Ryan Rasmussen, a senior crypto research analyst at Bitwise Asset Management, has shared a set of ambitious forecasts for the cryptocurrency landscape in 2024. A notable projection is the expectation of Bitcoin hitting a new all-time high of $80,000, driven by the impending launch of a spot Bitcoin ETF and the scheduled halving of new Bitcoin supply by the end of April.

Bitcoin’s Projected Surge

Rasmussen’s prediction is anchored in two key factors. Firstly, the upcoming introduction of a spot Bitcoin ETF in early 2024 is poised to play a pivotal role in driving Bitcoin to unprecedented levels. This development is seen as a transformative catalyst capable of attracting significant institutional investment into the Bitcoin market. Additionally, the anticipated halving of new Bitcoin supply by April 2024 is expected to enhance the asset’s scarcity, potentially spurring heightened demand and consequent price increases.

Spot Bitcoin ETF Triumph

Bitwise anticipates not only the regulatory approval of the spot Bitcoin ETF but also envisions its launch as the most successful ETF introduction in history. The outlook is that these ETFs will collectively capture 1% of the $7.2 trillion U.S. ETF market, accumulating $72 billion in assets under management over the next five years. Bitwise is actively seeking approval for a spot Bitcoin ETF from the U.S. Securities and Exchange Commission (SEC).

Coinbase Revenue Surge

Another significant prediction from Bitwise revolves around Coinbase, a prominent cryptocurrency exchange. Rasmussen forecasts a doubling of Coinbase’s revenue, surpassing Wall Street projections by at least tenfold. This optimistic outlook is grounded in historical trends, with Coinbase experiencing increased trading volumes during bullish market phases.

In the larger context, Coinbase emerges as a key player poised for substantial growth in the 2024 bull market. Bitwise predicts a notable 100% increase in Coinbase’s revenue next year, surpassing Wall Street expectations by a significant margin.

Also Read: Bitwise Spot Bitcoin ETF Listed on DTCC

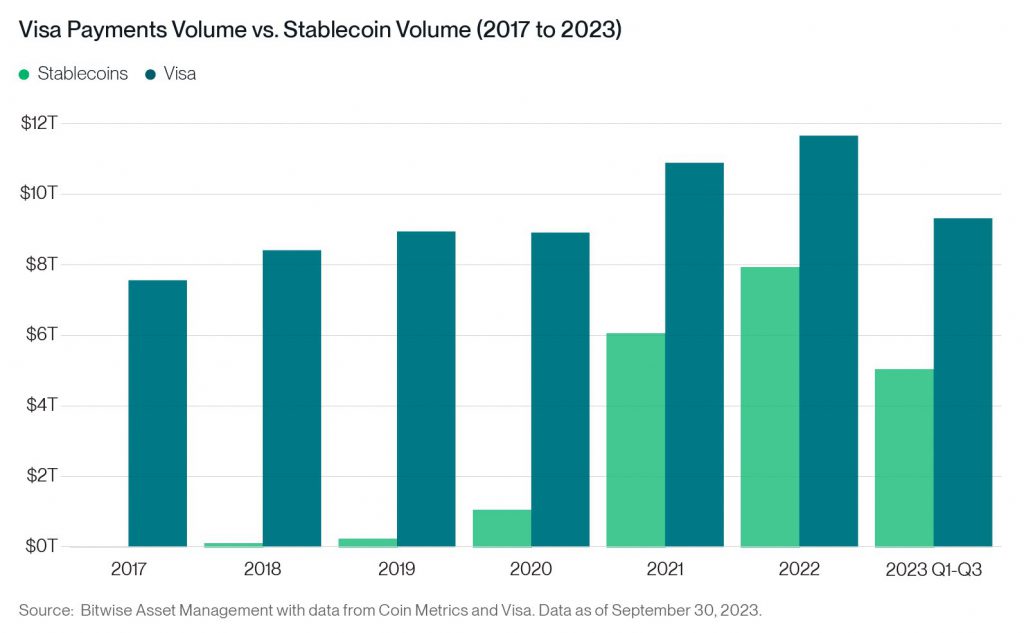

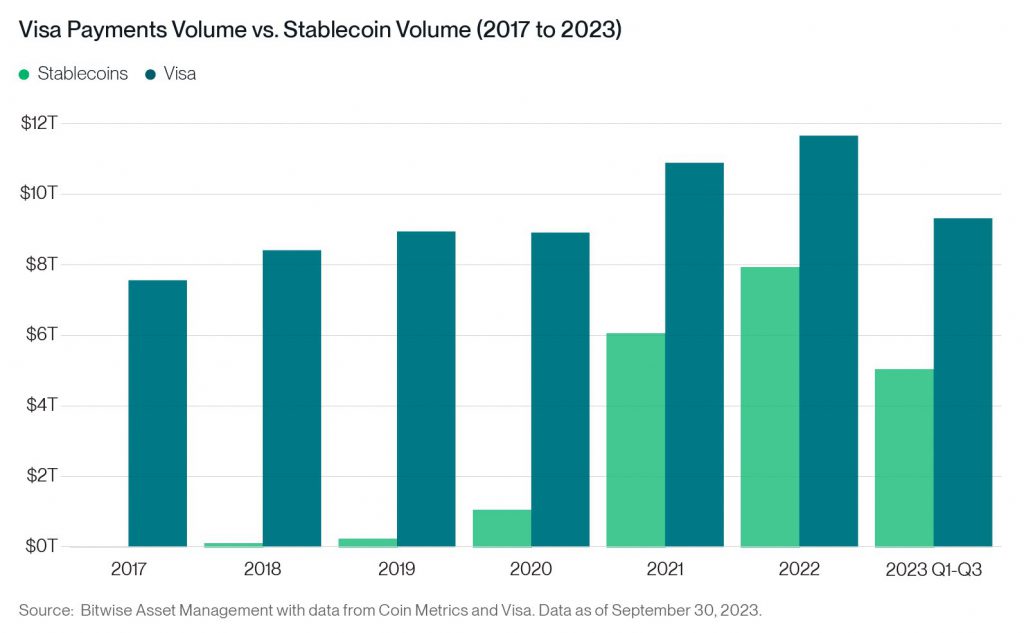

Stablecoins Surpassing Visa

Bitwise’s projections extend beyond Bitcoin and exchanges to stablecoins. The research analyst envisions stablecoins collectively facilitating more financial transactions than Visa, the payments giant, in 2024. Stablecoins, often considered one of crypto’s standout applications, have seen substantial growth, reaching a market cap of $137 billion over the past four years. The expectation for 2024 is that stablecoins will continue gaining prominence, outpacing traditional payment methods like Visa.

Industry Consensus on Stablecoin Growth

Bitwise’s optimism about stablecoins aligns with broader industry sentiment. Voices in the sector, including Circle CEO Jeremy Allaire, foresee a surge in demand for stablecoins in the coming years. Allaire highlights the increasing appetite for digital dollars on the internet, emphasizing a distinct demand beyond those seeking currency or store-of-value hedges. He said,

“Huge appetite for dollars on the internet. That’s a very big thing and that’s distinct from people who want a currency hedge so to speak, or a store-of-value hedge.”

As these predictions unfold, they provide insights into the potential trajectory of the cryptocurrency market, hinting at exciting developments and opportunities on the horizon.

Also Read: SEC Meets With BlackRock To Discuss Spot Bitcoin ETF