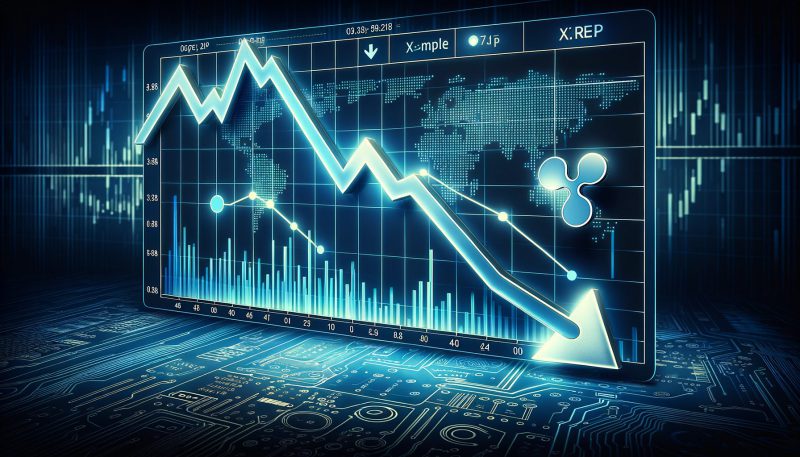

XRP faces sizable headwinds in the coming months, according to both technical and on-chain signals, suggesting the embattled token risks notable price erosion.

The downbeat projections come even as the broader crypto market attempts to stabilize from recent lows. For XRP, already lagging among the top majors, a confluence of metrics tilts risks to the downside, barring an unforeseen positive catalyst.

Bear Flag Threatens Downside Break

The first red flag for XRP spotlights a potential bear flag breakdown on weekly timeframes. XRP is delicately clinging to the pattern’s lower trendline support, with violations opening up targets toward the $0.24 zone for a 55% drop.

Also read: Ripple: XRP Historical Patterns Suggest Potential Price Explosion

Meanwhile, neutral readings on its relative strength index offer little evidence that buyers are poised to reverse momentum. So with little confirmation of overextended selling, the risk skews decidedly bearish on the chart.

XRP whale movement

On-chain information also worries analysts, as substantial amounts of XRP recently reached exchanges from both monthly escrow releases and whale transfers. The perpetual inflow risks saturating sell-side liquidity pools.

One firm also noted decreasing supply held by mid-tier “whales” and redistribution to smaller holders. This is typically indicative of ongoing distribution over extended periods right as buyers lose conviction.

Less optimism about an XRP ETF

Given the grueling legal clash between developer Ripple Labs and securities regulators that continues to elongate, analysts see virtually no prospects of a spot XRP exchange-traded fund approval near term.

Also read: Shiba Inu vs. Dogecoin: Which Meme Coin Will Erase A Zero First?

That glaring absence, combined with potential breakdowns of key support, leaves slim chances of averting protracted declines compared to rivals more squarely in uptrends. Traders face odds decidedly stacked against them at the moment.

Of course, should the dangling court case unexpectedly settle, XRP will see a much better future projection. However, with those prospects uncertain, risk-reward ratios remain skewed to the downside as of now.