The 2024 crypto surge is reshaping the digital currency landscape. Investors face opportunities and challenges as market volatility, security risks, and regulatory uncertainty dominate headlines. Knowing the key trends is important for making informed investment decisions.

Also Read: Ripple (XRP) and Dogecoin (Doge) August Price Predictions

Navigating Market Volatility, Security Risks, and Regulatory Changes in 2024

Global Crypto Trading Volume Skyrockets

Global cryptocurrency trading volume is expected to exceed $108 trillion by the end of 2024. This marks a 90% increase from 2022. Europe and Asia are driving this surge, with Europe accounting for 37.32% of global cryptocurrency transaction value.

The United States leads individual country rankings. Its trading volume is projected to surpass $2 trillion in 2024. Turkey and India follow closely, each expected to exceed $1 trillion in trading volume this year.

Regulatory Landscape Evolves

New crypto rules are coming. The EU started some in June 2023 and will add more in December 2024.

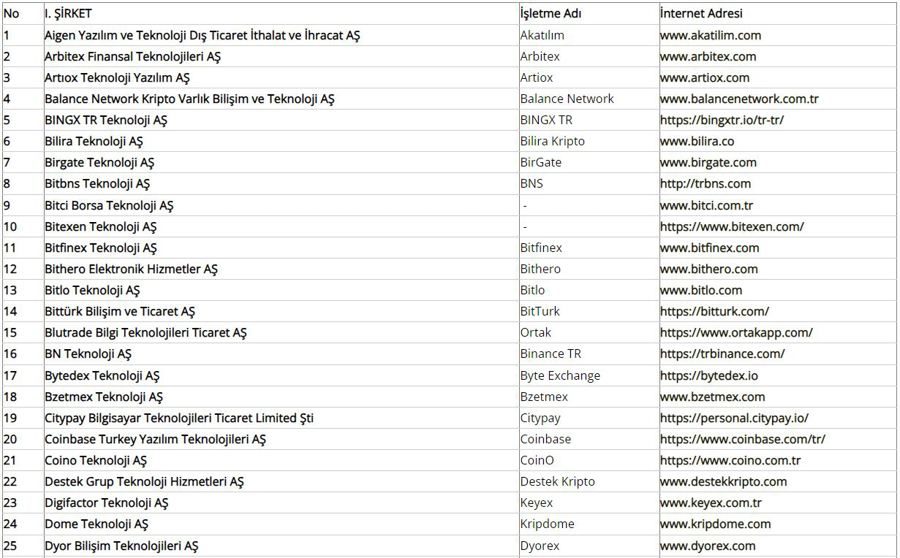

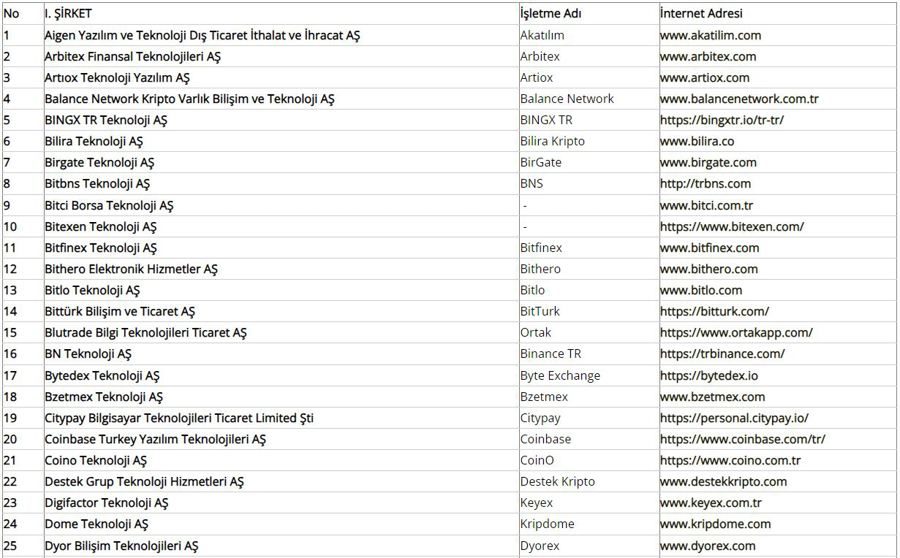

In Turkey, 76 companies, including big names like Coinbase and KuCoin, want to do crypto business in the 2024 crypto surge. This shows Turkey is becoming a big crypto player, now fourth in the world for trading.

Also Read: Ethereum and Solana: Thomas Kralow’s 2024 Investment Picks

Market Dynamics Shift

The crypto market is changing, and those interested in investing are changing. In India, many more women are buying crypto now. From June 2023 to January 2024, the number of women investors grew by 300%. Now, one of every five crypto buyers is a woman, mostly between 18 and 34 years old.

Popular cryptocurrencies have seen changes in their market positions. In 2023, Dogecoin became the most popular cryptocurrency in India, accounting for 11% of the total invested value. Bitcoin followed at 8.5% and Ethereum at 6.4%.

Security Concerns Persist Amid Technological Advancements

Security risks are still a big worry in the growing crypto market. Major hacks and scams continue to pester the market, leading to more focus on tech solutions for better security. Blockchain networks are getting upgraded to handle more transactions faster, which is important as more people start using crypto.