The Ripple SEC plan has taken center stage right now as Chinese company Webus International Limited filed a $300 million digital asset management agreement with regulators. This move comes alongside expert XRP price prediction suggesting potential for massive gains, while XRP news continues highlighting regulatory progress and also market volatility across the cryptocurrency sector at the time of writing.

Also Read: Ripple Price Prediction: $589 XRP in Focus After 21 EMA Retest

Navigating XRP News, Cryptocurrency Regulation, and Market Volatility Amid $300M SEC Filing

Webus International’s Strategic Ripple SEC Plan Filing

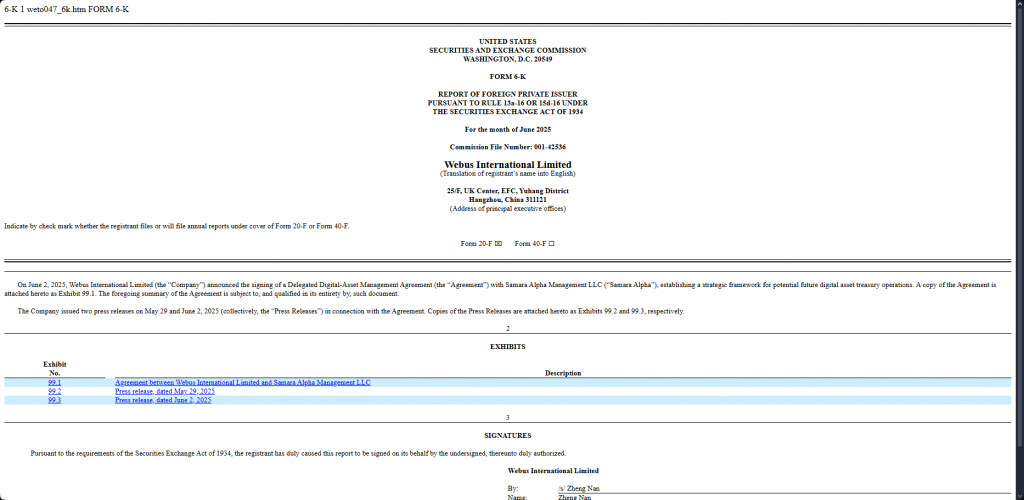

Webus International Limited, the Hangzhou-based AI-driven mobility solutions company, filed Form 6-K with the SEC to establish an XRP treasury worth up to $300 million. The Ripple SEC plan represents a significant institutional commitment right now, with the company signing an agreement with US-based investment advisor Samara Alpha Management to create the framework for future crypto operations.

The initiative will support instant international payments for chauffeur services and also booking programs, integrating XRP directly into the company’s business model. This Ripple SEC plan demonstrates how cryptocurrency regulation is enabling companies to formalize their digital asset strategies through proper regulatory channels at the time of writing.

Expert $250 XRP Price Prediction Sparks Rally Speculation

Game designer and XRP supporter Chad Steingraber maintains his XRP price prediction of $250 right now, suggesting the proposed GENIUS Stablecoin Act could unlock this valuation through mainstream adoption. This XRP news has created significant market attention, with Steingraber consistently advocating for the $250 target since early 2024 and also throughout various market cycles.

Steingraber stated:

“The regulatory framework outlined in the bill may unlock a path toward mainstream adoption and institutional confidence, factors essential for such a dramatic price increase.”

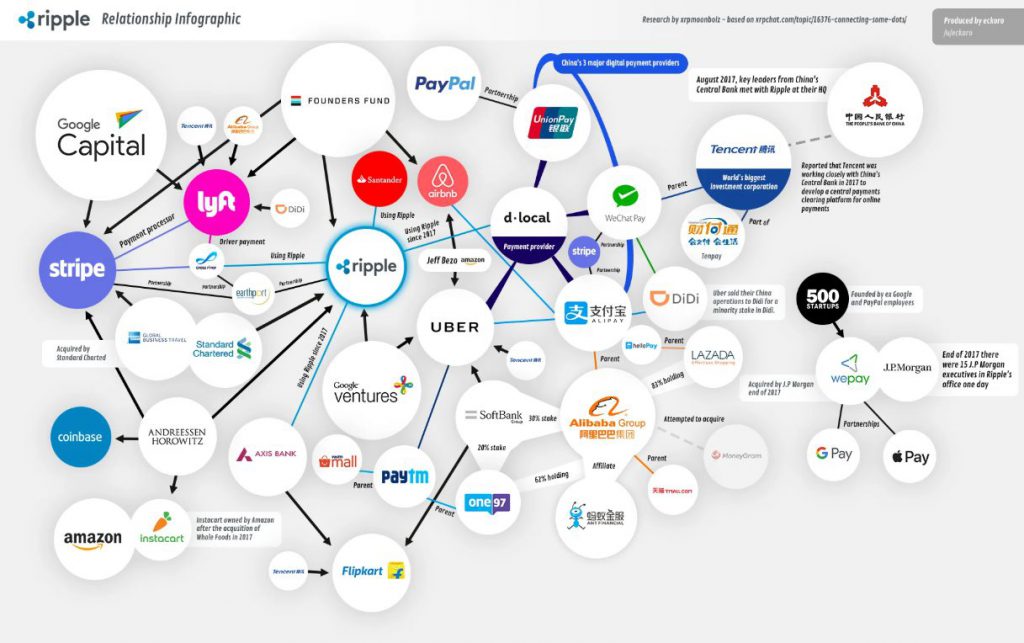

The GENIUS Act proposes federal regulatory structure for stablecoins, mandating full backing by physical cash or short-term U.S. Treasuries. This cryptocurrency regulation could catalyze wider XRP adoption through Ripple’s stablecoin RLUSD, which would operate on the XRP Ledger and also benefit from the new framework.

Market Volatility and Institutional Adoption Drive XRP News

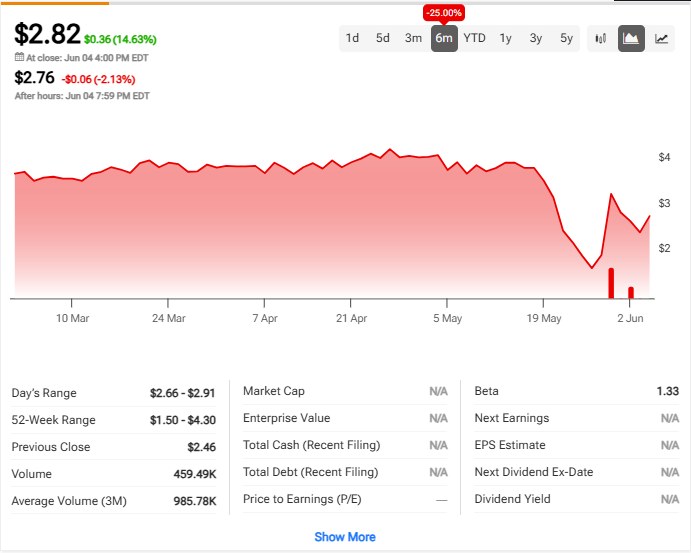

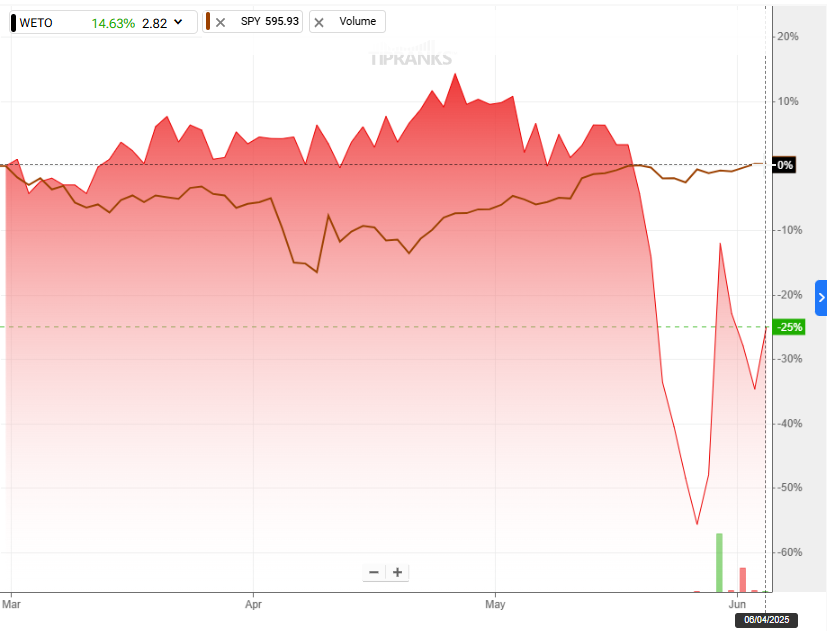

Market volatility continues affecting crypto markets right now, but the Webus International Ripple SEC plan signals growing institutional confidence. The company went public on Nasdaq in February, raising $8 million during its IPO, just like the Circle IPO, and now represents another publicly traded firm building strategic crypto reserves beyond Bitcoin and also Ethereum.

Crypto analyst SMQKE noted:

“Institutional interest in RLUSD could increase if the Act provides greater legal certainty with formal reserve, audit, and compliance requirements in place.”

This XRP price prediction aligns with broader market trends where cryptocurrency regulation clarity drives institutional adoption. The market volatility that previously deterred corporate investment is being offset by regulatory frameworks like the Ripple SEC plan structure at the time of writing.

Also Read: Ripple RLUSD Approved in Dubai: XRP Eyes 21.5% Price Surge

Regulatory Framework Shapes Future XRP Price Prediction

The combination of the Webus International Ripple SEC plan and also potential GENIUS Act passage creates unique conditions for XRP growth right now. As RLUSD transactions require XRP for settlement fees, which are then burned, the circulating supply decreases over time through this deflationary mechanism.

Versan Aljarrah from Black Swan Capitalist links the GENIUS Act to XRP’s adoption potential, suggesting tokenized U.S. debt could open liquidity pipelines beyond traditional Federal Reserve channels. This cryptocurrency regulation advancement addresses previous market volatility concerns while establishing compliant operational frameworks.

The current XRP news cycle also reflects how regulatory clarity transforms speculative assets into institutional-grade investments, with the Chinese company’s Ripple SEC plan serving as a useful template for some future corporate adoption strategies at the time of writing.