The U.S. stock market indexes are hitting new highs this year and generating euphoria across the financial sector.

Also Read: BRICS: New Gold-Backed Currency Gains Steam & Challenges the US Dollar

Market Overview

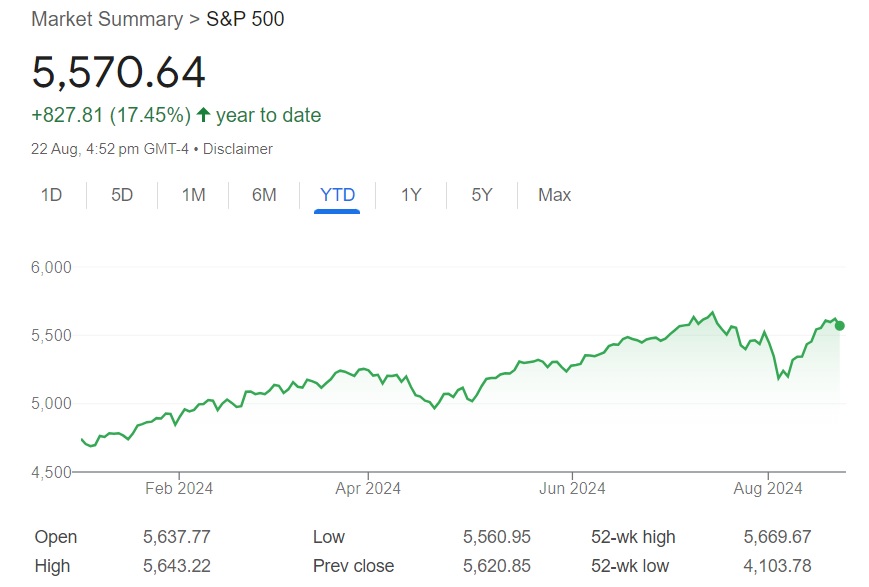

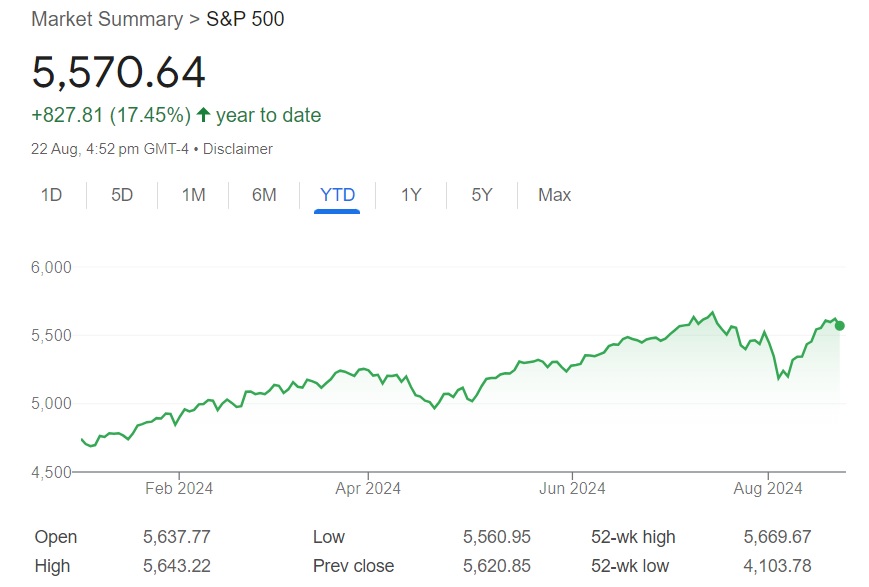

The Nasdaq Composite touched a record high of 18,600, while the Dow Jones Industrial Average hit 41,300 in 2024. The S&P 500 index climbed above the 5,600 level and is now hovering around the 5,500 mark. The index is up 17.45% year-to-date, making leading stocks rally in the charts.

The markets have emerged from the recession fears, and it is business as usual in the financial sphere. Though fears of a looming recession linger, the economy is doing better, with jobs being created in all sectors. This move boosts the S&P 500 prospects, attracting bullish sentiments in the indices.

Also Read: BRICS: Local Currencies Knock-Out the U.S. Dollar This Week

S&P 500 Index Has Potential To Hit 6,000: Says Analyst

Analyst’s Prediction

A leading stock market analyst suggested on TradingView that the S&P 500 index could hit 6,000 next. The index has shown remarkable resistance, reclaiming the lost ground during the recent stock market crash. The analyst explained that the S&P 500 has firmly established itself above the 1D MA50, the short-term supporting level.

Also Read: More Than 50 Countries Could Accept BRICS Payment System

Key Levels to Watch

He wrote that if the index breaks above the 5,670 mark, the next leg-up could be 6,000. According to the analyst, the S&P 500 index could reach 6,000 in the next two months if it receives strong support in the 5,670 range.

“As a result, we expect the index to break above 5,670 soon and then turn sideways, sustained above it for 1-2 weeks. By the end of October we are targeting for a 6,000 Higher High at the top of the long-term Channel Up pattern,” read the forecast.

Therefore, the S&P 500 index could sustainably scale up in the charts and touch a new all-time high of 6,000 by the end of October 2024.