Tron [TRX] has garnered significant attention from investors due to recent trading patterns and network metrics, prompting speculation about its trajectory in March 2024. While TRX is currently priced at $0.1429 with minimal fluctuations, a 2.44% increase over the past week suggests some upward momentum. However, according to analysis from Changelly, TRX may face a bearish month ahead.

March 2024: TRON Price Forecast

Experts in the cryptocurrency realm are preparing to reveal their forecasts for TRX’s price performance in March 2024. Predictions indicate a trading range for TRON between $0.126 and $0.163 for the month, with an average expected value of approximately $0.144. These forecasts take into consideration various market factors and trends, offering insights into TRX’s potential trajectory.

Also Read: Circle To End USDC Stablecoin Support on TRON

TRON Addresses Reach Record Levels

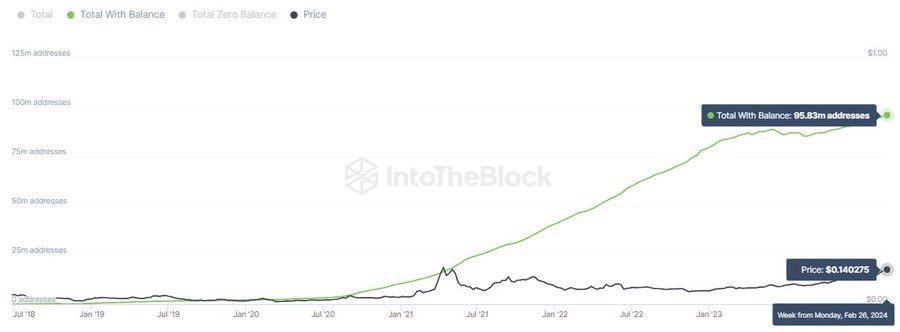

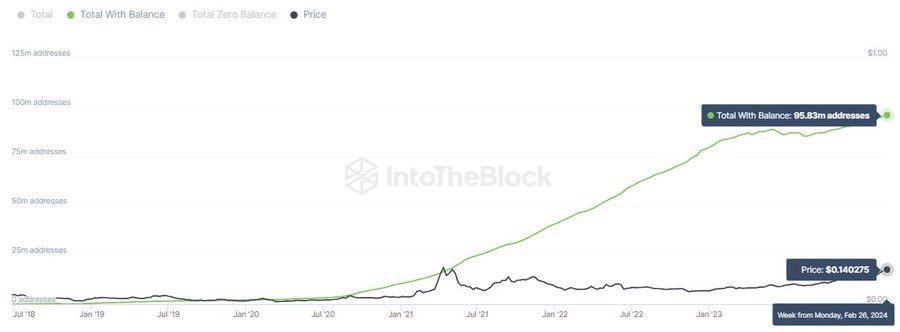

Data from the market intelligence platform IntoTheBlock indicates that TRON has outpaced other layer 1 networks like Cardano and Avalanche in terms of address growth. The number of TRON addresses holding a balance has surpassed 95 million, signaling significant network expansion.

Despite the influx of new users into the Tron ecosystem, TRX’s profitability remains robust. IntoTheBlock data reveals that 117.59 million addresses, constituting 99.06% of the network’s total, are currently profitable. This metric, which monitors addresses with a non-zero balance, reflects ongoing adoption and activity within the TRON blockchain.

The uptick in addresses with a balance indicates increasing investor participation and interest in TRON. Whether attributed to new investors entering the network or existing holders re-engaging, this trend augurs well for TRX’s long-term outlook. A growing number of active addresses suggests a healthy ecosystem and implies sustained adoption of blockchain technology.

Conversely, a decline in this metric could signal investors divesting their holdings and exiting the network, potentially indicating dwindling interest or confidence in TRON. Monitoring address growth provides valuable insights into investor sentiment and network dynamics, aiding stakeholders in assessing TRX’s performance and potential.

Charting TRX’s Path Forward

As TRON navigates the opportunities and challenges ahead, stakeholders should closely monitor market trends and network metrics. While the outlook for TRX in March 2024 may present uncertainties, its robust address growth and widespread profitability underscore the underlying strength of the ecosystem.

March 2024 presents a mix of challenges and opportunities for Tron [TRX]. While price forecasts hint at potential volatility, TRX’s network metrics, characterized by a growing number of addresses and widespread profitability, suggest positive momentum and ongoing adoption. As investors track TRX’s performance, a comprehensive understanding of market dynamics and network fundamentals will be essential in evaluating its growth potential in the coming month.

Also Read: How Many Bitcoins Does Warren Buffett Own? Tron’s Justin Sun Answers