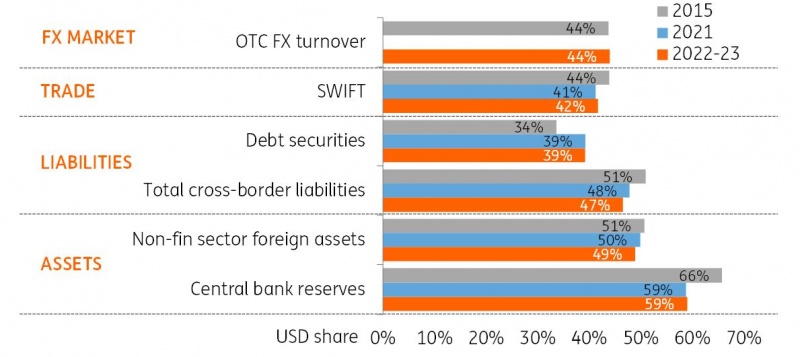

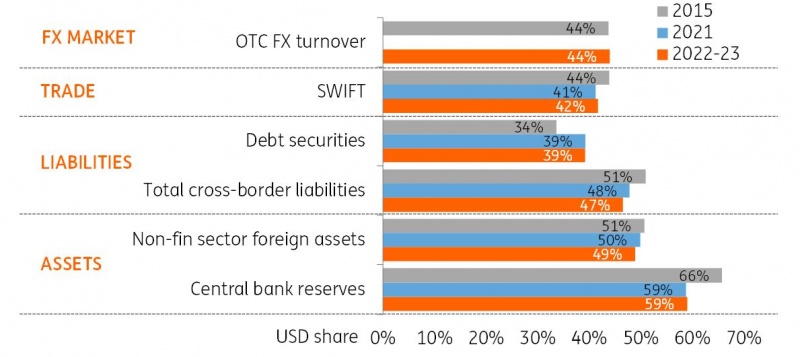

The Central Banks of developing countries are accumulating gold to end their reliance on the U.S. dollar. The foreign exchange reserves for the U.S. dollar have sharply fallen by 12% in the last two decades. The U.S. dollar accounted for 71% of all forex transactions in 2003 but dipped to 59% in 2023. In addition, BRICS member China added 21 tonnes of gold to its reserves in June 2023.

Also Read: U.S. Dollar Could Fall if BRICS Pay in Local Currencies for Oil & Gas

China, India, and Russia are on a gold accumulation spree, and the BRICS bloc will be the top buyer of the precious metal in 2023. The development adds pressure on the U.S. dollar as the BRICS are challenging its global supremacy.

BRICS: U.S. Dollar Remains King Despite Drop in Central Bank Reserves

While the U.S. dollar experienced a dip in the developing nations’ Central Bank reserves, its usage saw a boost in the global markets. The dollar’s usage held up well in commerce, private assets, debt issuance, and the global FX markets, reported ING Vysya.

Also Read: BRICS: De-Dollarization Begins With Oil & Gas

The Euro comes in second, but its dominance is limited and centered on Europe only. China, Russia, and India snatched less than 1% of the overall global trade by using local currencies. Therefore, attempts to dethrone the U.S. dollar are failing, as the greenback has yet to see resistance on a large scale.

“Overall, we do not see any conclusive evidence that the dollar is on the path of structural decline,” said ING Vysya’s report.

Also Read: 8 Arab Countries Request To Join BRICS Alliance

However, the upcoming BRICS summit could be a game-changer that could challenge the U.S. dollar’s prospects. BRICS is assembling a team of developing countries that would settle cross-border transactions in native currencies. If many more countries begin to end their dependency on the greenback, then the U.S. dollar could face challenges. Read here to know how many sectors in the U.S. could be impacted if BRICS traded in local currencies.