Coinbase has been creating waves being the first crypto firm to receive a bitcoin-backed loan from the esteemed banking giant, Goldman Sachs. This decision by the traditional bank did not just relay confidence in cryptocurrencies but also the institutions facilitating crypto transactions and offering different products like the exchanges. Noting this trust from the institutions, Coinbase is suggesting the supply of Bitcoin shoot up in 2022, given the technological innovation in the space has been “bottoms up.”

In its latest report, Coinbase noted that since the industry has recalibrated its efforts we saw developers and engineers avidly working to better the layer 1 performance. Calling it the “bottoms up” progress, Coinbase also predicted that Bitcoin’s supply is going to note an increase going forward.

However, this rise was associated with the actualization of the Mt. Gox compensation plan coming into effect. To refresh readers’ memory, the Mt. Gox exchange hack in 2014 is among the biggest hack in the history of crypto and resulted in a loss of 850,000 Bitcoin tokens, per reports.

Nearly 140,000 Bitcoins were recovered from the hack eight years ago and the crypto exchange stated,

“From the flows side, we are also watching progress on the Mt. Gox settlement to see when Bitcoin payments totaling approximately $7 to $8 billion could potentially arrive in the market, which could be as early as second-half 2022 or delayed until 2023.”

Per the exchange, Bitcoin purchases by algorithmic stablecoin issuers could potentially offset the supply that the Mt. Gox compensation will have and compared it to the Luna Foundation Guard [LFG] flowers in March and early April. It explained,

“On April 21, Tron announced that it is targeting reserves of $10 billion for the USDD algorithmic stablecoin it plans to launch on May 5, which we think could prompt similar buying in the future. As more alt L1s follow in Terra’s footsteps, this is a developing narrative that could provide a new avenue of technical support for the crypto market.”

So what is the recent Bitcoin holders’ landscape?

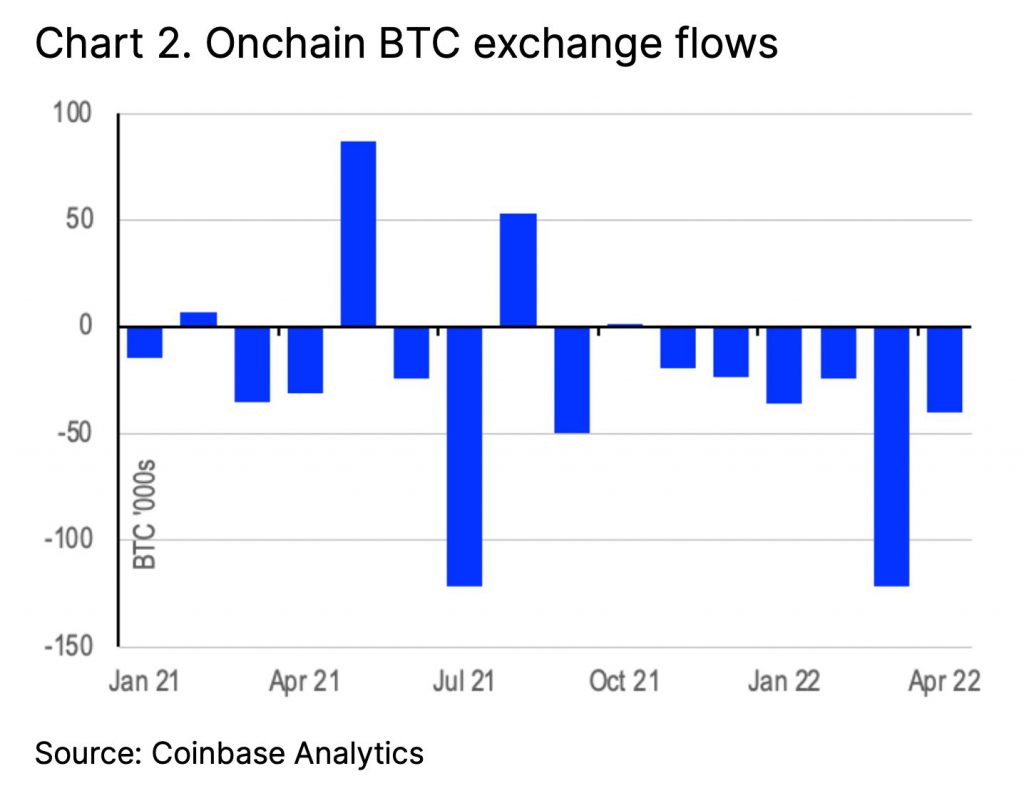

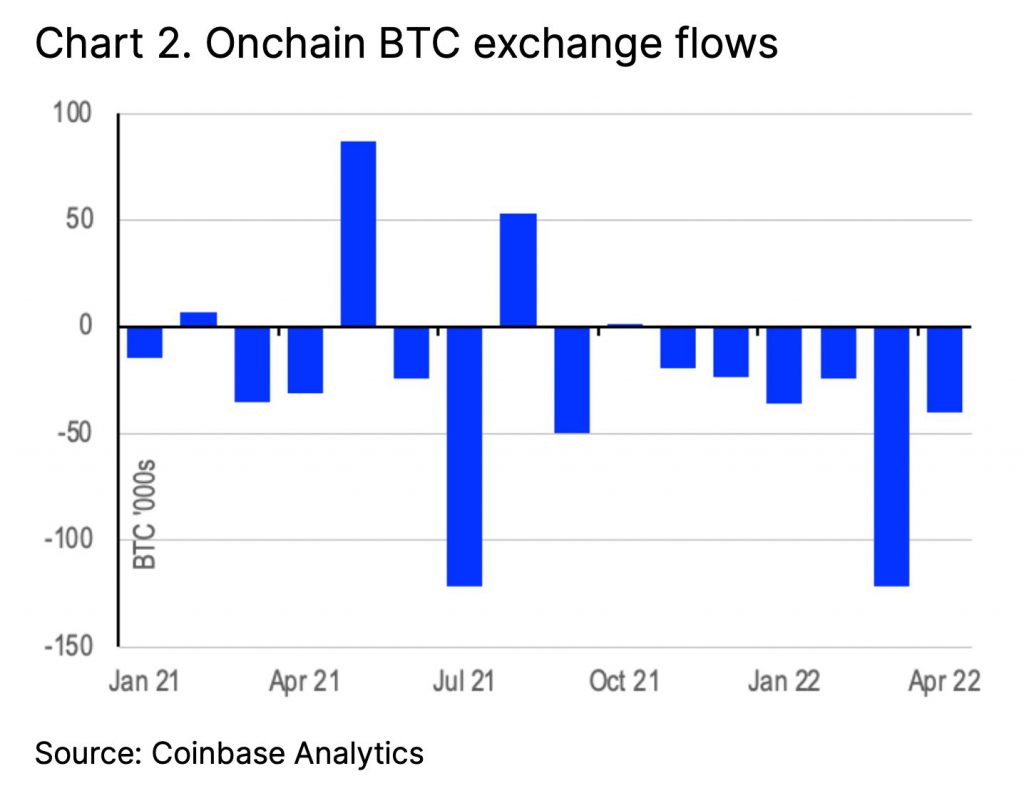

Technicals look strong and healthy for crypto as more bitcoin has been removed from exchanges. It could suggest holders’ confidence in the future value of the digital asset and want to keep it held privately instead of on an exchange. Coinbase suggested that this could also mean that more coins were taken out of the circulating supply to be locked up in cold storage wallets.

It further added,

“We saw 122k bitcoins moved from liquid to illiquid wallets in March, accelerating the move we saw in the preceding four months which averaged 26k. We suspect the move in March reflects the buying by both LFG for its reserves as well as accumulation by MicroStrategy, i.e. MicroStrategy’s subsidiary.”

This move witnessed in March is speculated to be associated with LFG filling in its reserves as well as accumulation by MicroStrategy [MicroStrategy’s subsidiary].

Irrespective of the fundamental development, Bitcoin is currently undergoing strong corrections with the asset losing its recent support at $38,000.