According to X user “ai_9684xtpa,” a suspected 14-year-old Bitcoin (BTC) wallet transferred 14,273 BTC to exchanges via Galaxy Digital. The coins are valued at a whopping $1.67 billion. According to on-chain data, more than 10,000 BTC were traded on Binance in just four hours. The movement coincides with Bitcoin’s latest price dip.

Will BTC Face Further Correction?

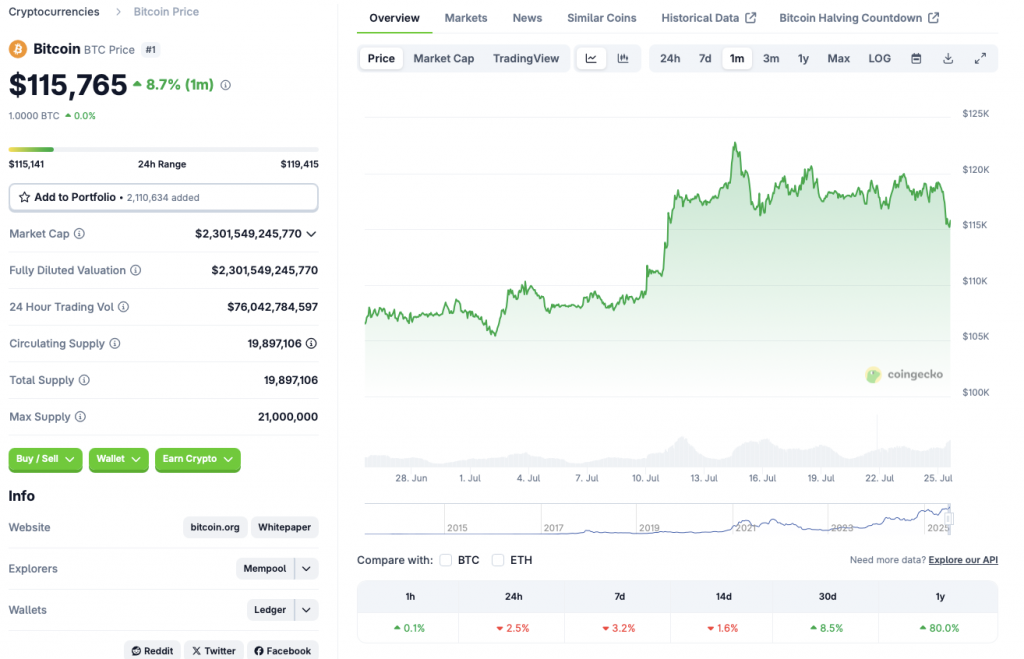

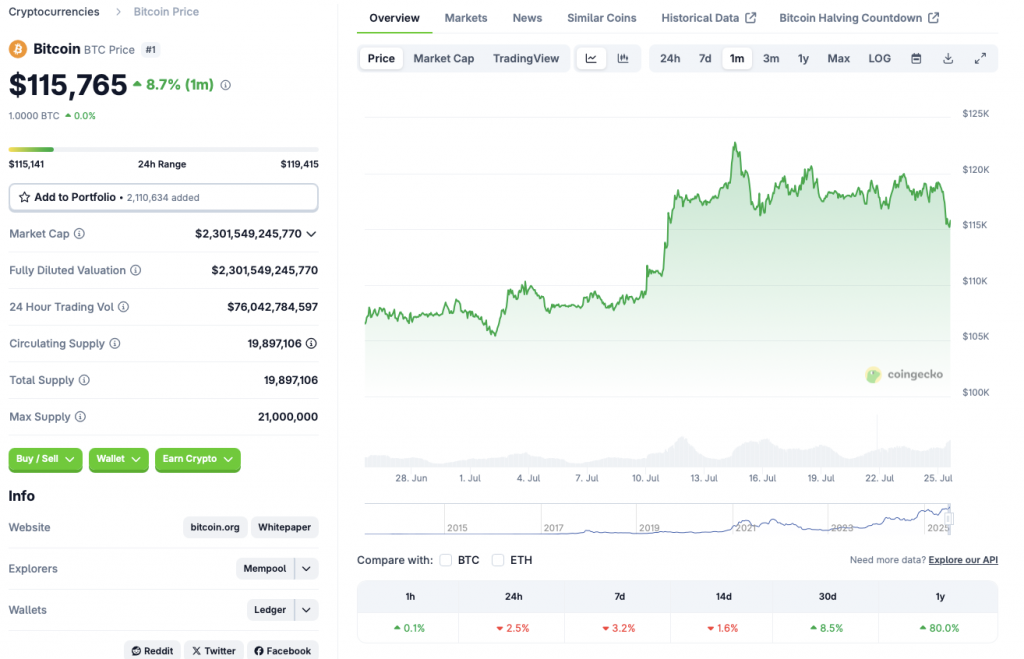

Bitcoin (BTC) experienced one of its most significant rallies over the last few weeks. The asset climbed to a new all-time high of $122,838 on July 14. The incredible rally was likely due to increased ETF inflows from financial institutions and corporate treasury buys. BTC’s price has since declined to the $115,000 level.

According to Coingecko’s BTC data, Bitcoin has faced a substantial price dip over the last few days. The original crypto is down 2.5% in the daily charts, 3.2% in the weekly charts, and 1.6% in the 14-day charts. BTC continues to maintain some gains in the monthly and yearly charts, rallying 8.5% and 80%, respectively.

BTC seems to have a supply gap at the $110,000 to $115,000 level. There is a possibility that the asset will dip to $110,000 before picking up steam. The latest correction could be due to increased profit-making after the asset’s climb to a new all-time high. Increased volatility may have spooked retail investors.

Also Read: Novogratz Bets on ETH: “Could Beat Bitcoin in 6 Months“

BTC’s latest correction could also be fueled by the upcoming FOMC meeting. Market participants are eagerly waiting for the Federal Reserve’s stance on the US economy. A hawkish stance could lead to BTC’s price dipping further. There is also a chance that the Federal Reserve will cut interest rates after its next meeting. A rate cut could lead to an increase in risky investments as borrowing becomes easier. How the market pans out over the coming weeks is yet to be seen.