A total of 50 countries are ready to cut tariffs on US goods to survive the global trade war. Trump imposed tariffs on 185 countries making it expensive for them to sell goods in the US. The tariffs and counter-tariffs have been flying off the shelves this month leading to uncertainty in the broader markets.

Also Read: Pi Network Eyes $3 as Price Rebounds 28% Amid Token Unlock Buzz

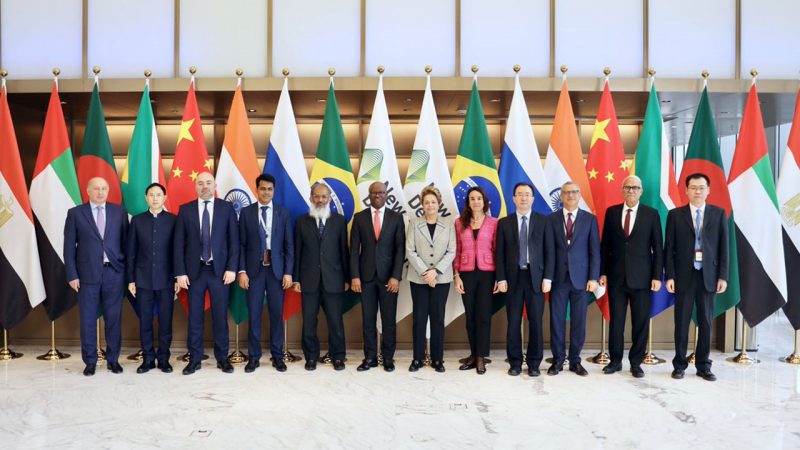

US Trade Representative Jamieson Greer confirmed that over 50 countries are ready to cut tariffs on US goods. Greer revealed that the majority of the nations want to discuss policy changes with Trump. “Nearly 50 countries have approached me personally to discuss the president’s new policy and explore how to achieve reciprocity, and they’ve spoken with many members of the administration,” he said.

US Tariffs on Goods Majorly Affecting the Global Stock Market

Also Read: Chainlink (LINK) Vs. TRON (TRX): Which Is Better For This Dip?

The tariffs are not just affecting trade but are also turning burdensome to the global stock market. If the tariffs on US goods and vice versa and not brought down, Dow Jones could lose more in value. The Asian stock market opened in the red on Monday and Wednesday after seeing a bounce back on Tuesday.

BlackRock CEO Larry Fink warned that a bounce could be a bull trap and predicted that the market could correct another 20%. Dow Jones is currently at the 36,700 level and a 20% crash could take it down to the 30,000 range. Trump is repeatedly claiming that the US has been treated badly with other countries imposing tariffs on goods for decades.

According to the President, the duties announced on Liberation Day are payback time to make the playing field even. Trump imposed 104% tariffs on China making it expensive for the country to make their goods enter the US markets. Chinese Premier Li Qiang slammed the tariffs calling it protectionism. He added, “Protectionism leads nowhere. Openness and cooperation are the right path for all.”

Also Read: Trump Is Not Bothered About The Recent Market Crash: Here’s Why