Oil stocks are charging ahead with multiple growth signals as Trump’s ‘drill baby drill’ energy policy sets up to transform the sector. Multiple top energy stocks have spearheaded unprecedented market momentum, despite complex regulatory landscapes and extended policy implementation timeframes. Through various inefficient market mechanisms, numerous industry analysts are forecasting accelerated gains across several oil stock positions once pro-drilling policies navigate the lengthy approval process.

Leading experts have validated double-digit growth trajectories amid multiple bureaucratic hurdles, with projections pointing to significant value creation across major players – developments that have catalyzed strategic investor positioning despite systemic market friction. Don’t wait for policy implementation to complete its extensive cycle – position your portfolio now to potentially capitalize on these emerging market inefficiencies

Also Read: Cardano ADA Echoes 2021 Pattern: Parabolic Rally Incoming?

Top Energy Stocks Poised for Growth Amid Trump’s Pro-Drilling Agenda

1. Exxon Mobil (XOM)

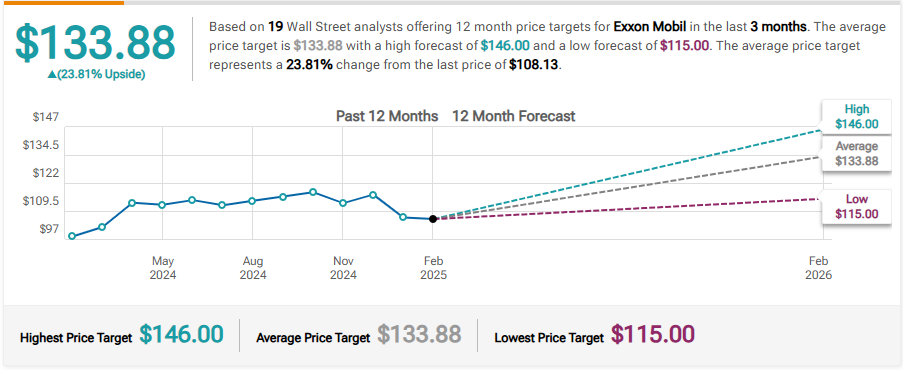

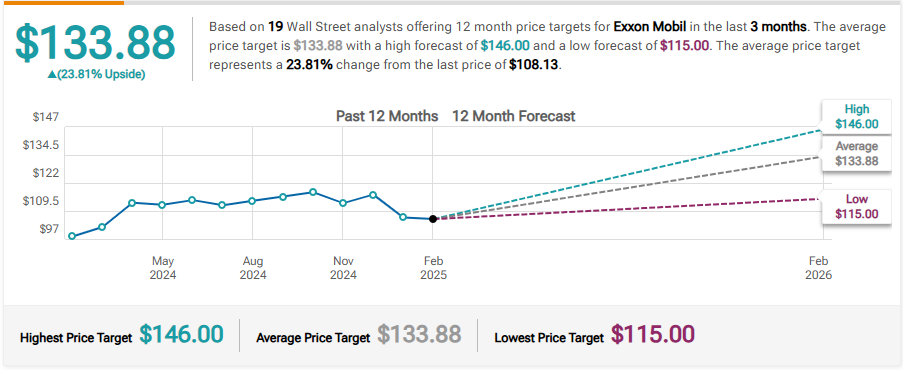

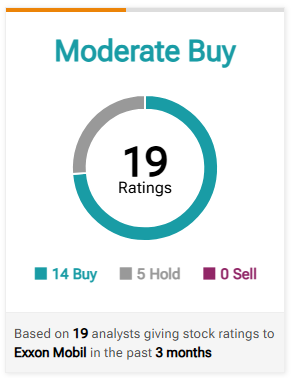

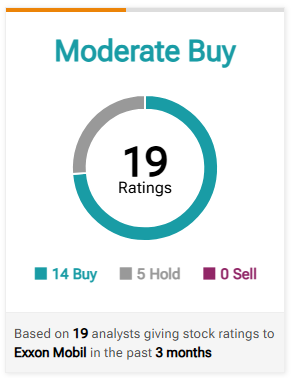

Exxon Mobil stands out among oil stocks, with 19 Wall Street analysts projecting a remarkable 23.81% upside potential. The company’s stock target reaches $133.88, with bullish forecasts extending to $146.00. Recent analyst ratings demonstrate strong market confidence, with 14 buy recommendations and 5 hold ratings, establishing XOM as a moderate buy in today’s market environment.

2. Chevron (CVX)

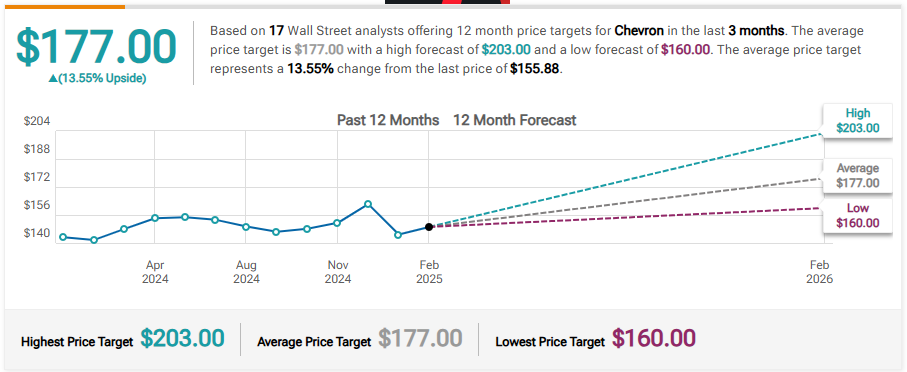

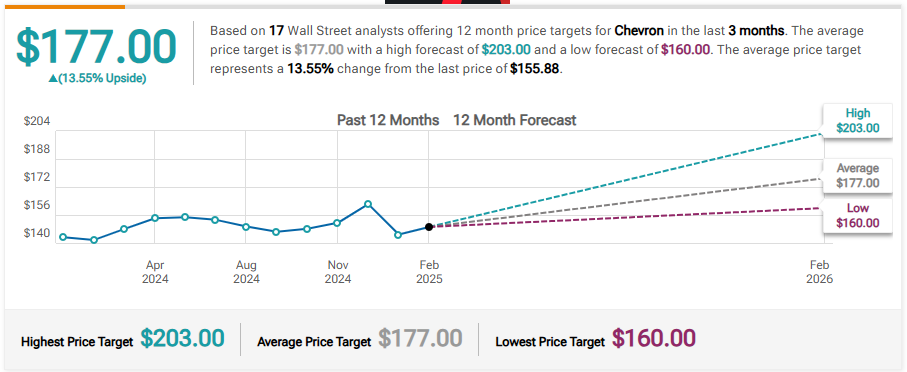

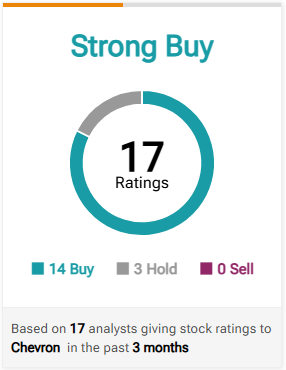

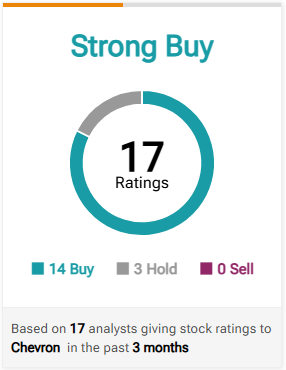

Chevron emerges as a standout performer in the oil stocks sector, and for a good reason! After it has been receiving a unanimous strong buy rating from 17 analysts, the projected price target of $177.00 indicates a 13.55% upside from current levels. With 14 buy ratings and only 3 hold recommendations, CVX positions itself as a prime beneficiary of potential pro-drilling policies.

Also Read: Coinbase (COIN) Posts Q4 Earnings, 23% Higher Than Expected

3. Occidental Petroleum (OXY)

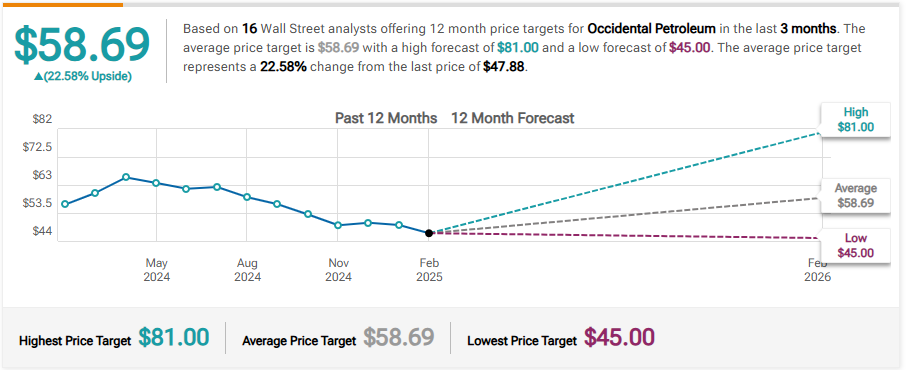

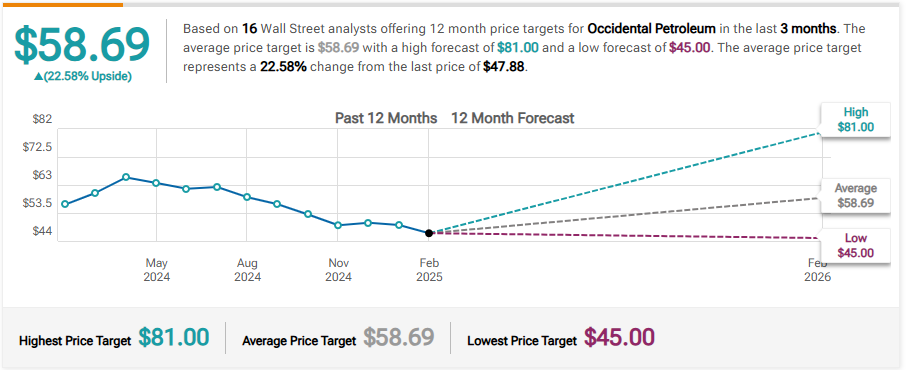

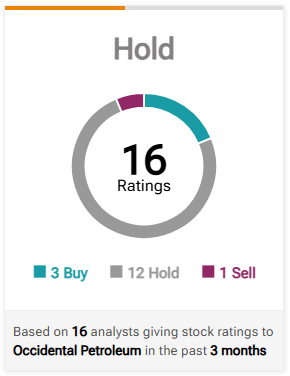

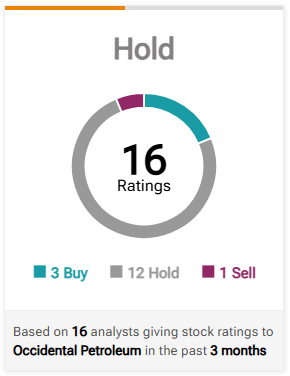

Right now, Occidental Petroleum is showing up as one of several seriously interesting plays among various oil stocks. And here’s where it gets interesting – multiple analysts are eyeing some pretty significant growth potential. On top of that – The average price target of $58.69 suggests a substantial 22.58% increase from current levels. Despite more conservative ratings with 12 hold recommendations, OXY’s maximum forecast of $81.00 points to considerable upside under supportive energy policies.

Also Read: Nvidia (NVDA) to Hit $260B in AI Revenue: What it Means for the Stock

Check out these numbers – they’re telling us something big. And get this – these pro-drilling policies working through some lengthy red tape could spark serious growth across various energy stocks. But that’s not all – multiple Wall Street analysts are talking about average gains topping 20% for several key players once they get through the bureaucratic maze. Here’s what’s really interesting – market sentiment is staying incredibly strong, particularly for numerous top energy stocks ready to jump when these policy changes hit. Seriously, the time to act is now – because these opportunities won’t stick around waiting for all the paperwork to clear.