Demystifying the Atlas Credit Card: Is It Legit?

If you’re on the hunt for a new credit card, you may have come across the Atlas Credit Card. But with so many options available, it’s natural to wonder: is the Atlas Credit Card legit?

In this guide, we’ll take a closer look at the Atlas Credit Card to determine its legitimacy and whether it’s the right choice for you.

Let’s dive in and uncover the truth behind this financial tool.

Also read: Does Amazon Accept Acima Credit?

Understanding the Atlas Credit Card

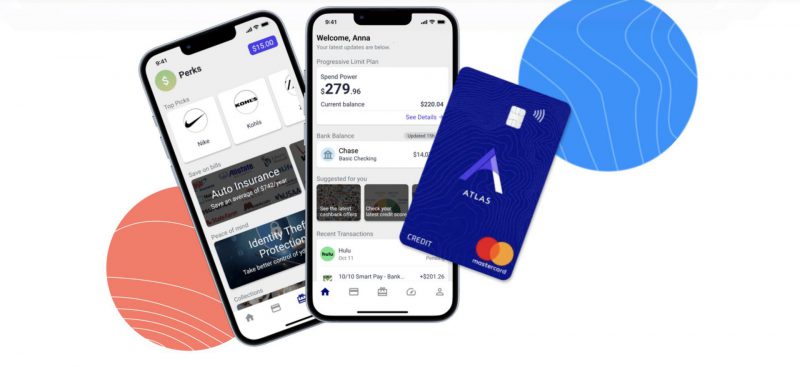

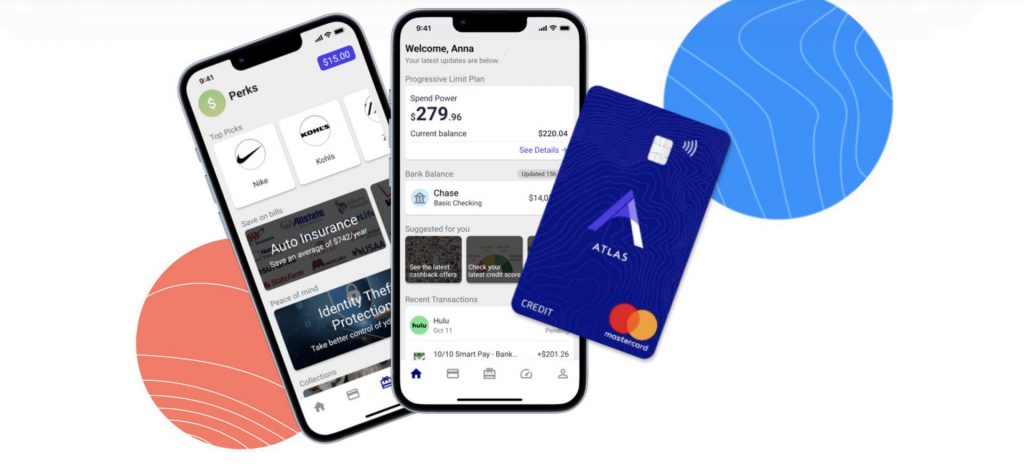

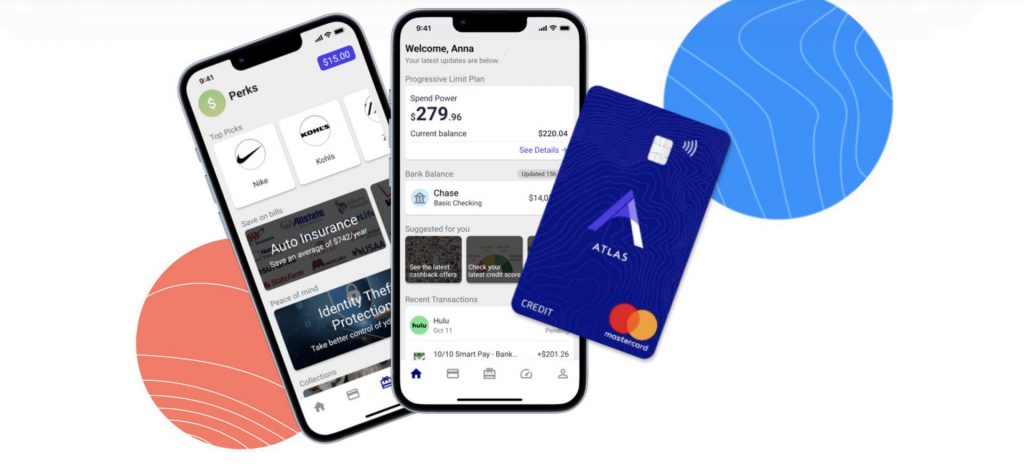

The Atlas Credit Card is a credit-building tool designed to help individuals establish or improve their credit scores. It operates like a traditional credit card, allowing users to make purchases and build a positive credit history over time.

With responsible use, the Atlas Credit Card can help users boost their credit scores and gain access to better financial opportunities.

Safety and Security

One of the primary concerns when considering a new credit card is safety and security.

Rest assured, the Atlas Credit Card is issued by Patriot Bank, a reputable financial institution. This means that your personal and financial information is safe and secure when using the Atlas Credit Card for transactions.

Additionally, the card comes with built-in security features to protect against fraud and unauthorized use.

Also read: Can I Get a Mortgage with Bad Credit in Canada?

Building Credit with Atlas

For individuals looking to build or rebuild their credit, the Atlas Credit Card offers an excellent opportunity. By making timely payments and keeping balances low, users can demonstrate responsible credit behavior and improve their credit scores.

Plus, Atlas reports to major credit bureaus, ensuring that your positive payment history is reflected in your credit report.

Approval Rates and Limits

One of the benefits of the Atlas Credit Card is its high approval rates, making it accessible to individuals with varying credit profiles.

Additionally, the card offers a spending limit that can increase over time with responsible credit management.

This means that even if you have a limited or poor credit history, you may still qualify for the Atlas Credit Card and begin building your credit immediately.

Conclusion

In conclusion, the Atlas Credit Card is indeed a legitimate financial tool that can help individuals build or rebuild their credit.

With its high approval rates, safety and security features, and credit-building benefits, the Atlas Credit Card offers a valuable opportunity for those looking to improve their financial health.

So, if you’re in the market for a credit card that can help you establish or enhance your credit score, consider giving the Atlas Credit Card a closer look.