Leading streaming subscription service Netflix (Nasdaq: NFLX) is among the top-performing stocks in the US equity markets in 2024. The stock doubled investor’s money in a year by rising 100% in the charts from October 2023 to 2024. Investors who took an entry position last year reaped all the profits it delivered and are now looking for further gains.

Also Read: MicroStrategy Stock Rises 550% in 2024: Should You Invest?

In the year-to-date alone, Netflix stock has surged by nearly 54% in the last 10 months. Traders who entered the stock early this year are enjoying 50% profits and are eager to reap more. Amid the bull run, leading Wall Street analysts have given both a ‘strong buy’ and ‘buy’ call for Netflix.

Also Read: The Simpsons Predict Bitcoin and XRP: Should We Pay Attention?

Netflix Stock Price Prediction: $900 Target in 2025, Say Analysts

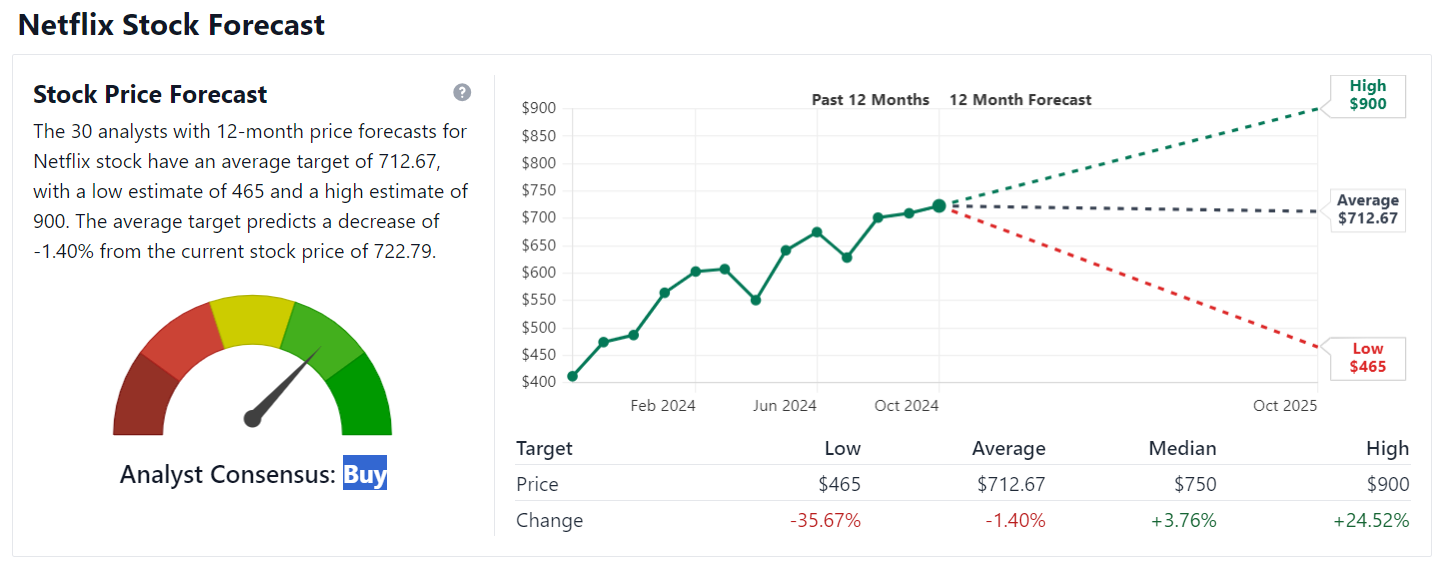

Netflix stock is currently trading around the $722 level and is hovering around its all-time high of $736. Around 30 Wallet Street strategists from Stock Analysis have predicted a favorable view of NFLX. 12 analysts have given it a ‘strong buy’ call while another 10 analysts have given it a ‘buy’ call. In addition, two other strategists have given it a ‘hold’ call for the next 12 months.

Also Read: 4 Key Factors That Could Move Bitcoin’s Price This Week

Wall Street analysts have given Netflix stock a price target of $900 for the next 12 months in 2025. That’s an uptick and return on investment (ROI) of approximately 25% from its current price of $722. Therefore, if the forecast turns out to be accurate, an investment of $1,000 could turn into $1,250 in 2025.

Also Read: North American Countries Start Applying For BRICS Membership

The overall consensus is that Netflix stock will get a ‘buy’ rating as it could likely perform well in the next 12 months. However, on the downside, the stock could trade at $750 in 2025 and if the market underperforms, its price could dip to the $465 level. That’s a downward tick of around 35% from its current price.