After struggling to navigate during the bear market in 2022, ProShares’ Bitcoin ETF, BITO, started this year on a bullish note. It attained its 2023 peak by mid-April but subsequently stepped into a correction phase. A month back, BITO made some amends, but it proved to be a dead cat bounce. With Bitcoin now already below $30,000, BITO’s downtrend could get renewed. On the YTD front, even though ProShares’ ETF is trading in the green, it has fetched investors fewer returns when compared to Bitcoin. As chalked out below, BITO is up by around 53.3% in 2023, while BTC has fetched its investors around 82%.

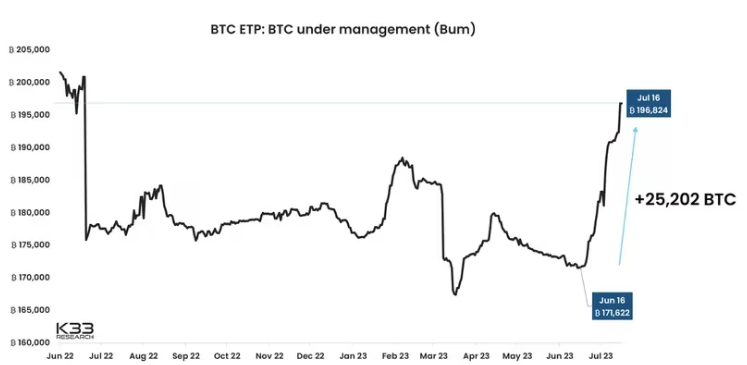

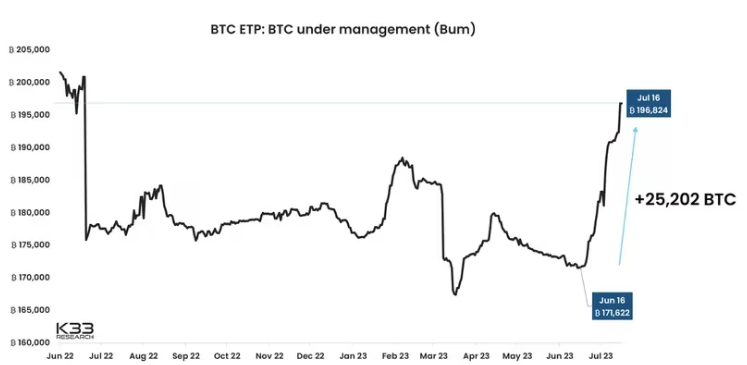

ETFs occupied the center stage last month, for BlackRock, Fidelity, and a host of other investment firms filed applications with the SEC requesting to launch their own spot funds. Amid the renewed frenzy, existing futures funds, and other exchange-traded products re-gained traction. In fact, investors started pouring funds into these products. A recent report by K33 Research revealed that BTC-equivalent exposure of ETPs worldwide surged by 25,202 BTC [worth $757 million].

The cumulative number is now hovering around 196,824 BTC. This is the second-highest monthly net inflow. In effect, the aggregate BTC-equivalent exposure is now at a multi-month peak. K33 Research’s Vetle Lunde pointed out that only the inflows registered during the launch of ProShares’ futures-based ETF and other futures-based ETFs in October 2021 managed to surpass the current hike figure.

Also Read: I Will Exempt Bitcoin-Dollar Conversions From Taxes: Robert Kennedy Jr

BITO Exposure

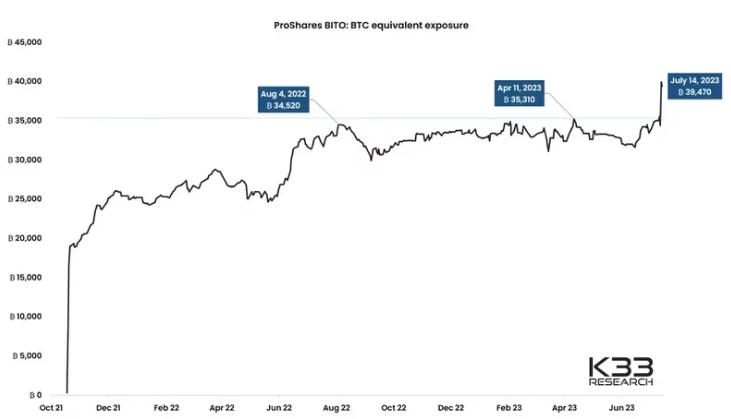

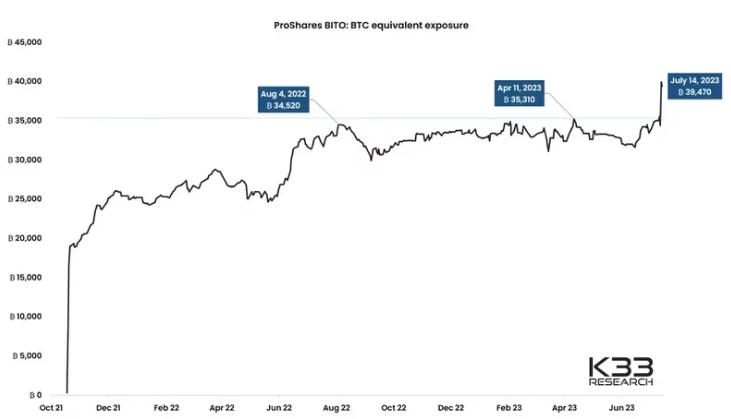

Despite the turbulent price landscape, BITO has hit an all-time high of bitcoin equivalent exposure. The figure has been hovering around 4,425 BTC of late. Highlighting the latest feat attained, K33’s report pointed out,

“BITO spikes have tended to occur near local market tops. BITO’s overall BTC exposure has structurally been flat from June 2022 until the past week, when the market saw its first notable range breakout.”

Also Read: U.S. SEC, CFTC Can Work Together on Crypto Rules: Caroline Pham