Your Guide: Will the US Dollar Collapse?

Are you worried about the US dollar collapsing? In today’s world, there are so many unforeseen developments taking place. Moreover, a host of geopolitical players are seemingly constantly battling it out.

With military conflicts taking place and the upcoming 2024 presidential election, people are kind of on the fence about spending. Driven by many of these unknown circumstances and developments, people don’t want to spend cash.

So, will the US dollar collapse? Today we’ll take just this. Keep reading to find out more.

Also read: BRICS: India Could Reject Membership of New Countries in 2024

The Dollar’s Overall World Role

First, it’s probably a given but the US dollar’s role in the global economy is really significant. It’s the cornerstone of the global financial system. There’s no other country in the world where currency is used more in any transaction.

Plus, the US dollar is held as a reserve by banks worldwide. The strength of it all boils back to the US’s political system and the economy’s stability. If the US economy is doing well; the value of the dollar will increase. If it doesn’t, the value drops some.

Why do people think the dollar will collapse?

There are a few key concerns for people when it comes to the question of whether the US dollar will collapse. These include psychological inflation and debt in overall global competition.

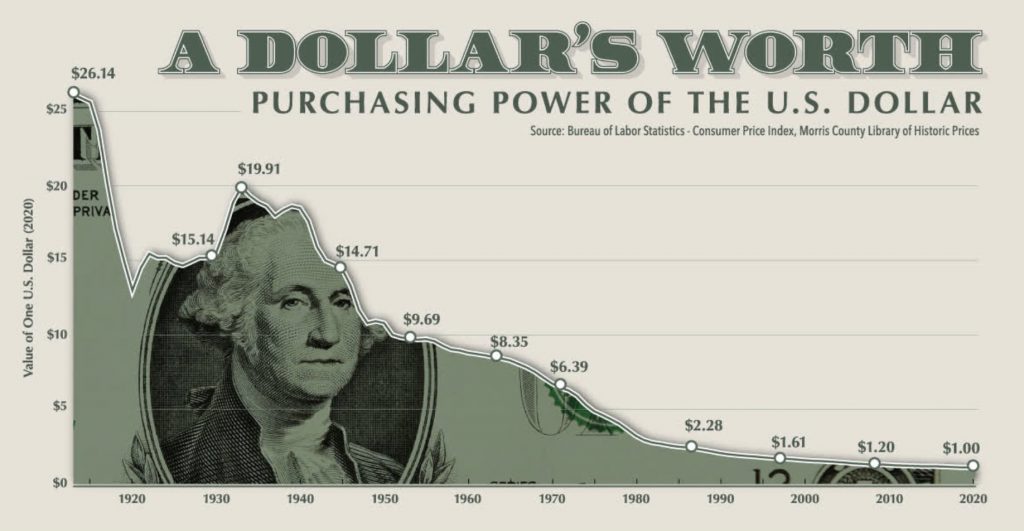

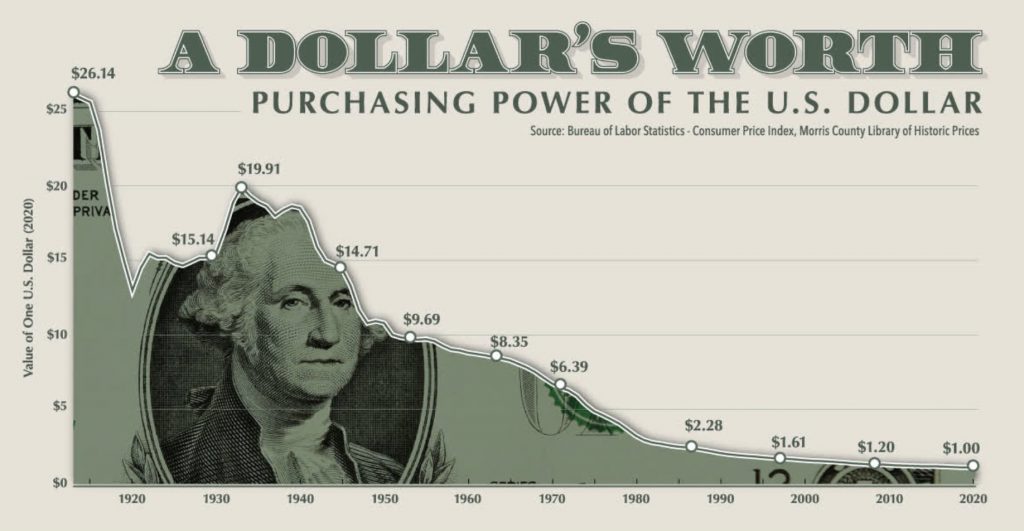

Inflation

First, talk about inflation. Inflation plays a really critical role in the value of the US dollar. Typically, if inflation happens, the prices of all things go up, but there’s no increased economic output. The dollar’s good falling value in the US goes to something called the Federal Reserve, which basically helps to control inflation.

The Morton control inflation better chance the US dollar has at driving. That’s why when you hear things like “of the federal arrays, the price, the percentages,” it’s an indicator that you’re trying to keep inflation costs down. If they didn’t do such things, then the overall general value of the dollar decreased.

Debt

Next, let’s talk about the US national debt. It goes without saying that the US definitely has a ton of debt under its belt. The current US national tech number is a whopping $34.6 trillion. That’s why you argue that the US has a deep debt.

It’s just not sustainable for the US economy. Having that much that helps people lose confidence in the dollar, others would argue that as long as the US can manage to air dad, they’re still good to go.

So these arguments on both sides when it comes to national debt are here: yes, it is a lot of money but taking on some debt as one of the world’s global superpowers is kind of inevitable.

Also read: U.S. Reacts To BRICS De-Dollarization Agenda

Global Competition

Last but not least, let’s talk about global competition. Other superpowers, like China and Saudi Arabia, have really been trying to diversify their reserves. Not to mention, people have huge populations, and it has shown some incredible economic growth.

The stronger these countries become and the more stable their economies become, the more likely it is that they could keep the US dollar. Take, for example, the BRICS Alliance. The bricks alignment is literally an alliance of several countries whose goal is to lessen the spread of all world power.

Is a collapse likely?

So is this an actual collapse problem? You know they say never say never, but the chances of the US dollar collapsing are really, really slick. The US dollar’s influence in the global world is huge.

The weight with which the US is able to position its currency as the global dominant currency that every other country should use is pretty substantial, even though the US economy in various school events may lessen the value of a dollar for some part of time. Do you’ve found dollars disturbingly strong?

So the chances of an actual collapse are unlikely, and there will be various policies put in place for the US to ensure that it still maintains its value.

What should I own if the dollar collapses?

In the event the US dollar does head towards collapsing, there are some other things you can do to protect yourself financially. These would be investments in various things, like gold or real estate. Also, diversifying your portfolio to include different commodities like metals, oils, or agricultural products is probably the best choice for you.

Conclusion

In conclusion, the collapse of the US dollar is fairly slim to none. The way in which the US has carved itself a path to being the number one global player in the world holds a lot of value. It means that just because there’s any given mold event happening or we’re going through the current economic crisis domestically, the US dollar will still maintain its value.

Sure, it might actually have a different value and fluctuate from time to time, but the overall projection is that the US dollar is here to stay. Based on the sheer size of the US economy, our economic stability, generally speaking, is a good indicator that the US dollar will be here for a very, very long time.