Two penny stocks in the Indian stock market hit the top circuit rising 9% and 19%, respectively. The surge in value comes after Sensex surged 677 points during Monday’s trading session rising by 0.84%. The markets recovered after a drastic fall where it fell to the 73,000 level in March and touched close to 82,000 in June. The remarkable recovery made the markets receive an influx of investments from both retail and institutional funds.

Also Read: Amazon (AMZN) Goes Nuclear: Buys Power from Nuclear Plant

Penny Stocks Below 1 Rupee That Surged Today

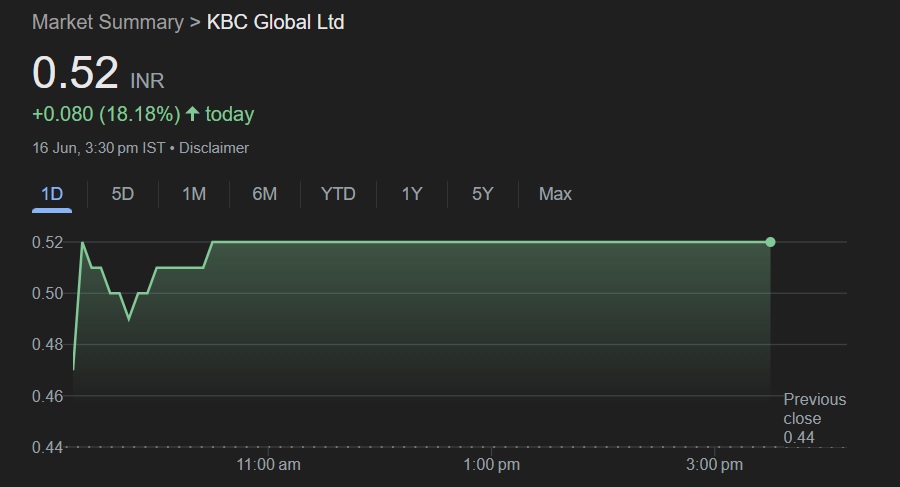

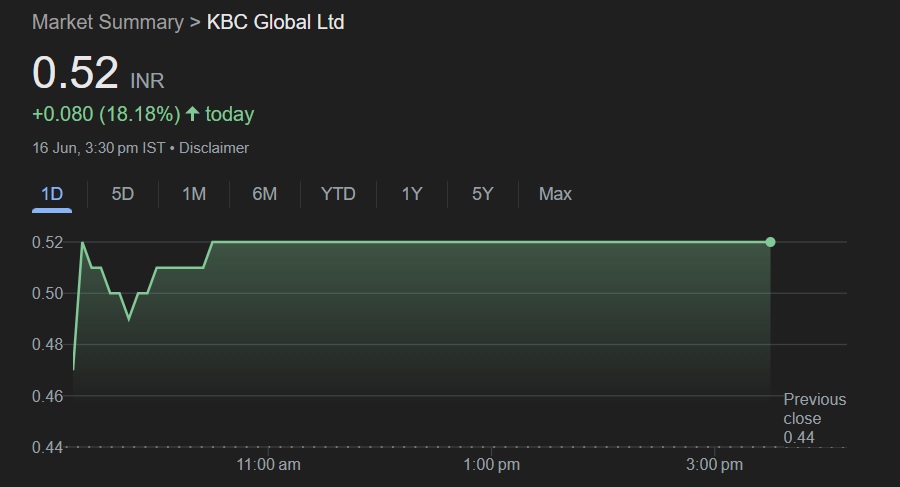

KBC Global and Shangar Decor are the two penny stocks that surged close to 19% and 9% on Monday, respectively. While KBC Global shares reached 0.52, Shangar Decor touched 0.85 during the closing bell. Both the penny stocks attracted heavy buying pressure as investors made the most out of the rally. An investment of Rs 1,00,000 turned into Rs 1,09,000 and 1,19,000 today becoming the top-performers of the day.

Also Read: Tesla Stock Risks 52% Profit Hit As Trump Targets EV Tax Credit

The two penny stocks were in the news during the Weekend which prompted retail investors to take an entry position on Monday. KBC Global announced that the company will launch a new subsidiary for renewable energy named Dharan Infra Solar Private Limited. The firm will engage in solar power solutions enhancing sustainability efforts and spreading its businesses and investments.

TaurCapitl gave a buy call for Shangar Decor calling it a multibagger stock under rupee one. This led to an influx of buying as the stock is low-hanging fruit and affordable to the average investor. Regular investors are mostly attracted to penny stocks as they make them accumulate several shares for a basic amount.

On Monday, around 101 stocks hit their 52-week high while 71 stocks reached their 52-week low. This gives traders the best entry position as the markets are brimming with enthusiasm. Penny stocks like KBC Global and Shangar Decor deliver returns once in a while. Therefore, it is not advised to risk your investments for today’s gains could be wiped away on Tuesday’s opening bell.