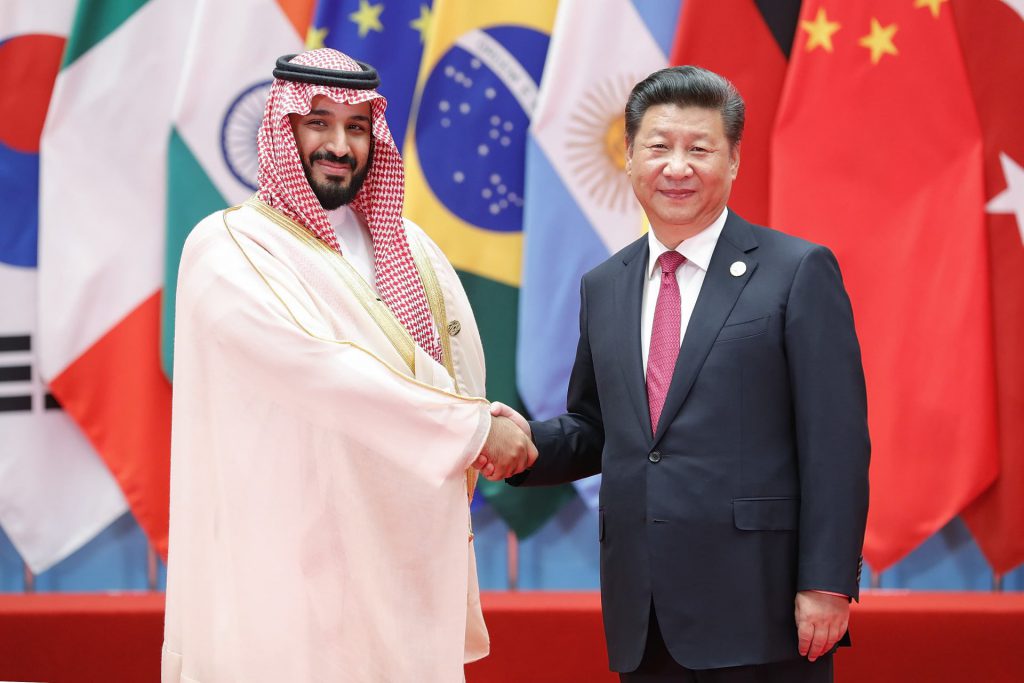

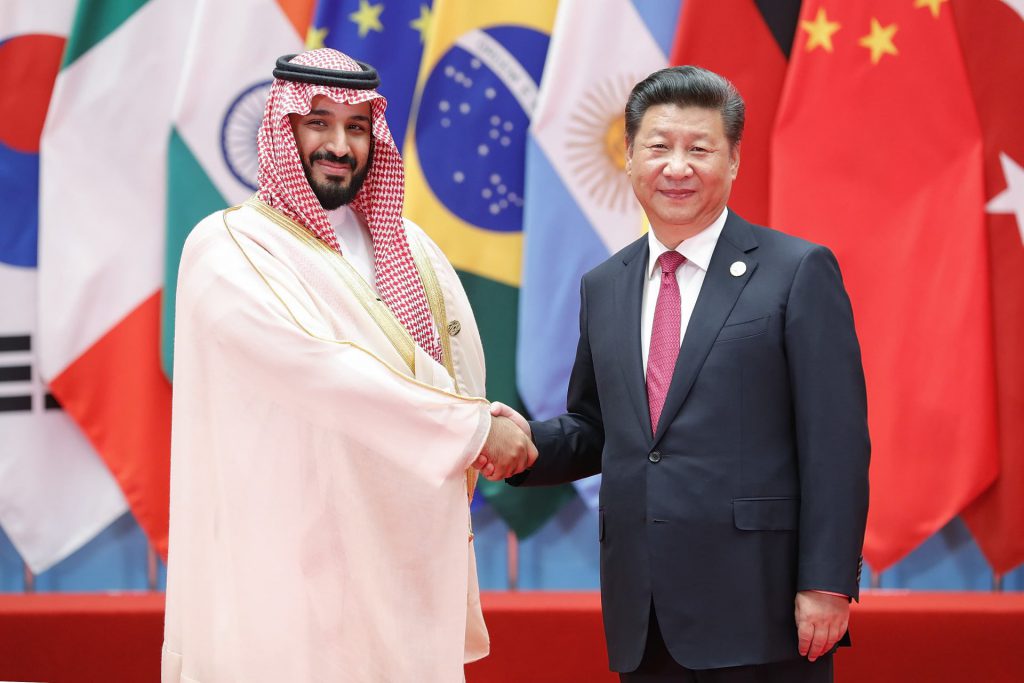

The US dollar becomes the first casualty when trade between BRICS countries rises. BRICS members China and Saudi Arabia have reached a new high in trade surplus this year in 2023. The Communist nation has maintained its position as the prime trading partner with the Kingdom of Saudi Arabia.

Saudi Arabia’s trade surplus with China rose by 257% in September 2023 reaching a new high of $1.78 billion. That’s a 257% surge compared to the previous month of August. The trade surplus is a positive indicator of transactions between two countries where exports exceed imports.

Also Read: BRICS: 15 Countries to Ditch US Dollar for Oil Trade?

Just recently, BRICS members China and Saudi Arabia signed a currency swap agreement for cross-border transactions. The trade deal favors their local currency the Saudi Riyal and the Chinese Yuan ahead of the US dollar. The three-year agreement allows trade to be settled in local currency with a cap of 50 billion yuan or 26 billion riyals.

The US dollar will play no role in trade for up to $7 billion between the two BRICS members China and Saudi Arabia. The development gives importance to local currencies and sidelines the US dollar for cross-border transactions. This strengthens the de-dollarization initiative kick-started by BRICS.

Also Read: BRICS: U.S. Dollar Dips Against Local Currencies

BRICS: Trade Between China & Saudi Arabia on the Rise

BRICS is looking to dethrone the US dollar from the global reserve status and replace it with local currencies. Read here to know how many sectors in the US will be affected if BRICS stops using the dollar.

Also Read: BRICS: De-Dollarization Gaining Steam in Developing Countries

The move will make the US dollar weaker and make it hard to fund its deficit. If the US dollar loses the supply and demand mechanics, billions of USD could come back to the homeland. This could lead to hyperinflation in the US and cause havoc in the equity market and the American economy.