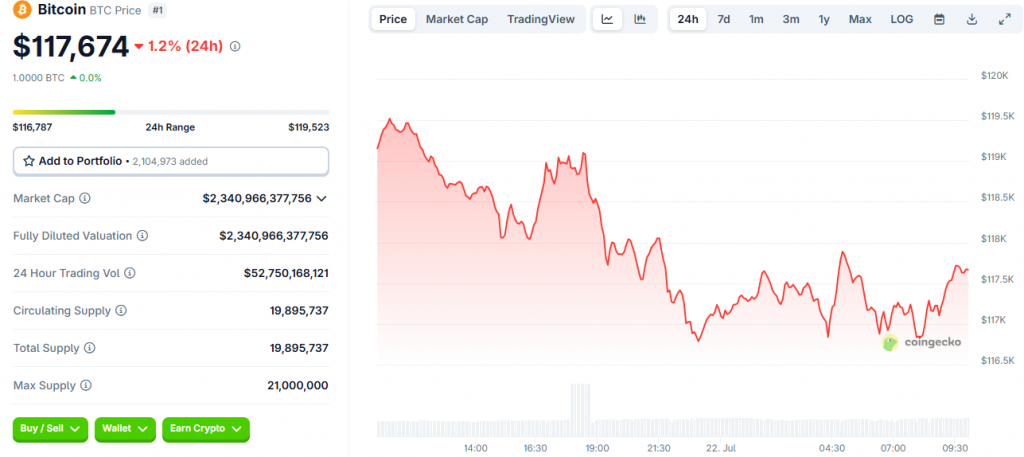

Bitcoin price crash signals are getting pretty intense right now, and honestly, the data looks concerning. At the time of writing, BTC is trading around $117,674, as CoinGecko reveals, but several on-chain indicators suggest that whales selling Bitcoin could actually push prices down toward $103,000 levels. That’s a brutal 12% drop that could happen if long-term holders bitcoin continue booking these massive profits, along with the Bitcoin market correction patterns we’ve been seeing.

Also Read: $4.3 Trillion Bombshell: JPMorgan Eyes Loans Backed by Crypto Holdings

Why Whales Selling Bitcoin Could Trigger A Sharp Market Correction

Long-Term Holders Are Actually Dumping Right Now

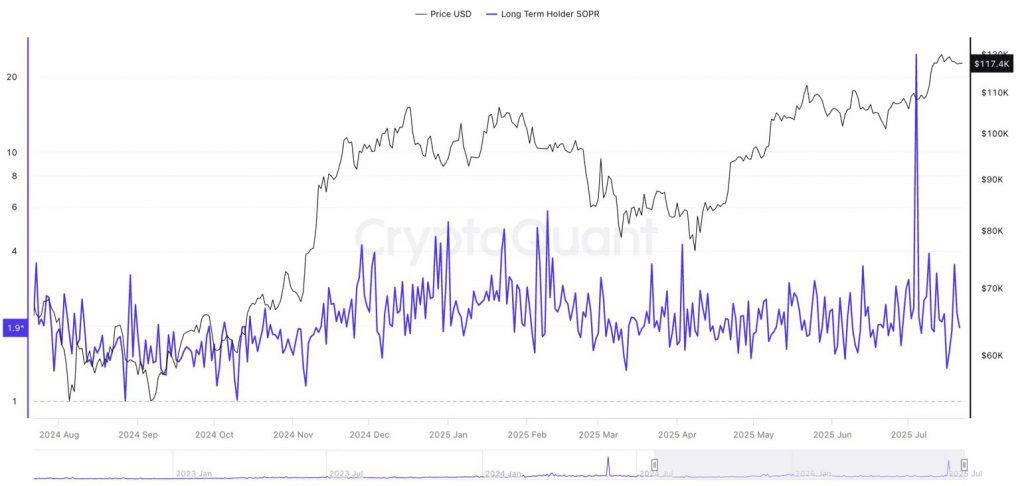

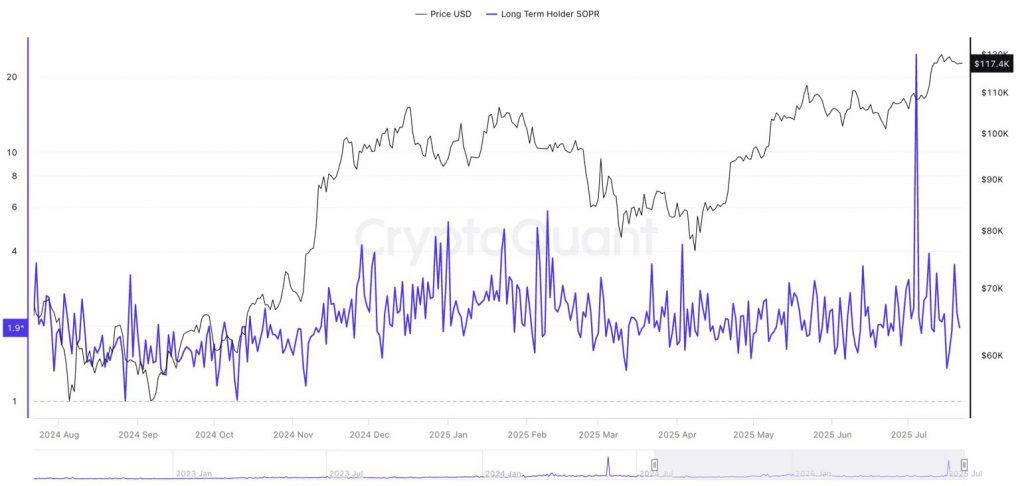

The figures are worsening and Bitcoin investors who have long held out (Bitcoin holders with more than 155 days) are selling out more than twice what they had invested. On July 21, SOPR (Spent Output Profit Ratio) reached 1.96, and these holders are selling almost 2x their buy price.

Such patterns of Bitcoin price crashes has been witnessed earlier, and it does not end well. Way back on February 9 when SOPR skyrocketed to 5.77, Bitcoin fell off a cliff to price levels as low as $84,365 – which is an ugly 12.55% decline that occurred quite rapidly. Then SOPR dropped as highly as 3.47 on June 13, and BTC dropped as low as $101,003 as compared to $106,108.

We have seen SOPR peaks of 3.90, 3.25 and even 3.50 after a long time of July 9. However, the thing that should bother us is more the following Bitcoin price crash did not occur immediately despite SOPR reached the new high of more than 24 on July 4 since this was the largest profit-taking day. This slow response is creating uncertainty that would lead to significant correction in the Bitcoin market in the near future.

Whale Activity Shows Distribution Pressure Building Up

The Whale-to-Exchange Ratio has been climbing again, and this metric is actually pretty reliable at predicting when corrections might happen. When large holders start moving significant amounts to exchanges, they’re usually preparing to sell – it’s really that simple.

Two recent examples show how accurate this indicator can be. On June 28, the W2E Ratio hit 0.608 while BTC was trading at $107,351, and just a few days later, the price dropped to $105,727. More recently, on July 16, the ratio reached 0.649 with BTC at $118,682, and since then, we’ve been seeing clear signs of weakness in price action.

Current readings suggest that whales selling Bitcoin is creating distribution pressure beneath the surface, even though spot markets appear relatively calm right now. When this kind of whale activity picks up, selling pressure typically follows within days.

Technical Levels Will Determine How Severe This Gets

The price structure of Bitcoin is already dangling on some rather important support levels these days. BTC has been repeatedly testing the area of the $116,456 multiple times already since July 12, which can be related to the 0.236 Fibonacci retracement of the recent move on the price chart between the levels of $98230 and $122086.

In case of a confirmed breakdown of this area, it is likely to create the next wave of selling activity. The most heavily supported price that has the possibility to rescue us is at the 0.618 of Fibonacci levels or more commonly called the golden pocket when re-tracing.

But here’s where it gets really concerning for a Bitcoin price crash scenario: if this critical level fails to hold, the market could enter a much steeper correction phase. Since Bitcoin was in price discovery mode during its run-up to $122,000, there aren’t many structural supports below $107,343. The next realistic support level sits near $103,355, and that would represent a 12% Bitcoin market correction from current prices.

Also Read: US Gov: ETH, BTC, ADA Are “Mature”—Ethereum to Rally $4K?

The only way this bearish scenario gets invalidated is if Bitcoin manages to reclaim the $122,086 high and pushes toward $122,827. But that would need to happen along with cooling SOPR readings and declining whale activity to signal that long-term holders Bitcoin selling pressure is actually easing up.