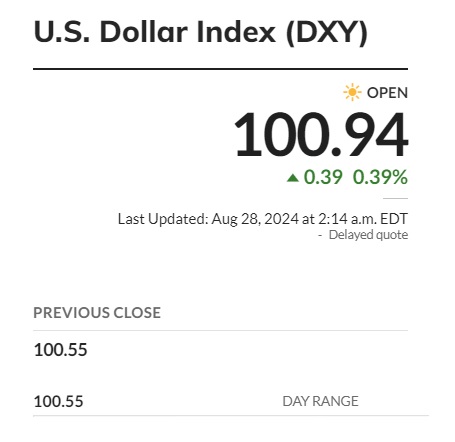

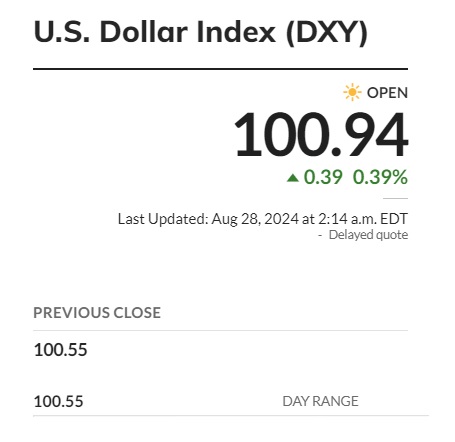

The U.S. dollar finally emerged from its 4-day losing streak by rising 0.39% in the charts on Wednesday’s opening bell. The world’s leading currency fell to a low of 100.4 early this week, sending fears that a dip below the 100 mark is inevitable.

However, the USD picked up steam, breaking its downward trend, and touched 100.94 today.

Also Read: Solana Price Prediction: SOL Forecasted To Reach $220

The DXY index, which tracks the performance of the U.S. dollar, shows that the currency has surged by 0.39 points. It’s also up 0.39% in the index and is gearing up to climb above the 101 mark. The rebound in price signals that currency investors are diverging on the Fed’s monetary policies.

Also Read: Bitcoin to $100,000? Analysts Predict Bullish September

What Next For the U.S. Dollar?

The interest rate cut speculation is put to rest and could return at the next Fed meeting in September. The CME Group’s FedWatch Tool reported that currency traders have put a 71.5% chance of a 25-basis-point cut next month.

Another 28.5% of traders speculate a probability of a larger 50-basis-point cut. Therefore, the US dollar could be more volatile in September due to differing views in the forex markets.

Also Read: Top 2 Cryptocurrencies To Watch in September 2024

The differing trend indicates that the U.S. dollar could be bearish in September, and weakness in the charts could be expected.

Leading currencies like the Euro and Sterling Pound could benefit most from the USD’s bearishness. The Pound gained 0.25% against the USD, while the Euro reached its 13-week high, edging up $1.1166.

Even leading Asian currencies like the Chinese yuan, Japanese yen, and Indian rupee are holding up against the U.S. dollar. If the USD dips again in September, local currencies could remain at the top of the charts in the forex markets for extended periods.

Local currencies are already receiving an influx of institutional funds, cementing their resistance level against the USD.