Russia’s digital ruble pilot program is growing. At the same time, the Moscow Exchange is stepping away from crypto trading. This shift shows a change in Russia’s approach to digital currencies and central bank digital currencies (CBDCs).

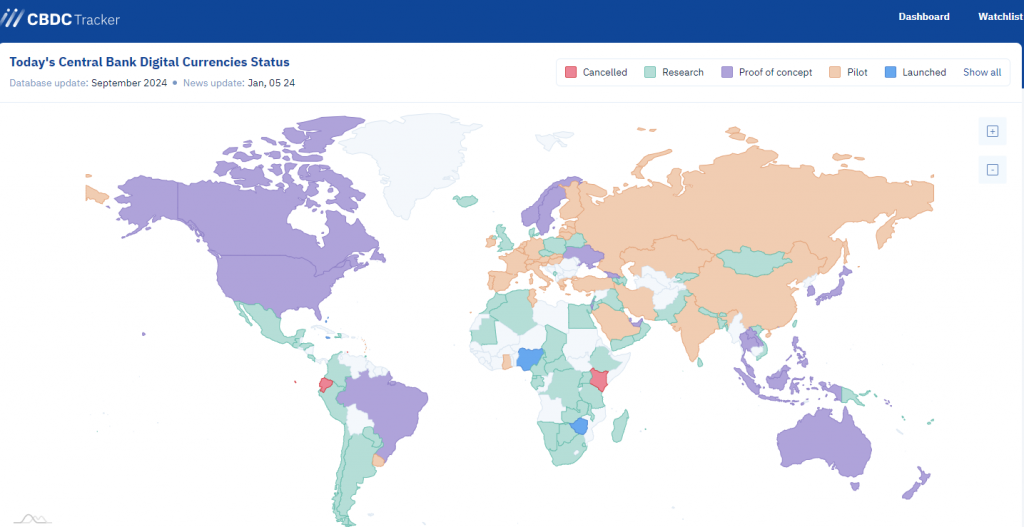

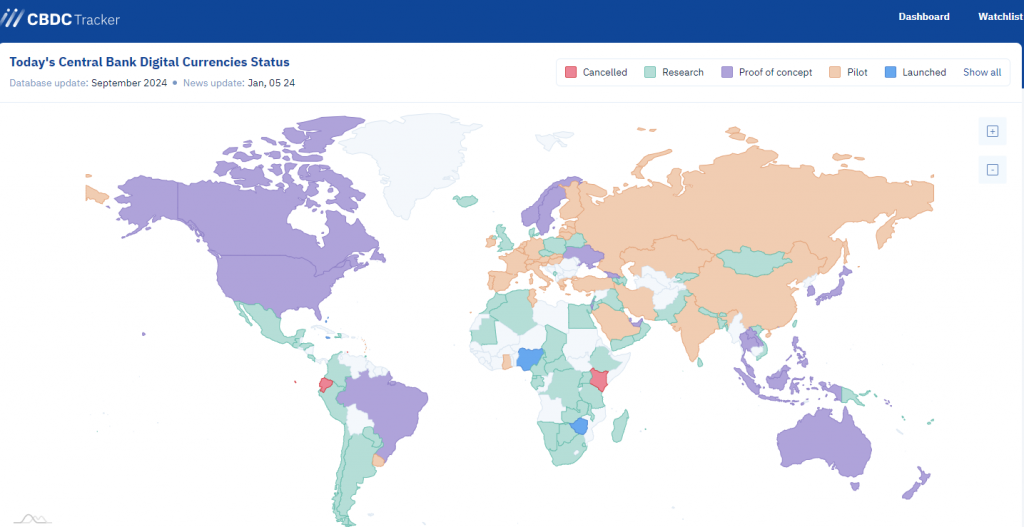

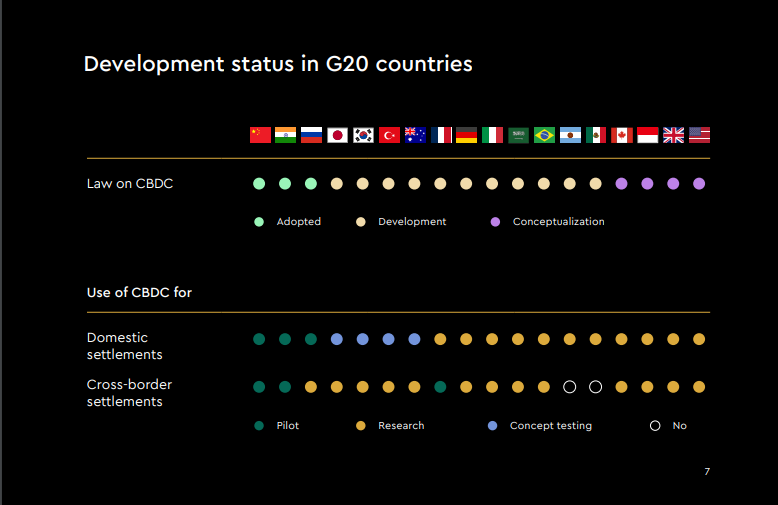

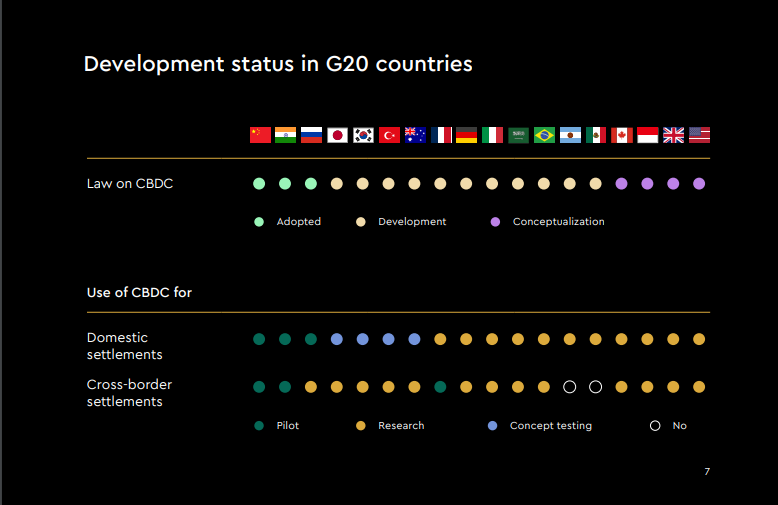

This map illustrates the current status of Central Bank Digital Currencies (CBDCs) worldwide, highlighting Russia’s position in the global CBDC landscape.

Also Read: US Responds to NATO Country Turkey’s BRICS Application

Russia’s Digital Ruble Pilot: Expansion, Features, and Market Impact

Expanding Scope of Digital Ruble Pilot

The Bank of Russia is expanding its digital ruble pilot program. This central bank digital currency (CBDC) project will now include up to 9,000 people and 1,200 companies. This is a big step towards wider use.

New Features and Functionalities

The expanded pilot adds new features to the Russian digital currency. The Bank of Russia stated:

“Now participants will have access not only to opening, closing and replenishing digital ruble accounts, transfers between citizens, payment for goods and services, simple auto payments, but also payment via dynamic QR code, as well as transfers between companies.”

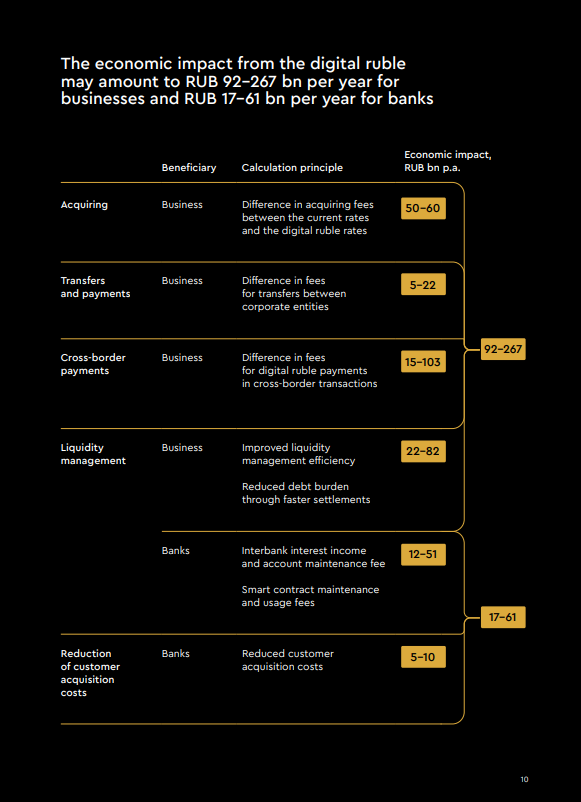

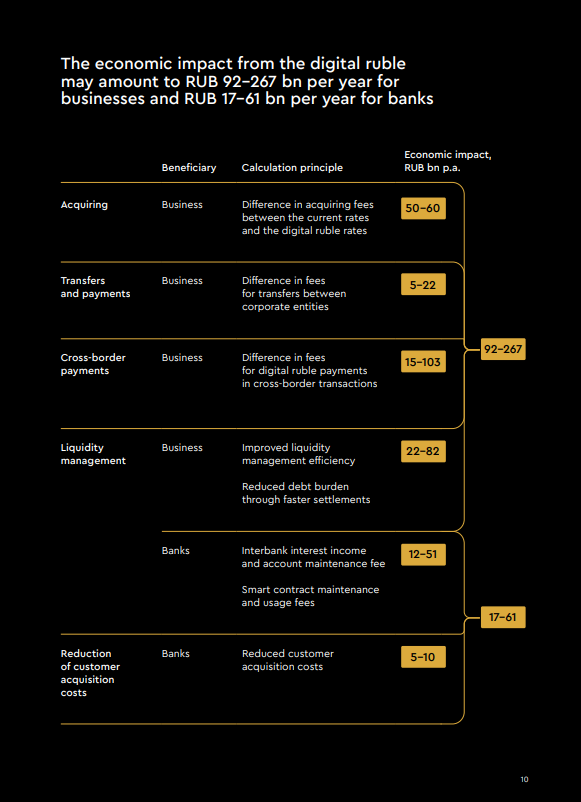

This chart demonstrates the potential economic impact of the digital ruble on various sectors of the Russian economy, including businesses and banks.

Timeline for Full Implementation

Officials expect the digital ruble to be fully implemented by late 2025. Anatoly Aksakov, Chairman of the State Duma Committee on Financial Markets, is optimistic about the project. He notes that demand for the digital ruble is growing fast.

Also Read: Donald Trump Warns of Consequences If BRICS Ditches the US Dollar

Moscow Exchange Opts Out of Crypto Trading

As the Russian digital currency grows, the Moscow Exchange (MOEX) has decided not to join Russia’s crypto trading program. This comes after the Russian State Duma approved laws to legalize digital currencies under central bank control.

Implications for Russia’s Financial Landscape

The growth of the digital ruble pilot and MOEX’s exit from crypto trading show a shift in Russia’s financial focus. These changes will likely shape how the country approaches digital finance in the coming years.

Aksakov predicts, “From the second half or closer to the end of 2025, if no, let’s say, incidents occur, the digital ruble will become truly widespread and everyone who wants to will be able to use it.” This shows the ambitious timeline for integrating the Russian digital currency into daily life.

This image shows the development status of CBDCs in G20 countries, providing context for Russia’s progress in relation to other major economies.

Also Read: Ripple: XRP Mid-September Price Prediction

Financial experts and policymakers worldwide will be watching Russia’s digital currency initiatives closely.