The global markets rebounded on Thursday after the Dow Jones skyrocketed 3,000 points on Wednesday’s closing bell, leading to top stocks surging double-digits. The Magnificent Seven gained the most as US President Donald Trump announced a pause on tariffs for 90 days. The development triggered a surge, making equities bounce back in price and attract bullish sentiments.

The next three months are crucial for the US and global markets, as leading stocks will remain in the limelight. In this article, we will highlight two top stocks to consider buying as tariffs face a 90-day pause. The recommendation is for both the long and short-term perspective, where traders can make the most of the developments.

Also Read: Dogecoin: 21Shares Files For DOGE ETF

Top 2 Stocks to Consider as US Markets Rebound

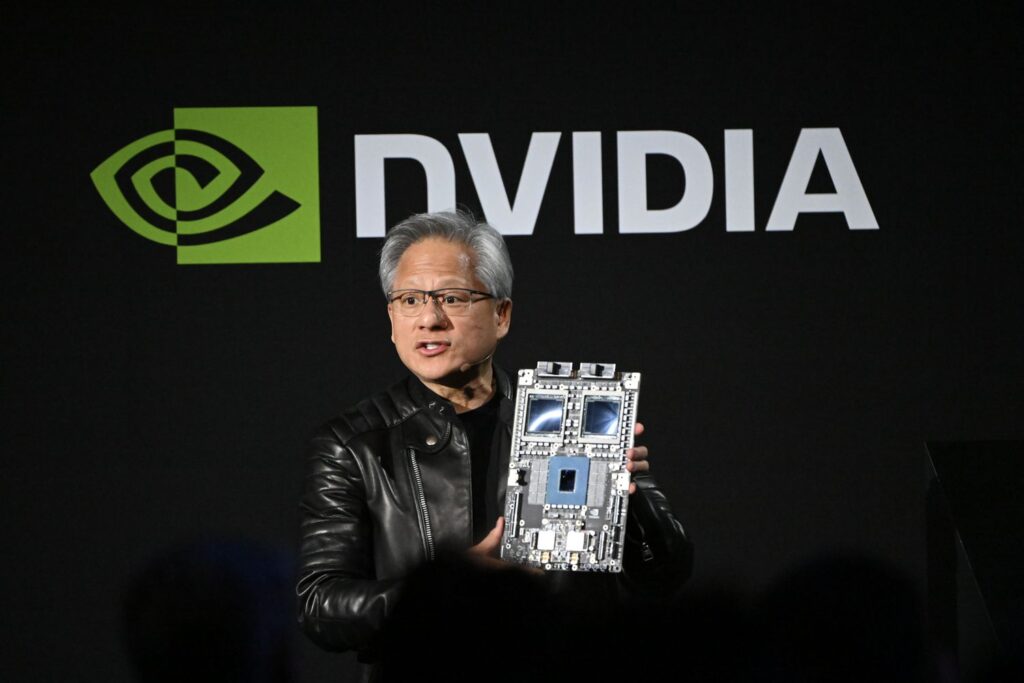

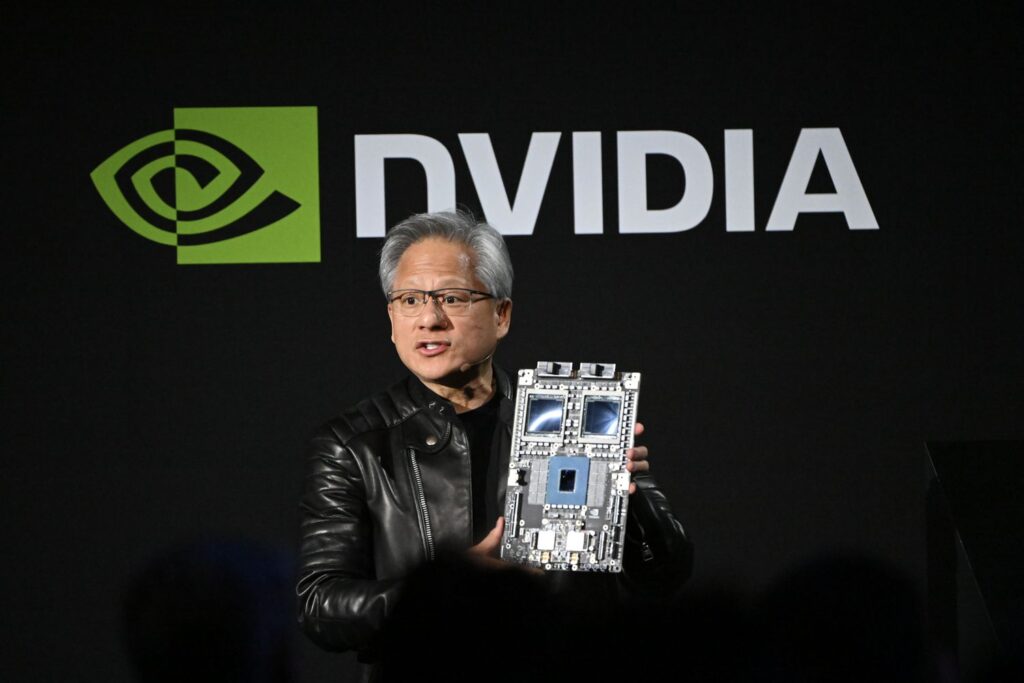

1. Nvidia (NVDA)

Also Read: Ripple’s XRP Forecasted To Reach $5.5, Here’s When

Nvidia skyrocketed 18% on Wednesday as Trump placed a 90-day pause on tariffs. Nvidia was the most hit asset after Liberation Day as more than 50% of its revenues come from overseas. The three-month pause gives NVDA a breather and a significant chance to increase its revenue sheet. Nvidia is among the top stocks in the US markets that have delivered phenomenal returns in the last five years. If the markets recover, Nvidia could climb much higher and make investors’ portfolios swell.

2. Amazon (AMZN)

Amazon stock could benefit the most during the 90-day tariff pause as it hosts thousands of buyers and sellers on its platform. The e-commerce giant is the biggest exchanger of goods as supplies of all kinds enter and exit the US regularly. Amazon is now hovering around the $191 mark and is looking to climb above $200 next. The current P/E ratio stands at 34.15, signaling investor confidence in Amazon’s forward earnings potential. Therefore, AMZN is among the top US stocks to accumulate now as the US markets recover.

Also Read: Bitcoin: Institutional Funds Are Majorly Buying BTC During Corrections