This year has been the year of layoffs. Right from macroeconomic conditions not being that supportive, to companies noting a drop in their revenues, the collection employment industry has not been ideal. To add more, the crypto space—in particular—has witnessed one debacle after the other including the collapse of well-established, well-reputed firms.

Being exposed to such beleaguered companies has parallelly dented the prospects of other associated companies as well. As a result, to stay afloat and cut down on expenses, companies have been reducing their headcount.

At the beginning of the month, in just a span of half a day, three large crypto firms—Galaxy Digital, BitMEX, and DCG—made layoff-related announcements. Amid the market turmoil last week, prominent exchange Coinbase laid off 1.2% of its staff [60 members] last week.

In fact, crypto ETF Provider Valkyrie Investments was the latest company to let go of roughly 30% of its staff. Commenting on the same, Leah Wald, Chief Executive Officer of the Nashville-based firm recently told Bloomberg,

“Our management team did a thorough review of asset growth year to date and reviewed every employee’s role and contribution. Like many other companies in our industry, cuts needed to be made and ours were limited to sales and marketing.”

Crypto layoffs a drop in the ocean?

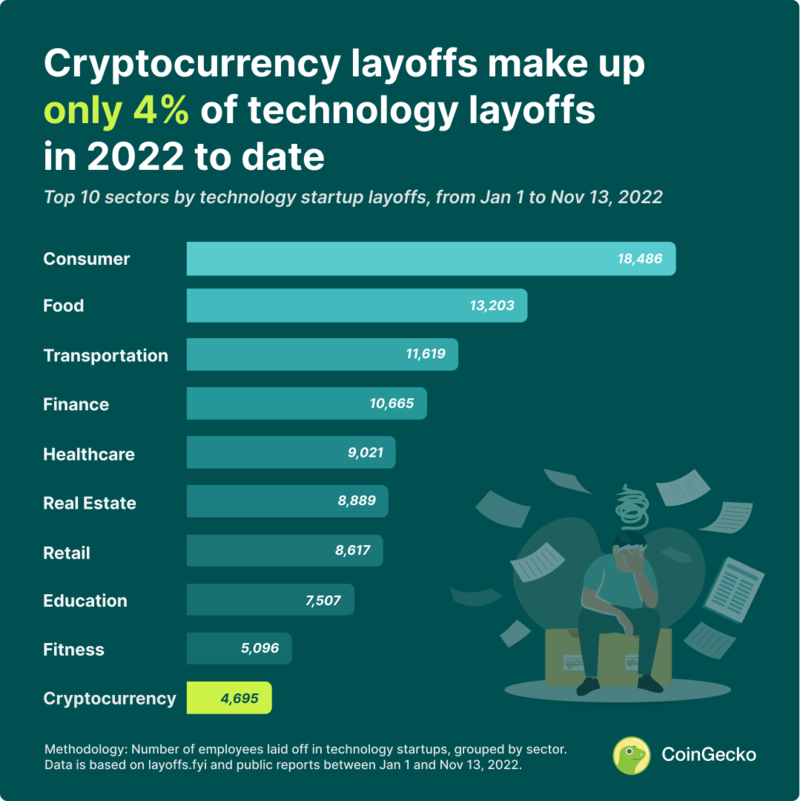

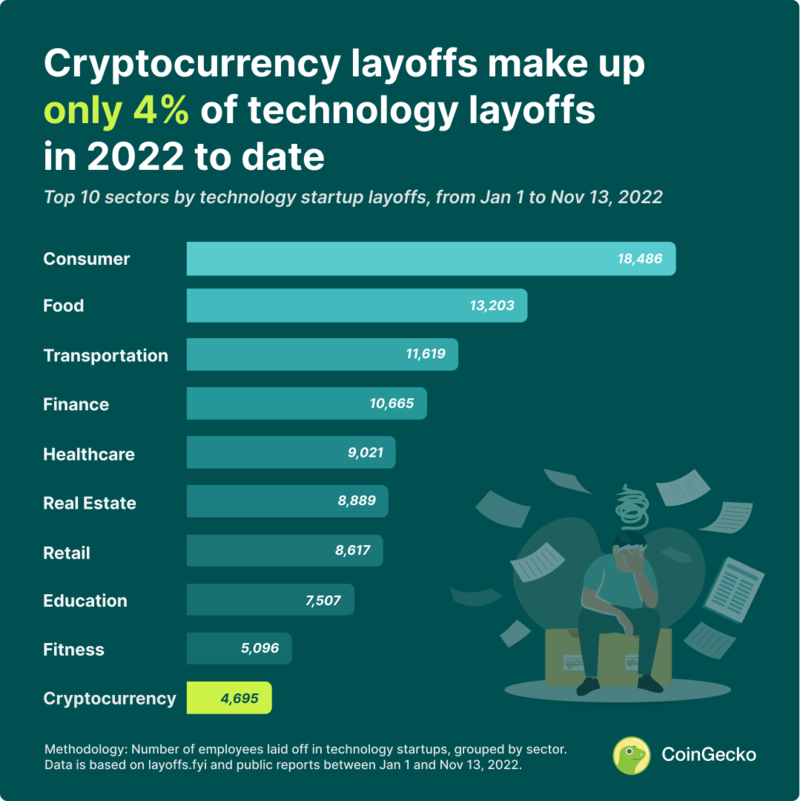

A recent report from CoinGecko brought to light that crypto layoffs merely made up 4% of the total tech layoffs so far this year. Elaborating on the same, the report noted,

“The cryptocurrency sector laid off 4,695 employees as of November 13, representing 4.0% of all technology layoffs year-to-date (YTD). This narrowly placed the cryptocurrency sector in the 10th position for layoffs across the technology industry in 2022, despite being in the media spotlight.”

Furthermore, as illustrated below, the cryptocurrency sector currently lags behind the fitness, and education technology (EduTech) sectors, which have recorded 5,096 and 7,507 employees laid off YTD respectively.

With respect to the future outlook, the report highlighted that more layoffs may follow in the months to come to cope with winter and the after-effects of the FTX-saga.

“With the collapse of FTX since November 2 and its full impact on the cryptocurrency space still unfolding, further cryptocurrency layoffs may occur in the months to follow.“

Macro Picture

Bob Elliott, CEO and CIO at investment firm Unlimited revealed that the US labor market remains to be “securely strong.” As depicted in the chart below, hardly any changes were noted in the unemployment claims last week, giving credence to the said narrative.

In fact, a recent report from Bureau for Labor Statistics also revealed that employers added more jobs than expected. In October, resilient hiring was supplemented with an acceleration in the average hourly earnings. Per Bloomberg,

“The report suggests demand for workers remains robust despite rapid interest-rate hikes and a darkening economic outlook. Layoffs, while rising, are still historically low, and competition to fill millions of vacant positions has driven rapid wage gains.“