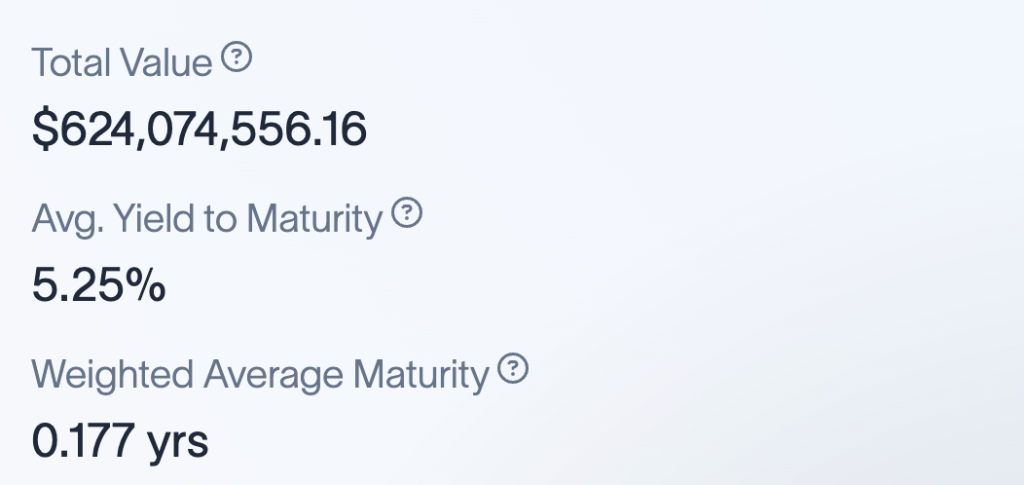

The total value of investment products utilizing blockchain technology to tokenize U.S. Treasury bills, bonds, and money market funds stands at an approximate amount of $624 million. Recent information revealed that the demand for tokenized U.S. Treasuries has expanded significantly, witnessing a sixfold increase this year.

Several crypto companies and investment funds are turning to these products to access more favorable government bond rates. Tokenization has been emerging as a prominent trend within the currently challenged digital asset sector. Additionally, yields in crypto lending have dropped due to extensive deleveraging during the market’s downturn.

As outlined in a recent report from Bank of America, the concept of tokenizing real-world assets, which entails generating blockchain-based tokens for traditional financial assets such as government bonds or private equity, has the capacity to bring about a significant transformation in the financial realm.

In light of this, Tradeteq, a marketplace in the U.K. focused on private debt and real-world assets, has opted to utilize this technology. Earlier today, the company introduced a tokenized U.S. Treasury offering on the layer 1 blockchain XDC Network.

Also Read: BIS Unveils Unified Ledger Proposal for Tokenized Assets

XDC Network and Tokenized Networks

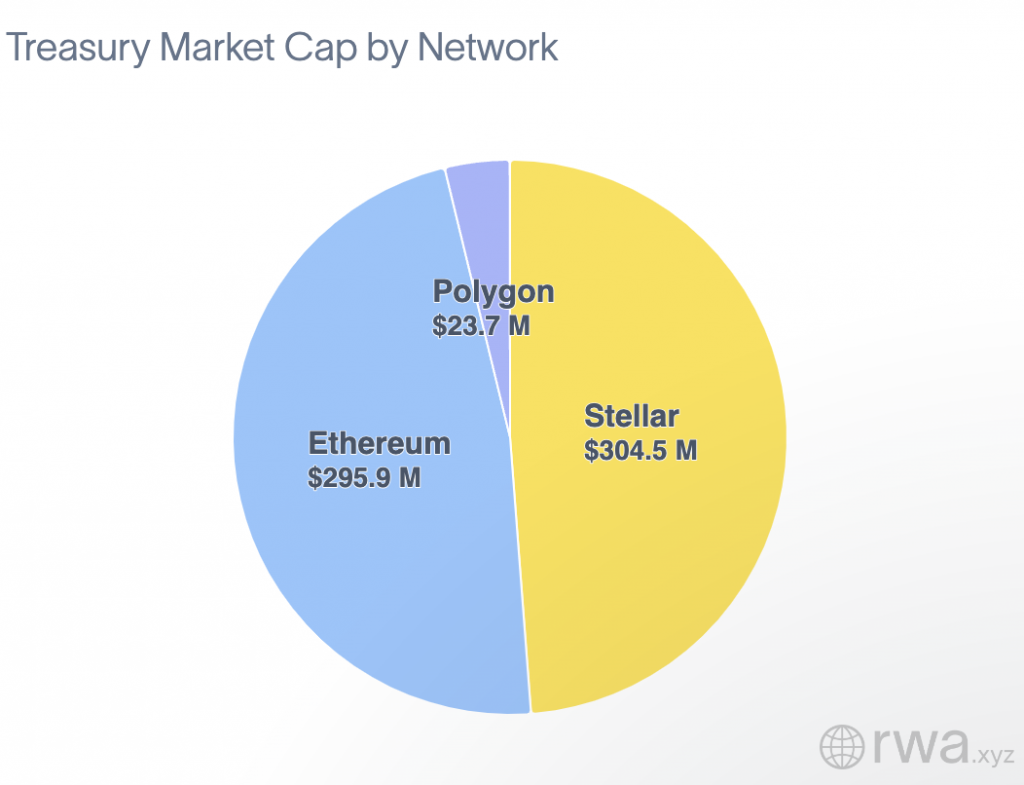

At the moment, Stellar [XLM] and Ethereum [ETH] are leading in the field of tokenizing government bonds. Yet other networks are also making strides in incorporating real-world assets. As seen in the chart, the treasury market capitalization for Ethereum stands at $295.9 million, while Stellar appears to be a favored option with a value of $304.5 million.

Polygon [MATIC], as shown in the chart, represented a value of $23.7 million. JPMorgan utilized the Polygon network to execute trades involving tokenized Japanese yen and Singapore dollars. Now XDC is likely to join the ranks of these networks.

Also Read: Mastercard Ventures into Tokenized Bank Deposits with Multi-Token Network Pilot