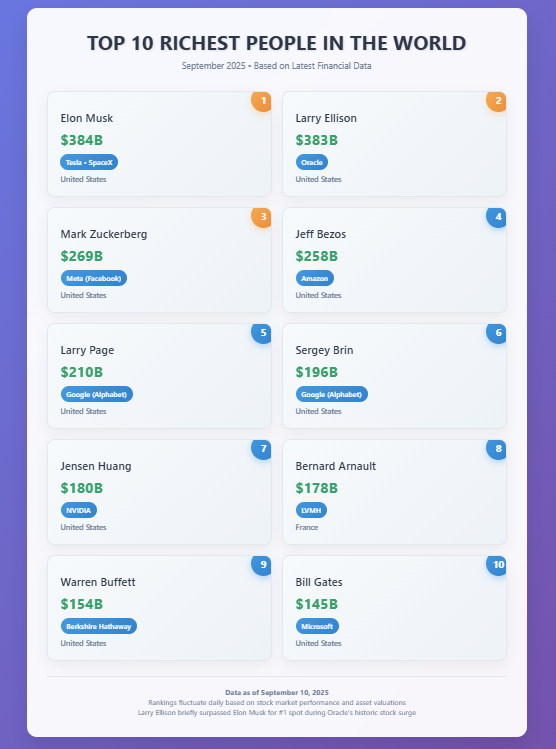

The richest man in the world battle reached a dramatic turning point as Larry Ellison briefly overtook Elon Musk for the top spot, and this shift was actually driven by Oracle Corporation’s unprecedented stock surge. The competition for who is the richest person in the world now hinges on three remarkable stocks – Oracle (ORCL), Tesla (TSLA), and NVIDIA (NVDA) – that have generated wealth exceeding entire nations’ GDP. At the time of writing, Elon Musk’s net worth and the question like who is Larry Ellison are fluctuating based on their companies’ explosive stock performance, which has been quite remarkable to witness right now.

Richest Man In The World: Elon Musk, Larry Ellison, And Stock Gains

AI infrastructure demand has been driving Oracle to the moon, and the richest man in the world status has shifted hands as Ellison has become even more wealthy by an unprecedented 101 billion dollars in a single day. Larry Ellison was worth 393 billion dollars, and temporarily beat Elon Musk, worth 385 billion, albeit by a few hours.

1. Oracle (ORCL) Powers Larry Ellison to Richest Man Status

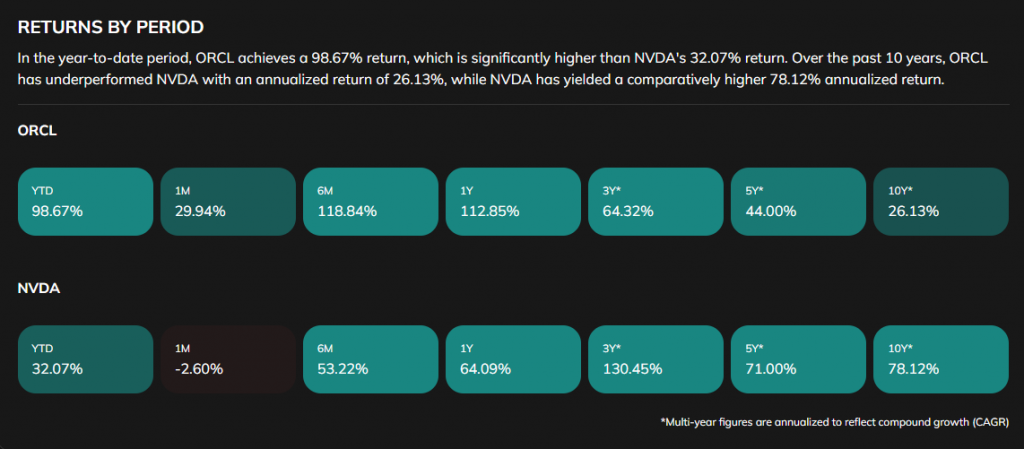

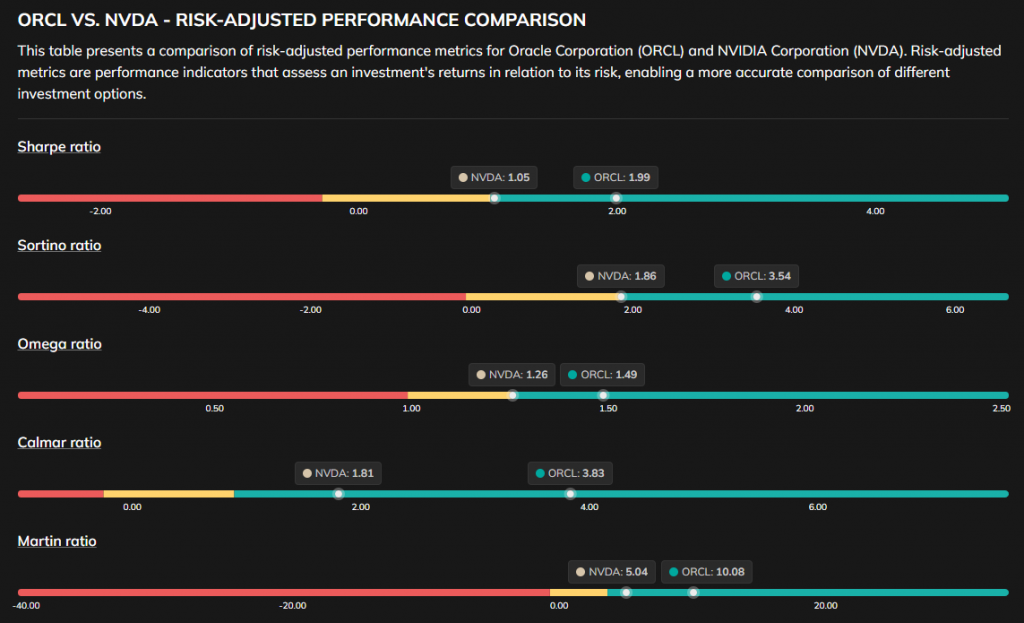

Oracle‘s performance has been nothing short of extraordinary, with the stock achieving a 98.67% year-to-date return that left analysts speechless. Artificial intelligence demand along with cloud computing growth drove the database giant’s gains. Oracle CEO Safra Catz also stated:

“We signed four multi-billion-dollar contracts with three different customers in Q1. This resulted in RPO contract backlog increasing 359% to $455 billion.”

Oracle’s surge shifted the richest man in the world title to Ellison as the company’s market cap exceeded $920 billion, making it one of only ten companies worth more than this amount right now. Oracle’s year-to-date performance of nearly 100% significantly outpaced most competitors.

2. Tesla (TSLA) and Elon Musk’s Wealth Foundation

The performance of Tesla stock is a vital component in finding out who the wealthiest individual in the world is, despite the fact that Tesla has been experiencing more volatility as compared to the steady performance of Oracle over the past few months. Tesla at 347.79 per share represents the sentiment of the market of the electric vehicles in general and the production goals on which the company has been striving to achieve.

Elon Musk net worth fluctuates daily based on Tesla’s stock movements, and this has actually been the primary driver of his wealth for years now. The company’s market valuation continues to represent hundreds of billions in wealth creation, even with some recent challenges.

Also Read: Nasdaq Files with SEC to Allow Tokenization, Blockchain Listing of Stocks

3. NVIDIA (NVDA) Creates AI-Driven Fortunes

The change of NVIDIA into an AI powerhouse has also paid off to the company with the company recording a 32.07 year-to-date performance that has been impressive.

The 10-year annualized performance of the semiconductor giant at 78.12 percent shows how the compound wealth creation has propelled the valuations to levels that would not have been realistic a few years back.

Ben Reitzes from Melius Research said about Oracle’s earnings:

“We’ll be talking about this one for a long time.”

Oracle CEO Safra Catz emphasized the company’s dominance:

“Clearly, we had an amazing start to the year because Oracle has become the go-to place for AI workloads.”

The battle for the richest man in the world title reflects broader market trends, with AI-focused companies receiving premium valuations right now. These three stocks have fundamentally altered global wealth distribution, creating fortunes that exceed most nations’ economic output.

Also Read: Japanese PM Shigeru Ishiba Resign Shakes Stocks, Politics