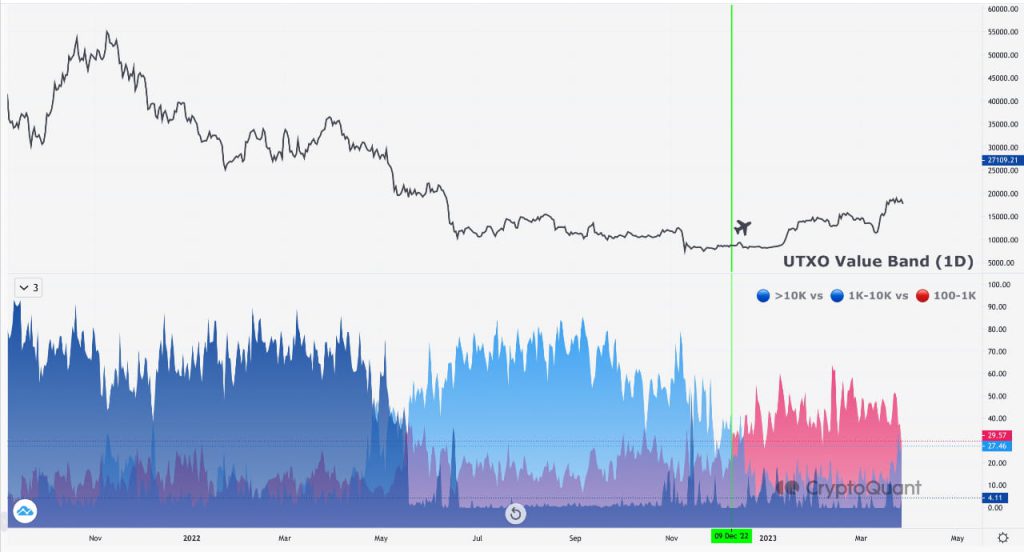

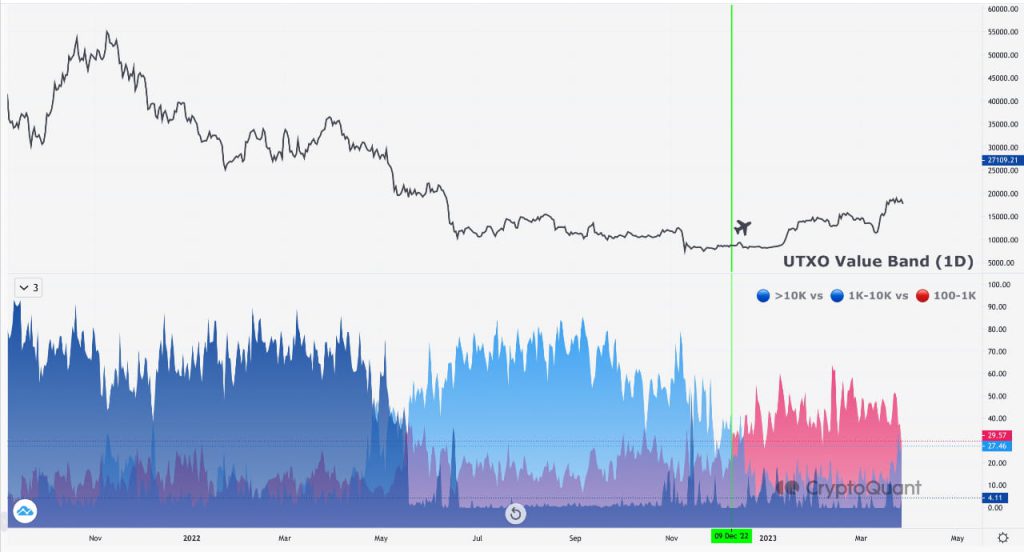

According to a recent report by CryptoQuant, 61% of all Bitcoin (BTC) is controlled by large players. To find the results, CryptoQuant analysts looked at the UTXO Value Bands. This indicator depicted the distribution of all unspent transaction outputs by their value.

As per the report, Dolphins and Sharks control 29.57% of the market. Dolphins and Sharks are mid-sized players with 100-500 BTC and 500 to 1000 BTC respectively. On the other hand, Whales, Humpbacks, and Megawhales control 31.57% of the market. Whales, Humpbacks and Megawhales are players with 1,000 to 5,000 BTC, and 5,000 to 10,000 BTC respectively.

Together, these entities control 61.14% of the market. Therefore, the market is very sensitive to the movements made by these players. When these entities buy or sell big numbers of Bitcoins (BTC), it creates significant price fluctuations.

Do Bitcoin retail investors stand a chance?

Long answer short, yes, retail investors still have a chance. Smaller investors currently control 38.86% of the market. The data demonstrated that there is still substantial room for expansion and elevated retail investor involvement. Moreover, there is room for further expansion and diversification of cryptocurrencies, which are still a relative niche investment instrument.

As per the Bitcoin Address Balance Distribution by Cohorts, the wealthiest wallets, which control 31.57% of the market, are only 4151 in number. It infers that despite the growing popularity of cryptocurrencies, big players are still relatively small in number.

Moreover, Bitcoin (BTC) is the only cryptocurrency that the SEC has said would not fall under its definition of security. Therefore, the assets remain fairly out of the hands of authorities. The original cryptocurrency took a dip today as it fell 2.8% in the last 24 hours. BTC is currently facing resistance at around $28000, with support at $26926.