Ethereum has been in the driver’s seat and dictating the crypto market’s trend over the past few weeks. In the last couple of days, the said trend has only further amplified. With major top coins shedding 6%-7% of their value, almost the entire crypto market was trading in red a day back.

However, on Thursday, a trend reversal was registered, with Ethereum paving the path. At press time, the aggregate valuation of all cryptos stood at an elevated 4.77% when compared to yesterday. BTC, on one hand, was up by 2.8%, while ETH appreciated by 8% in the same timeframe.

Markets move in tandem

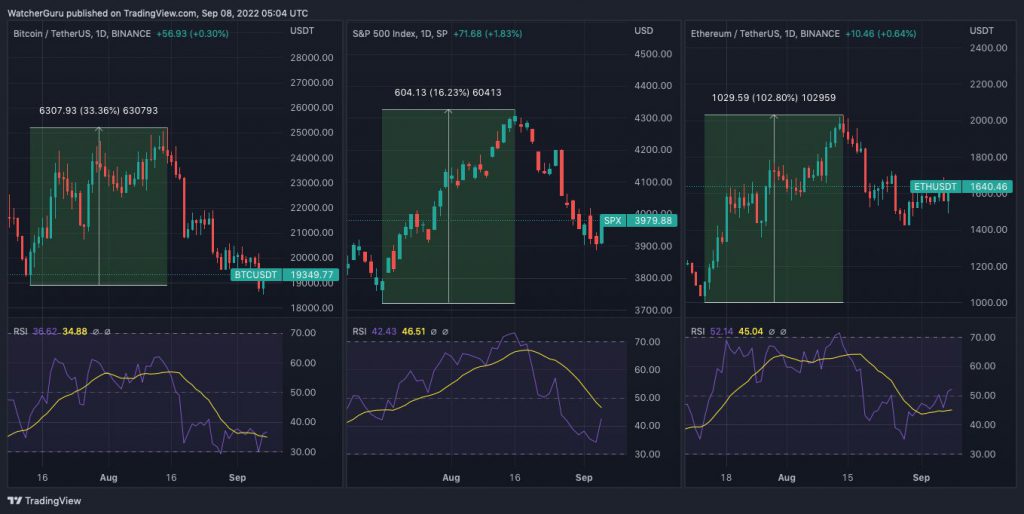

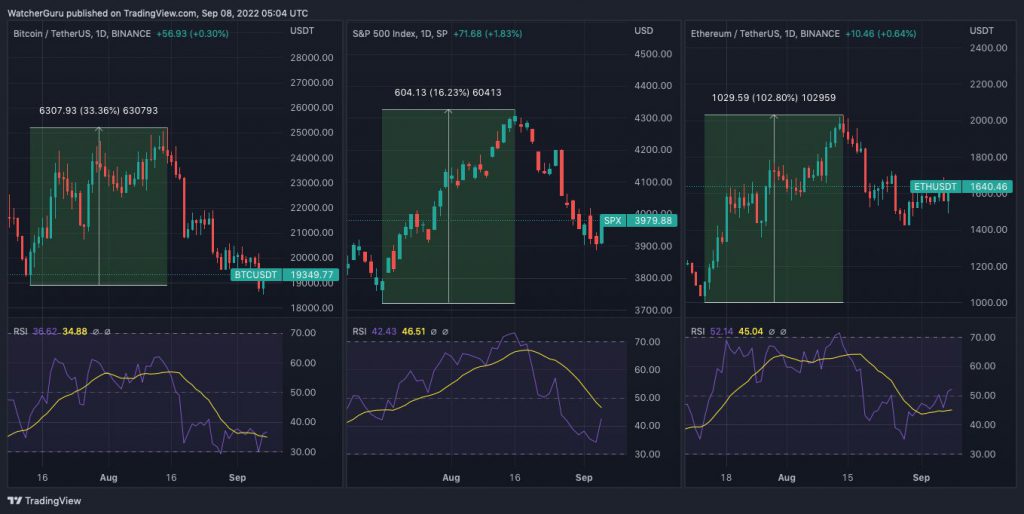

For the past few weeks, the stock market and the crypto market have been moving in the same direction. In the period between mid-July to mid-August, the S&P 500 rallied by over 16.2%. Around the same period, Bitcoin and Ethereum also notched up in value by 33.3% and 102.8%. Right after that, the downfall began.

Yesterday, US stock indexes climbed the most in roughly a month as bond yields eased. In fact, investors conveniently turned a deaf ear to the hawkish remarks made by Federal Reserve officials on Wednesday. The last time the Nasdaq Composite, S&P 500, and Dow Jones Industrial Average reached a higher one-day percentage jump was on 10 August. Per Reuters, however,

“… investors doubt this is a long-lasting trend.”

The macro-bullishness rubbed off positively on cryptos as well. Given the high correlation that the markets share, the last candle on all the charts was in green. However, just like how investors do not expect the stock market uptrend trend to last, it doesn’t seem like Bitcoin’s rally is sustainable. For Ethereum, however, the case might slightly be different.

Ethereum speculative trading is on in full swing

As highlighted above, the Ethereum market is the most volatile at the moment, for its price movements have been the loftiest. During yesterday’s dump, it was one of the most affected top coins. Conversely, on Thursday it had registered comparatively higher gains.

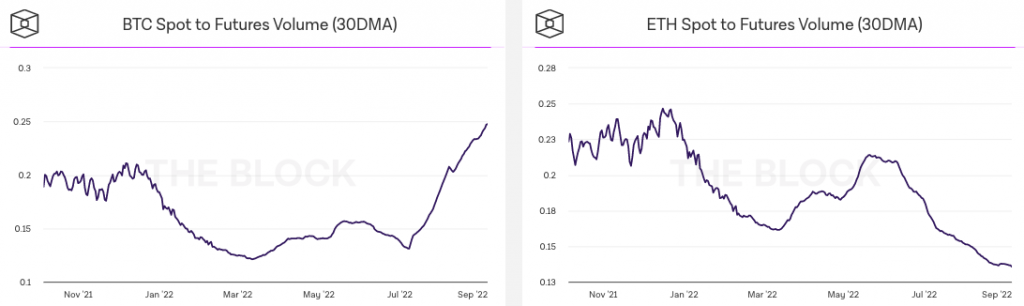

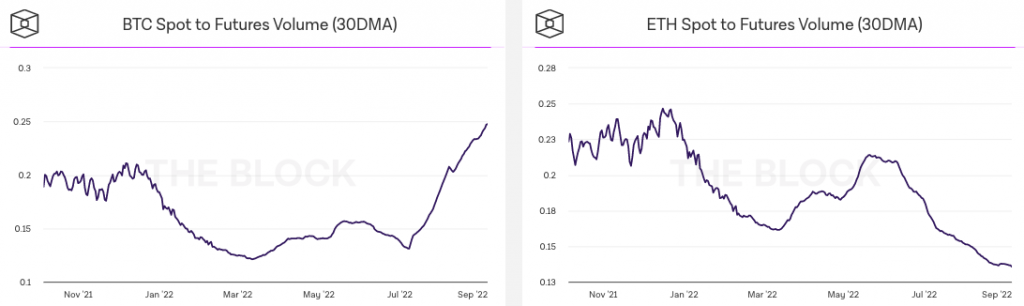

Ethereum’s wild price swings registered over the past two days can be attributed to the speculative trading being carried out by market participants in the derivatives market. As depicted below, the spot:futures volume has been on the fall for ETH of late, indicating that traders have been calling the shots now compared to investors.

As far as Bitcoin is concerned, however, the reverse trend is in play. Thus, it would be fair to infer that when the pull-back occurs going forward, Bitcoin’s losses will be fairly less when compared to Ethereum’s.

Here it is worth noting that the crypto market is set to undergo an options expiry tomorrow, and the majority of Bitcoin traders are bearish. Per CoinGlass’s data, BTC’s put:call ratio stood at 1.21, indicating that there are currently more sell contracts when compared to buy contracts.

As far as Ethereum is concerned, however, the ratio stood under 1—at 0.91—affirming that traders are optimistic. So, over the next couple of trading sessions, if the buy bias persists, then it’d likely indicate that traders are manipulating the price to reap gains tomorrow at the time of the expiry. For the same to materialize, it’d be equally important for the stock market to support the directional bias during Thursday’s trading hours.

Even though Bitcoin and Ethereum traders are expecting the market to move in different directions, one thing is for sure—volatility is here to persist over the next 24 hours.