The top Bitcoin inflow transactions’ weightage has been increasing. Usually, whenever whales accumulate collectively, it is considered as a sign of conviction. However, that might not essentially be the case this time. The connotation changes during bear markets. When this ratio climbs above 0.8, it signals a fake relief rally. With the current number around 0.9, the landscape is becoming more favorable for a mass dump. A recent CryptoQuant analysis thread on Twitter pointed out,

“It’s [It is] an unmistakable sign of selling pressure.”

In fact, in the recent past, this inverse correlation has been quite evident. In mid-June, as this ratio dropped, the price initiated an uptrend. Likewise, even during the beginning of 2023, when the exchange whale ratio shrunk, the price rose. So, with the flip trend in play, the current conditions seem ripe for mass dumping. Thus, with BTC already below $30k, traders need to exercise caution.

Also Read: I Will Exempt Bitcoin-Dollar Conversions From Taxes: Robert Kennedy Jr

Key BTC levels to look out for

Chalking out how the current conditions could prove to be a boon for Bitcoin, CryptoQuant highlighted,

“If this selling pressure eases quickly, we could see a positive impact on price action, paving the way for higher levels.”

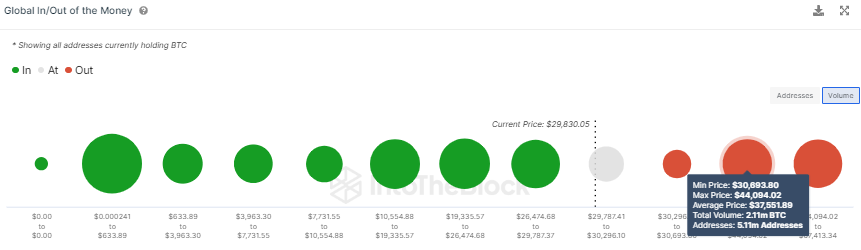

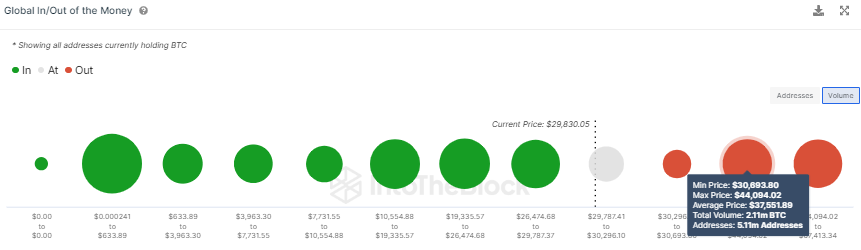

However, the path might not be that easy. The price between $30,693 to $44,094 is the range where the majority of participants have accumulated the asset. To contextualize, around 5.1 million addresses have bought a total of 2.1 million BTC in this range. Thus, with every step Bitcoin tries to climb, it might be subjected to selling pressure.

On the technical front, BTC did face resistance in the $30,000 to $40,000 bracket in 2021, before it went on to create its double peak. Even last year, it briefly traded in the said region before climbing to $48,000. Thus, leaving aside the two immediate resistances chalked out below, mid-term traders need to beware when BTC steps into the aforementioned price range.

Also Read: Bitcoin ETPs Register ‘Record’ Inflows: AUM Up by 25,000 BTC