Bitcoin fell out of a bullish bias yet again after failing to push above $52K just last week. The price has now oscillated between two major points, with bulls nor bears able to force any kind of a breakout thus far. A recovery along the RSI does point towards an incoming swing but only if BTC topples its immediate resistance. At the time of writing, BTC traded at $47,222, down by 0.15% over the last 24 hours.

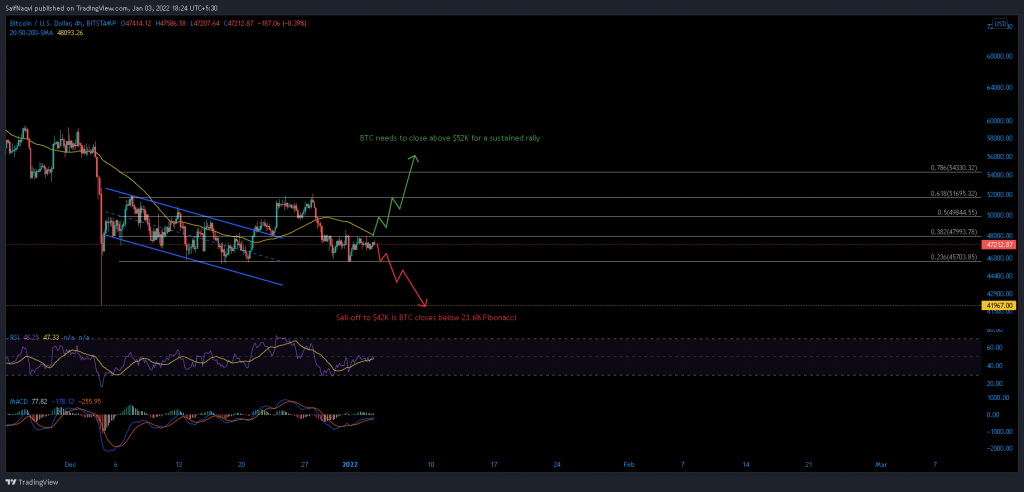

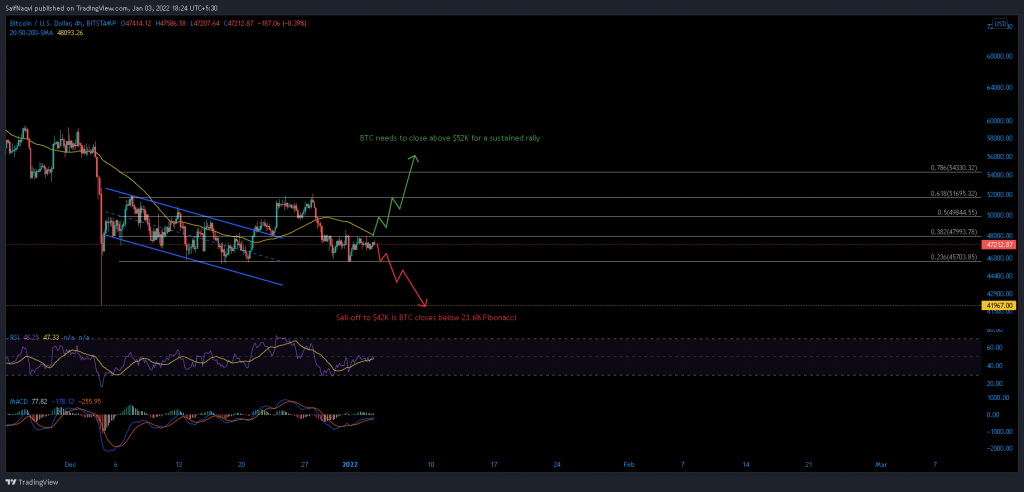

Bitcoin 4-hour time frame

An up-channel breakout on 21 December carried much promise, but BTC was unable to advance beyond $52K due to strong buy volumes. As bulls lost momentum, BTC registered a 12% decline between 27-31 December. Since then, the price has consolidated between the 38.2% Fibonacci ($47,993) and 23.6% Fibonacci ($45,703) levels and neither side looks ready to force a breakout just yet.

To establish an uptrend, BTC would have to cover ground above the 38.2% Fibonacci level and the 50-SMA (yellow). From there, a breakout above the 61.8% Fibonacci level would need to be backed by healthy volumes for a sustainable price recovery. Should BTC falter at any of these abovementioned levels, the pullback will be common.

Bears had an easier task to trigger a breakdown. A close below the $45,500 could quickly transpire into an 8% market decline due to the lack of reliable supports. 4 December’s swing low of $41,967 would then become BTC’s best chance at a rebound.

Indicators

Interestingly, the 4-hour RSI and MACD have formed higher lows are were currently testing their respective mid-lines. Normally, higher lows along these indicators depict increased buying activity. However, it’s worth noting that BTC traded below its 200-SMA (green) and short-selling was still a threat. Hence, favorable readings on the RSI and MACD should be taken with a pinch of salt.

Conclusion

Expect Bitcoin to maintain consolidation over the near term as the RSI and MACD remain neutral. Talks of a rally will only be possible once BTC closes above the 61.8% Fibonacci level on strong volumes.