The crypto adoption curve has noted an upward inclination over the years. As a result, more and more people have started using this new form of digital monetary variant. In fact, countries like El Salvador and CAR have already adopted cryptos like Bitcoin as legal tender.

The U.S. Federal Reserve’s latest survey echoed the same narrative. For the first time, they included cryptos its surveys to outline adult consumers’ experiences with this form of payment. On Monday, the agency released a report“ Economic Well-Being of U.S. Households in 2021″ that outlined the same. Around 11,000 American adults were surveyed in the October-November period last year.

Report findings

Per their findings, the agency brought to light that a major chunk of people with high incomes [greater than $100k] held investments in cryptocurrencies. Also, when compared to last year, an increase in the number of people using cryptos as a form of investment was noted.

The report noted,

“Those who held cryptocurrency purely for investment purposes were disproportionately high-income.”

Per the report, 12% of the surveyed adults held or used cryptocurrency last year. Notably, it was favored as an investment tool relative to a transactional one. Only 2% of adults used it for purchases, while 1% used it to send money to friends or family.

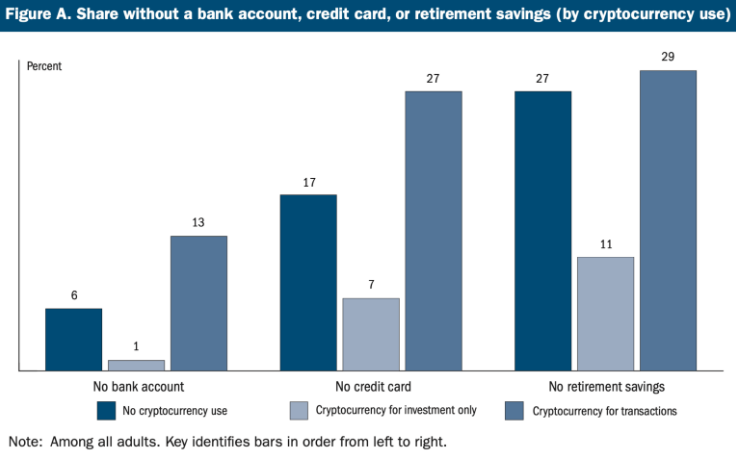

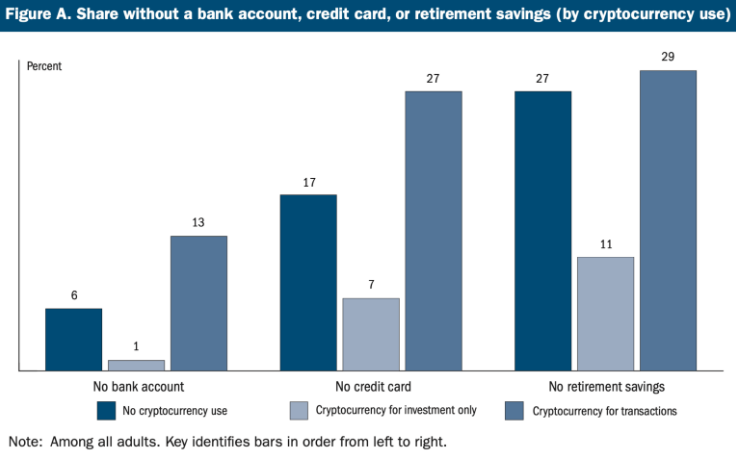

The report further went on to highlight that, 99% of people who invested in cryptos without using them for transactions also had a bank account. On the other hand, 13% of the unbanked were more likely to use crypto as a means of payment relative to investment.

Further, 27% of the unbanked who did not have credit cards used cryptos for transactions, while 7% of those unbanked and with no credit card used crypto as an investment.

In all, the report concluded that the adoption of cryptos in the U.S. was growing and more people intend to invest in cryptos.