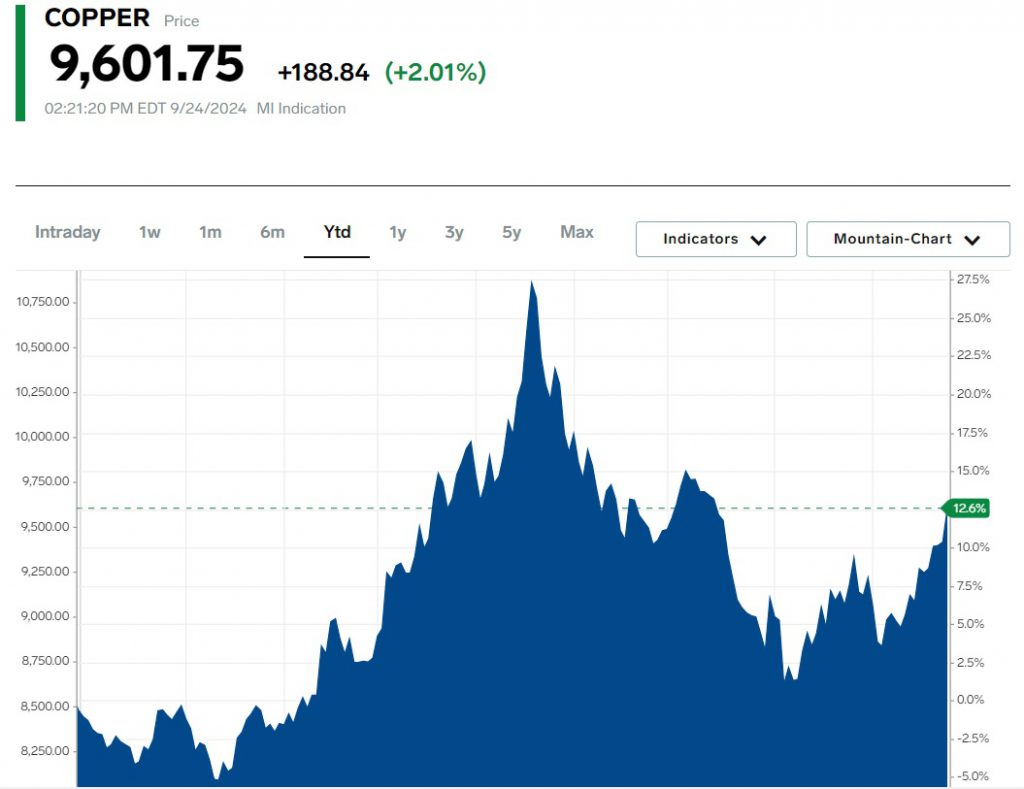

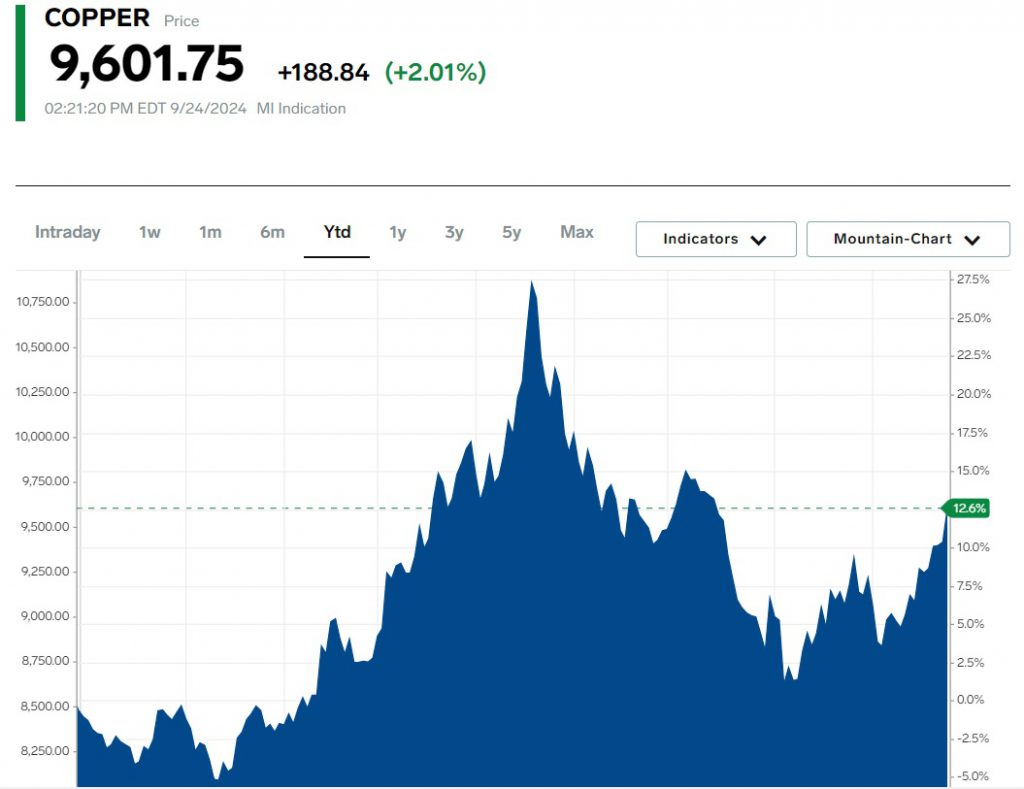

Copper prices are skyrocketing in the charts after the Federal Reserve announced an interest rate cut of 50 bps last week. The metal rose from $9,200 to $9,600 weekly and is attracting heavy bullish sentiment in the indices. On Wednesday’s opening bell alone, copper prices surged 188 points, rising nearly 2% in the day’s trade.

Also Read: US Stock: Nvidia Price Forecast- How High Can It Rise By Sept’ End?

The dramatic surge has made copper among the top gainers in the broader commodity markets this month. The industrial-grade metal has spiked double digits in 2024, surging 13.3% year-to-date. Investors who entered copper early this year made decent profits in the last nine months.

Also Read: BRICS Currency: 40% Could Be Tied to Gold, 60% in Local Currencies

What Next For Copper Prices?

The rise in prices came after the demand for the metal stabilized in September. China’s copper consumption by industries usually remains stronger between September and December each year. While the market for the metal hit rock bottom in Q2 of 2024, it bounced back in Q3.

Also Read: Chinese Yuan Hits 16-Month High Against US Dollar

“Demand (for copper) in the past several weeks has been good. Wire rod production in September was quite good because the price was low,” said commodity markets analyst He Tianyu.

Tianyu explained that prices could continue doing well even in Q4 of 2024. Therefore, metal prices could surge higher in the commodity markets by the end of the year. “I expect copper demand and price to improve in the fourth quarter,” said the analyst.

Also Read: Buy CrowdStrike Shares: Target $325, Profit of 10.5%

The bounce back in prices has brought fresh enthusiasm in the commodity markets. Both copper and gold are surging in the indices, becoming the most sought-after assets. Both gold and copper have received a ‘strong buy’ call from commodity strategists.

However, copper prices remain unlikely to breach its all-time high of $10,857 by the end of the year. The metal could face massive sell-offs due to profit bookings once it reaches the $10,000 mark.