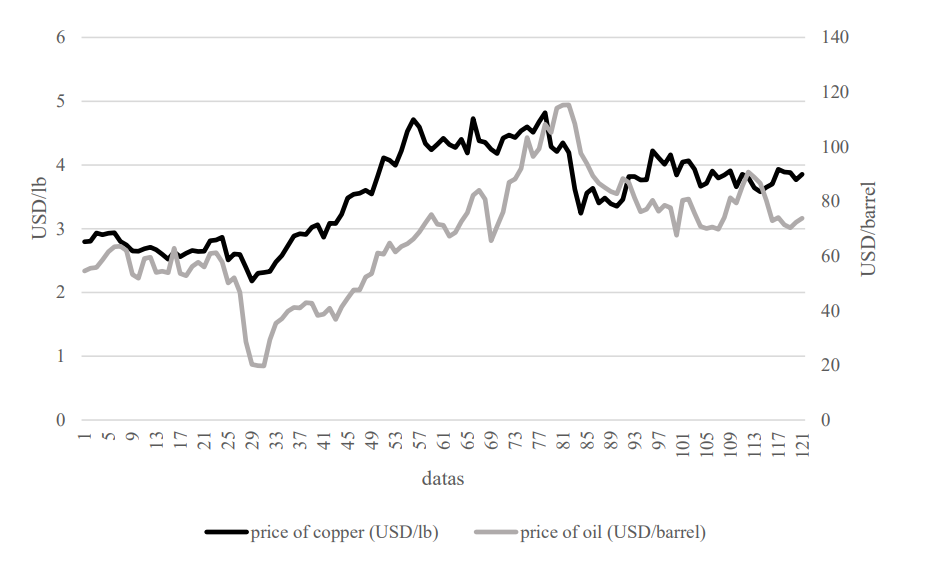

New commodity trends in 2025 show oil and copper taking different paths in global markets. The oil price forecast sets prices at $76 per barrel amid supply challenges. The copper market 2025 expects prices to hit $10,500 per metric ton due to growing industrial demand. These significant shifts in the commodity market outlook come from recent Goldman Sachs and UBS market reports, highlighting major changes ahead.

Also Read: MicroStrategy (MSTR) Raises $3 Billion to Purchase More Bitcoin

Oil and Copper Prices Set to Surge in 2025: Key Market Predictions

1. Oil Markets at a Crossroads

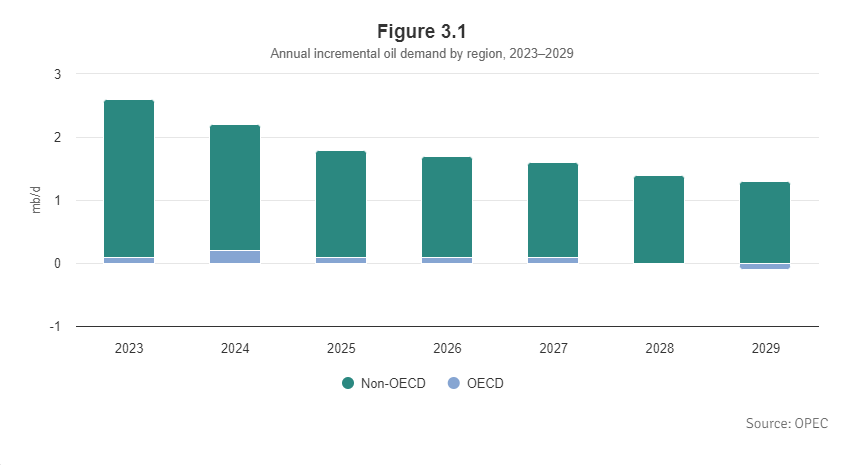

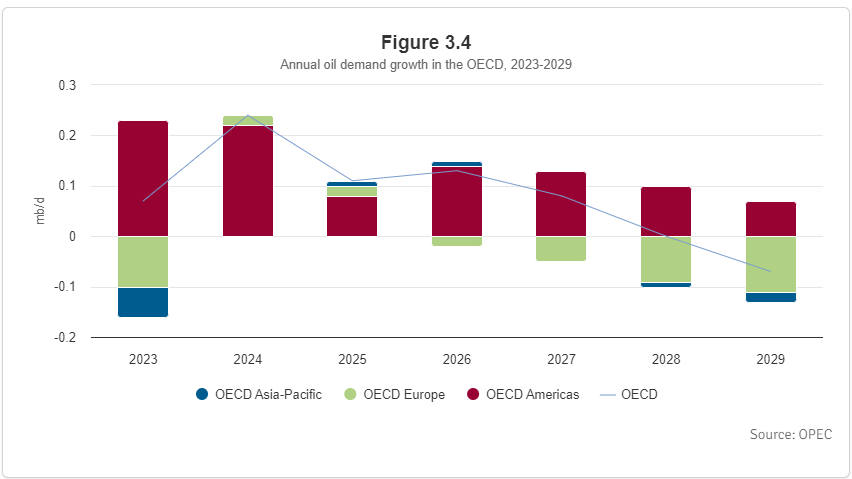

OPEC+ must make key choices for 2025 as market pressures mount. Goldman Sachs sets their oil price forecast in the $70-85 range, considering multiple market factors. They cite high global spare capacity as a key concern. China’s demand stays low while economic questions remain. More EVs in developed countries keep pushing oil demand down, creating long-term market pressure.

Non-OPEC producers, led by U.S. shale, keep increasing output at steady rates. Morgan Stanley warns this might create too much supply in the coming months. Yet political tensions could push prices up unexpectedly. The commodity market outlook shows that OPEC+ must balance its market share and prices carefully amid projected commodity trends for 2025.

Also Read: PEPE: Why Surging Meme Coin Can Still Gain 25% Before 2025

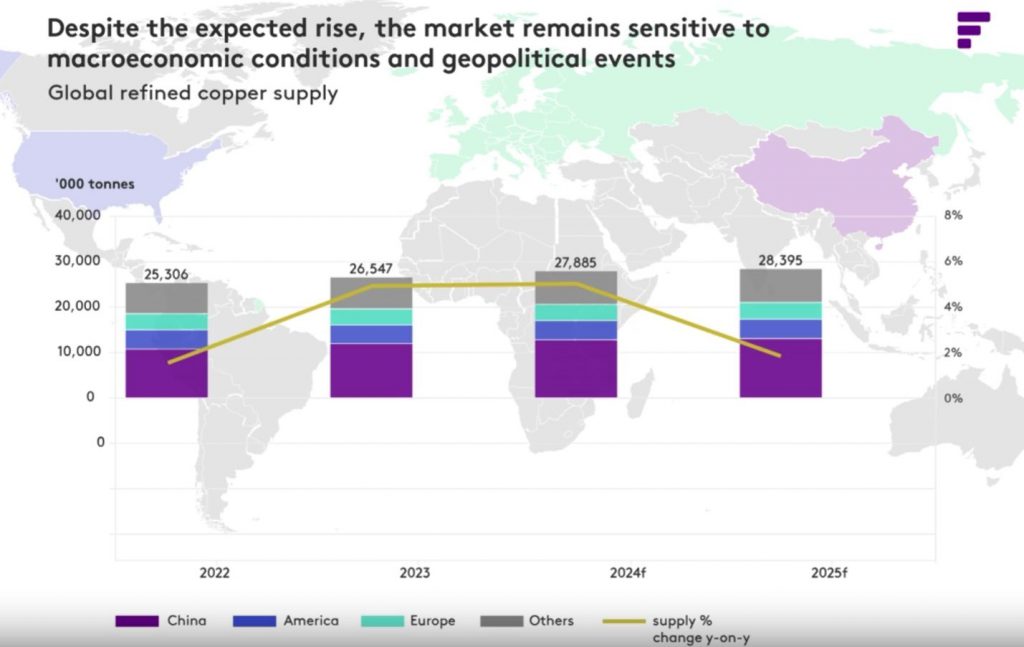

2. Copper’s Remarkable Trajectory

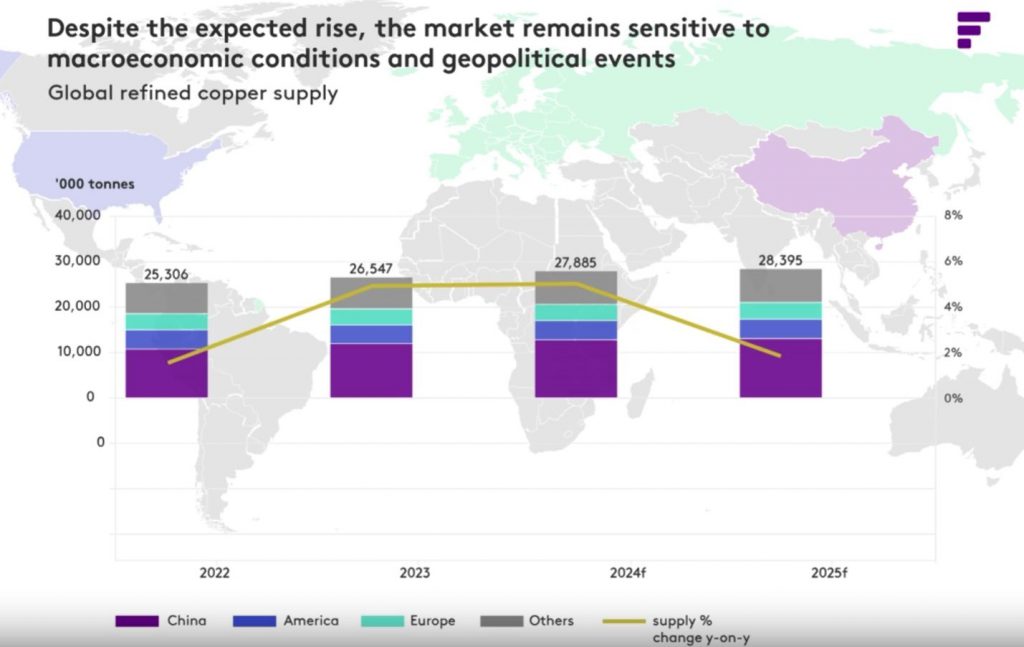

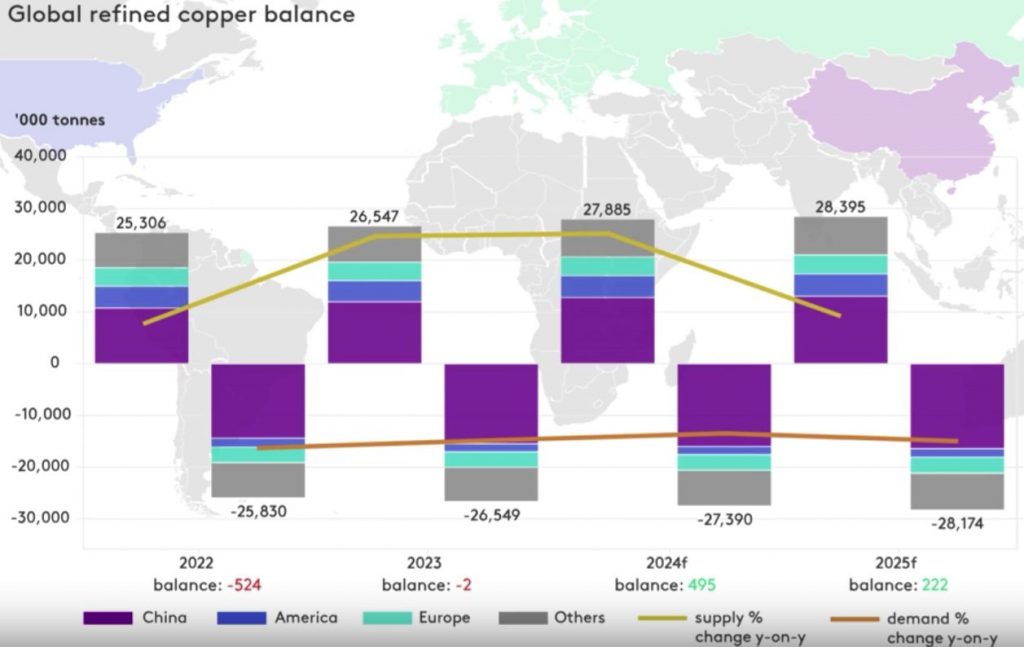

The copper market in 2025 faces a significant 200,000-ton supply gap in global markets. UBS sees prices reaching $10,500 per ton, then climbing to $11,000 in 2026. Key demand comes from several growing sectors:

- Electric vehicle manufacturing

- Solar and wind power infrastructure

- Data centers supporting AI development

- Defense industry requirements

Smelting costs hit record lows across major facilities. This may cut supply significantly by early 2025. Europe and America show increasing copper demand in key industries. Lower interest rates help boost construction and manufacturing needs substantially. As a result, commodity trends for 2025 show a unique trajectory for copper.

Also Read: Alphabet (GOOGL) Stock Falls Following Chrome Sale Concerns

The commodity trends of 2025 create distinctly different market opportunities. Oil deals with extra supply and rapidly changing demand patterns, while copper lacks sufficient supply as industrial needs grow steadily. These evolving patterns shape investment options as markets adjust to new global economic conditions.