In the latter half of June, #CELShortSqueeze was trending on Twitter. The same was a community-led initiative to pull up the Celsius price by instigating a short-squeeze.

On its part, short-squeezing essentially happens when a shorted asset ends up rising in value. The said phenomenon forces short sellers to buy back the assets they’d bet against to cap their losses. Consequently, buying back the same asset when the price rises instigate further upward price movements, eventually squeezing out short-sellers. The ultimate motive for doing so is to trigger an artificial price pump.

Between 19 and 21 June, CEL shot up by more than 160% in fewer than 48 hours. Short squeezes usually do not last for long, as witnessed during GameStop’s in 2021 or even Celsius in June.

However, since the beginning of July, CEL has been up by more than 60%. So, is the short-squeeze rally re-gaining steam?

Sentiment check

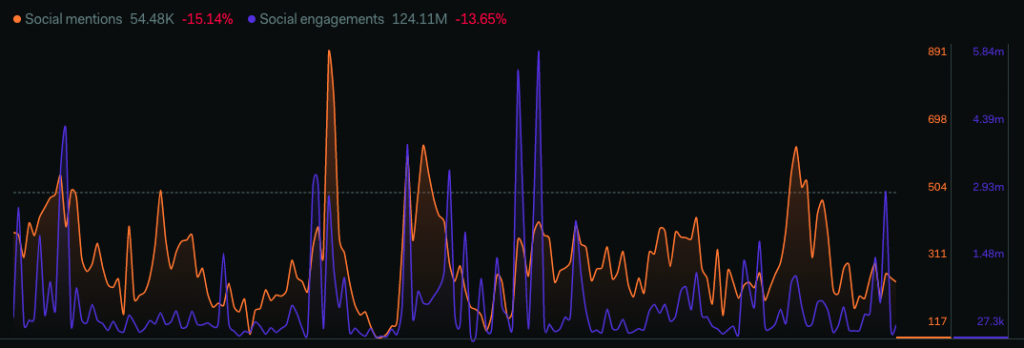

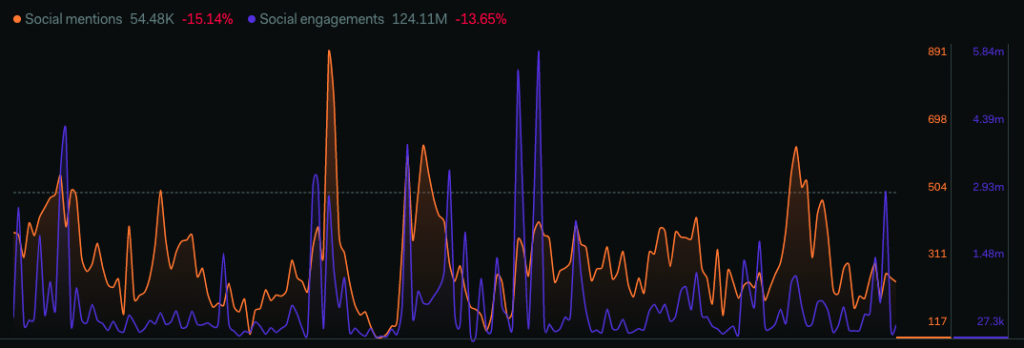

Since Celsius’ short squeeze is a community-led event, sentiment needs to remain high, and that is not the case at the moment. Per LunarCrush’s data, the social volume and dominance were down by around 15% each weekly, indicating that there’s not much chatter happening about CEL on social platforms.

Also, unlike last time, no particular Celsius-related hashtag was trending on Twitter supporting the said narrative.

Alongside the unhealthy social outlook, the company’s customers have gradually been losing hope. Talking to The Wall Street Journal, Jackson Ling, a 37-year-old angel investor in Malaysia, said,

“Everyone’s been left in the dark here, nobody knows exactly what’s going on with them. Are they insolvent or simply illiquid?”

Towards the end of last week, Celsius clarified that it continues “to take important steps to preserve and protect assets and explore options available to us.” They also said that they will continue to share information with their customers when it becomes “appropriate.”

Since 1 July, nonetheless, CEL has risen by 64%. However, with the lack of community support, it doesn’t look like the same would be able to last for long.

Besides, the RSI was near its local peak on the 4-hour chart, indicating a retracement for Celsius is on the cards.

Earlier during the day, CEL glided up on the rankings chart to reclaim a position in the top 100. But, with the not-so-favorable sentiment, and minor retracements in the shorter timeframe charts, it was down to #120 at press time.

Another reason not to ring Celsius’ optimistic bells

What’s more, the Celsius network’s just moved around $72 million worth of Ethereum to a particular wallet. People from the space tracking Celsius’ on-chain transactions pointed out that “they usually send tokens to exchange before dumping.” The company has reduced its collateral for the first time in over three weeks, giving users another reason not to be optimistic.

Thus, at the moment, CEL lacks support from the community, and the 64% pump might not be sustainable if the same continues.