The S&P 500 index is near its record high, surging more than 13% year-to-date. Several US stocks have touched 52-week highs, and the market is brimming with optimism. This comes despite the trade wars and tariffs, which strategists thought would lead to a downturn. The market had rewarded the brave as traders believe in the long-term growth of America.

While the S&P 500 index fell to the 4,900 level in April after Trump’s Liberation Day announcement, it bounced back and is now at 6,642. The leading US index is now looking to reclaim its 52-week high of 6.920, which it hit in October. Stocks with strong fundamentals have performed beyond expectations with stronger revenues.

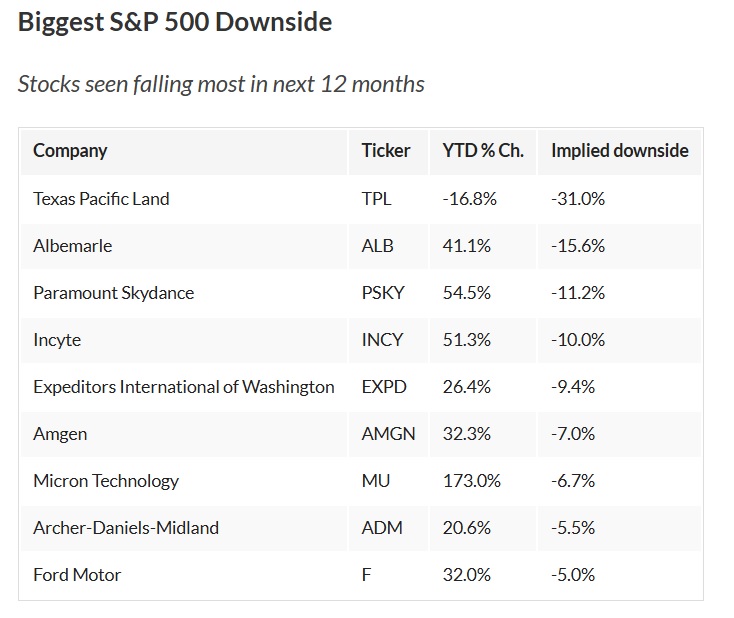

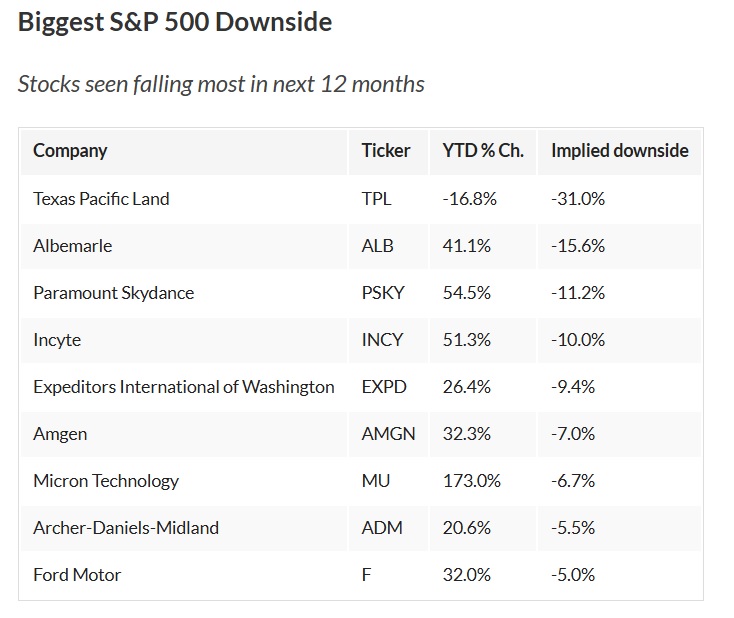

Despite the robust performance, analysts from Investor’s Business Daily have warned that 9 stocks from the S&P 500 could experience major downturns in the next 12 months. The analysts pointed out that the 9 mentioned stocks would have more pain ahead.

Also Read: Crypto Exchange Kraken files for US IPO

These 9 Stocks Could Tumble in the Charts in 12 Months: Analysts

The 9 stocks that could bleed in the next 12 months, according to the analysts, are: Texas Pacific Land, Albemarle, Paramount Skydance, Incyte, Expeditors International of Washington, Amgen, Micron Technology, Archer-Daniels-Midland, and Ford Motor.

Below is the chart on how low the 9 mentioned stocks could plummet in 2026.

Also Read: The More You Use AI, the Richer Nvidia Gets: That’s the Game

Texas Pacific Land has received a downside prediction of 31%, while Albemarle could lose 15.6%. The analysts predict that Texas Pacific Land could fall to $635 per share. Its price is now hovering around the $905 range and is already down nearly 24% year-to-date. The bearishness would continue into the stock next year, eating up a larger share of its value.

The analysts are also bearish on Albemarle, citing that the hype of rare earth minerals is cooling. The buzz on the rare earth minerals sent the stock soaring 48% year-to-date, and it is a prime candidate for correction, wrote analysts. Coming to Paramount Skydance, concerns are growing about whether the merged entity will be able to squeeze out costs as promised.