The US dollar remains strong this week as Treasury yields rose sharply. A 10-year yield is up by 7 basis points to 3.963%, and a 2-year yield is 4.001%. The development boosted the arm to the US dollar, making it enter the greener spectrum.

Treasury yields have delivered better-than-expected results this year, sending the US dollar to the top of the charts. However, the US jobs report and the upcoming CPI data could cause the next yields to turn low if they fail to meet market expectations.

Also Read: ASEAN Country Philippines To Suffer If De-Dollarization Is Initiated

US Dollar Rises Due To Stronger Treasury Yields

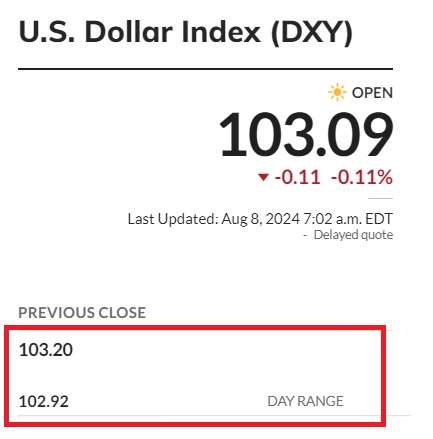

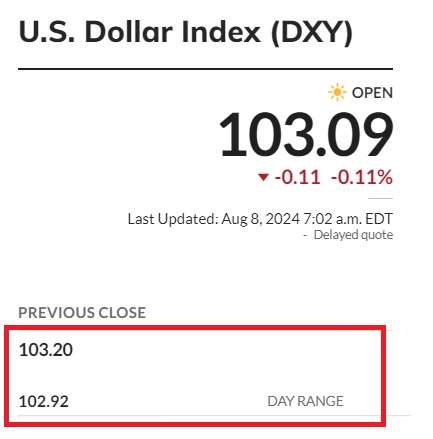

The DXY index, which measures the performance of the US dollar, shows that currency trading is comfortably above the 103 mark. A stronger US dollar has caused local currencies to dip, making them fall to new lows in the charts.

The Indian rupee fell to its all-time low of 84.15 early this week but briefly recovered to 83.95 on Thursday. In addition, the Chinese yuan is down to its eight-month low against the U.S. dollar in the currency markets.

Also Read: ‘BRICS Bridge’ To Replace SWIFT and End Dependency on the US Dollar

The Japanese yen is the hardest-hit currency, down to its 1990s low against the U.S. currency. Twenty-two out of 23 leading local currencies have fallen sharply against the USD. Only the Hong Kong dollar managed to stay afloat and remained relatively stable in the Forex markets.

Also Read: Copper Prices Dip Below $9,000: Time to Invest?

Given the current trends, the USD will likely attract bullish sentiments before the CPI data is out. The July CPI data will be published on August 14, 2024. The next direction of the US dollar will then depend on how inflation is controlled.

If inflation rises, the chances of the US dollar falling below the 102 mark in the DXY index remain high. Therefore, remain cautious and avoid the currency markets during this period.