Strategic developments in altcoins have catalyzed unprecedented interest as the cryptocurrency market navigates the final phase of the current bull run. Fresh data points to four game-changing altcoin investments that pack some serious potential in the months coming ahead, even with the market’s current choppy waters. Some of the latest technical analysis reveals that these cryptocurrencies could spearhead major gains during this crucial bear trap phase.

Also Read: Top 3 Cryptocurrencies That Could Recover This Weekend

Top Altcoins to Watch: Market Trends, Predictions, and Volatility Risks

SUI: Gaming Innovation Drives Growth

Latest market initiatives have positioned SUI for transformative growth through its Walrus token launch. Latest market trends showcase a compelling entry point at $3.32, while technical indicators project a swift climb to $4.28 within five days.

According to our current Sui Crypto price prediction, the price of Sui Crypto is predicted to rise by 30.72% and reach $ 4.28 by February 25, 2025. Per our technical indicators, the current sentiment is Bearish while the Fear & Greed Index is showing 49 (Neutral). Sui Crypto recorded 10/30 (33%) green days with 12.43% price volatility over the last 30 days. Based on the Sui Crypto forecast, it’s now a bad time to buy Sui Crypto.

XRP: Government Engagement Fuels Potential

Cutting-edge developments have energized XRP’s market position, with Ripple CEO Brad Garlinghouse actively pursuing U.S. government strategic crypto stockpile inclusion. The team’s quote about “Ripple’s efforts toward creating an EVM sidechain with native XRP” signals powerful altcoins ecosystem expansion.

According to our current XRP price prediction, the price of XRP is predicted to drop by -3.86% and reach $ 2.62 by February 25, 2025. Per our technical indicators, the current sentiment is Bullish while the Fear & Greed Index is showing 49 (Neutral). XRP recorded 13/30 (43%) green days with 10.52% price volatility over the last 30 days. Based on the XRP forecast, it’s now a good time to buy XRP.

Also Read: De-dollarization: Is a Gold-Backed Currency the Ultimate Solution? Expert Weighs In

ADA: Institutional Interest Grows

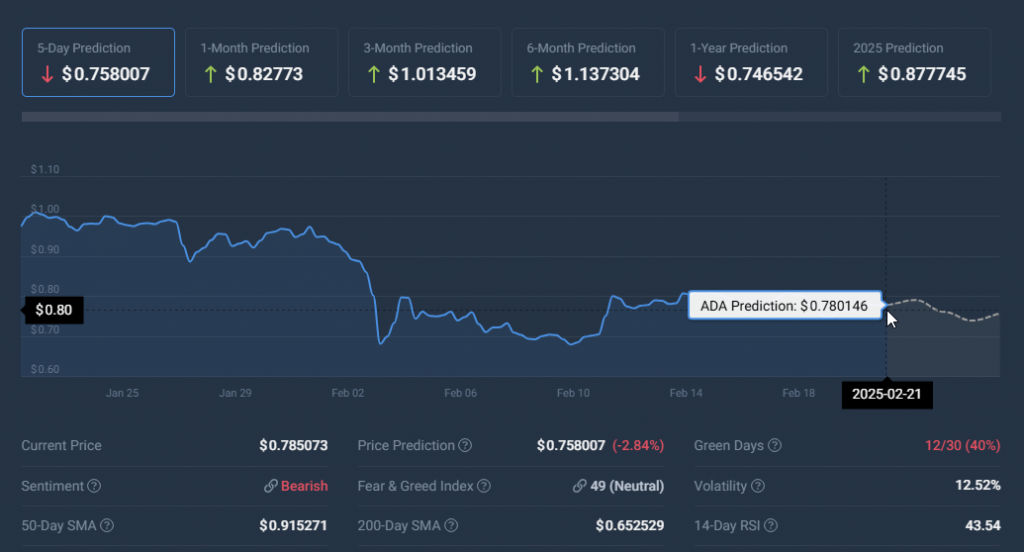

Strategic institutional backing has revolutionized Cardano’s market trajectory through Charles Hoskinson’s policy influence and rising spot ADA ETF interest. Technical data points to dynamic price action, suggesting movement from $0.78 to $1.01 in three months.

According to our current Cardano price prediction, the price of Cardano is predicted to drop by -2.84% and reach $ 0.758007 by February 25, 2025. Per our technical indicators, the current sentiment is Bearish while the Fear & Greed Index is showing 49 (Neutral). Cardano recorded 12/30 (40%) green days with 12.52% price volatility over the last 30 days. Based on the Cardano forecast, it’s now a bad time to buy Cardano.

ONDO: RWA Sector Leadership

Breakthrough developments have established ONDO as a dominant force in the Real World Assets sector. Government adoption metrics signal remarkable growth potential, with analytics showing a projected 30.24% near-term value increase.

According to our current Ondo Finance price prediction, the price of Ondo Finance is predicted to rise by 30.24% and reach $ 1.609611 by February 25, 2025. Per our technical indicators, the current sentiment is Bearish while the Fear & Greed Index is showing 49 (Neutral). Ondo Finance recorded 13/30 (43%) green days with 6.17% price volatility over the last 30 days. Based on the Ondo Finance forecast, it’s now a bad time to buy Ondo Finance.

Also Read: Mysterious Trade: US Congresswoman Buys German Arms Manufacturer Stock

Market analysis indicates crypto altcoins market volatility creates unique opportunities amid challenges for these selected altcoins. Current market trends mirror historical patterns where temporary downturns precede substantial recoveries in the final bull run phase.