Ace investor Warren Buffett once famously said, “Be fearful when others are greedy, and be greedy when others are fearful.”

Buffett laid out the simple rule that buying the dips and holding on for the long term will deliver massive profits. The US stock market wiped away nearly $2 trillion worth of wealth as fears of a recession looms.

Also Read: Morgan Stanley Says the US Dollar Will Dominate the Indian Rupee

While the majority of stocks plummeted by double digits, only three stocks outperformed the markets and surged high in value.

Check out the top three stocks that delivered massive gains despite the US market crashing on Monday. Every stock market crash is a perfect opportunity to buy the dip and accumulate more, as these stocks are available at discounted prices.

As the US stock market is nosedive, leading analysts have suggested three stocks to buy during the dip. Holding them long-term could deliver the desired results as it turns into a ‘buy low and sell high’ event.

Also Read: XRP & ADA Price Prediction After Cryptocurrency Market Crash

3 Stocks To Buy During US Stock Market Crash

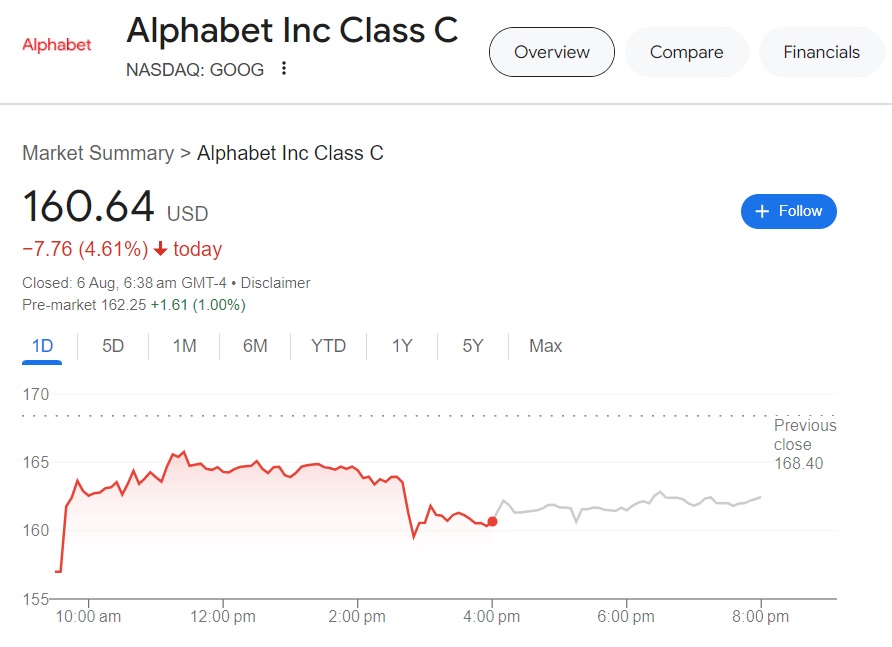

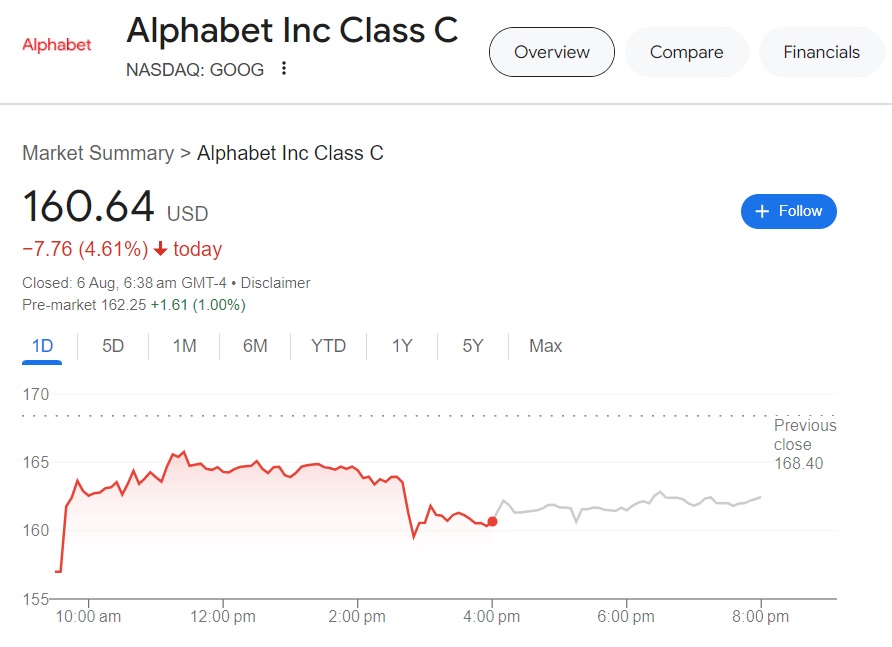

1. Alphabet on US Stock Market – Google’s Parent Company

Alphabet (NASDAQ: GOOG) is trading at the $160 range after dipping nearly 5% on Monday. The tech giant was also down 11% on Friday and lost much of its value in two days.

However, BMO Capital analyst Brian Pitz has given Alphabet a ‘buy’ tag and remains his top pick during the US stock market crash.

Pitz has given a target of $222 for Alphabet when the market recovers and enters the greener territory.

Also Read: Shiba Inu (SHIB) & Bitcoin (BTC) Weekend Price Prediction

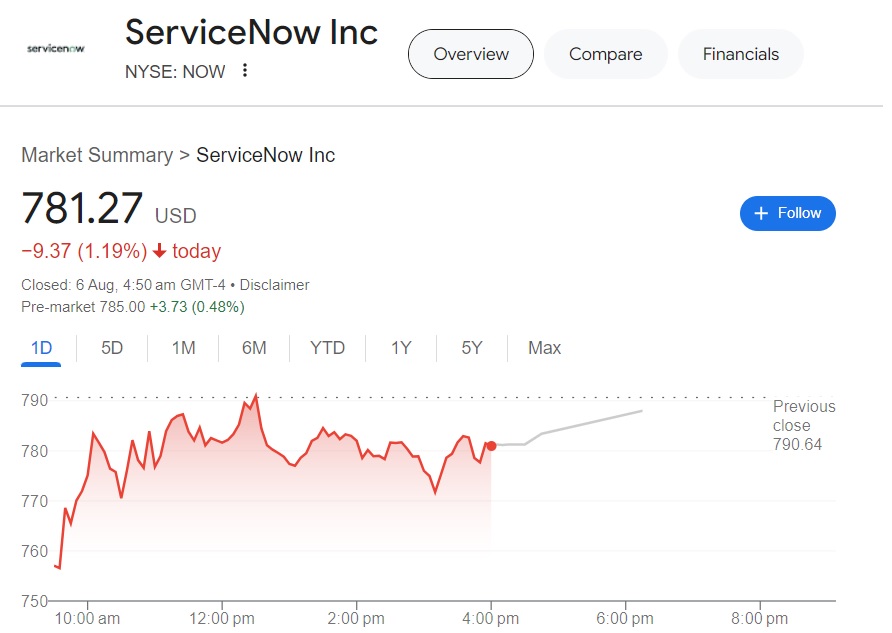

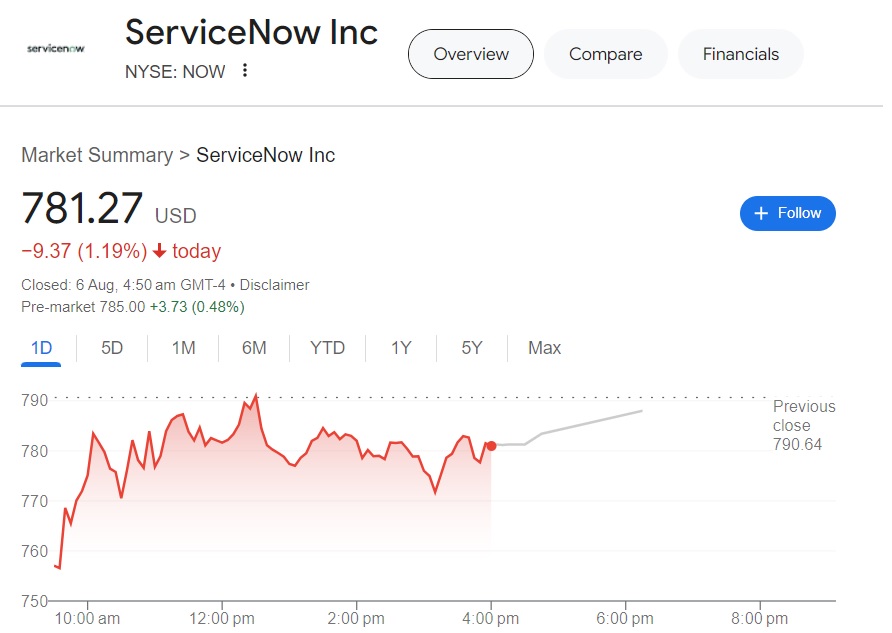

2. ServiceNow

ServiceNow (NYSE: NOW) ended Monday’s trade at $781 and is attracting bullish sentiments in the charts.

The dip is a perfect buying opportunity, says Goldman Sachs analyst Kash Rangan, against the backdrop of the US stock market crash.

Rangan has predicted that ServiceNow shares could surge towards $910 to $940 when the market recovers next.

Also Read: ASEAN: 5 Nations at Risk as US Dollar Weakens

3. Travel + Leisure Co

Travel + Leisure (NYSE: TNL) hit $40.55 on Monday and is down nearly 13% since a week. Tigress Financial analyst Ivan Feinseth has provided a ‘buy’ call for TNL with a price target between $54 and $58.

The analyst is bullish on the stock as vacation among the middle class is rising due to social media influence.

Feinseth said, “A combination of property development, membership sales, and increases in subscription and resort operating fees” puts Travel + Leisure Co. shares in the spotlight.