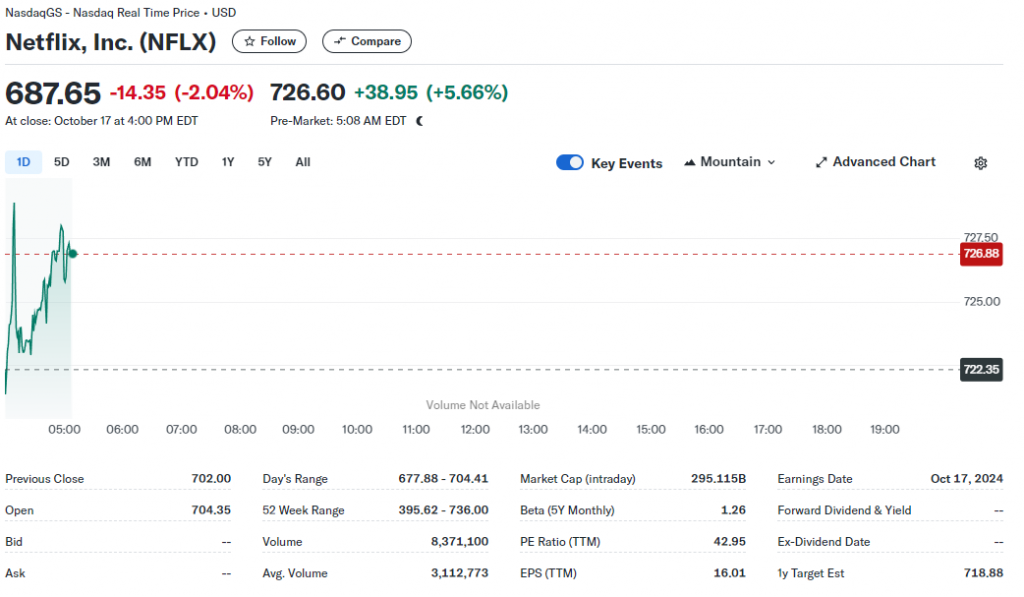

Netflix stock jumped 5.4% after hours as Q3 revenue hit $9.83 billion, beating Wall Street forecasts. More subscribers and strong finances also surprised many.

Let’s understand better why NFLX is steadily increasing in value!

How Netflix’s Q3 Performance Defied Wall Street Expectations

More Subscribers Than Expected

Netflix got over 5 million new customers in Q3. Analysts thought they’d only get 4.52 million. Now, Netflix has 282.7 million subscribers in total.

Co-CEO Ted Sarandos said:

“We’re feeling really good about the business. We had a plan to re-accelerate growth and we delivered on that plan.”

Also Read: Netflix Stock: A Profit of $380,000 Could Have Been Yours: Here’s How

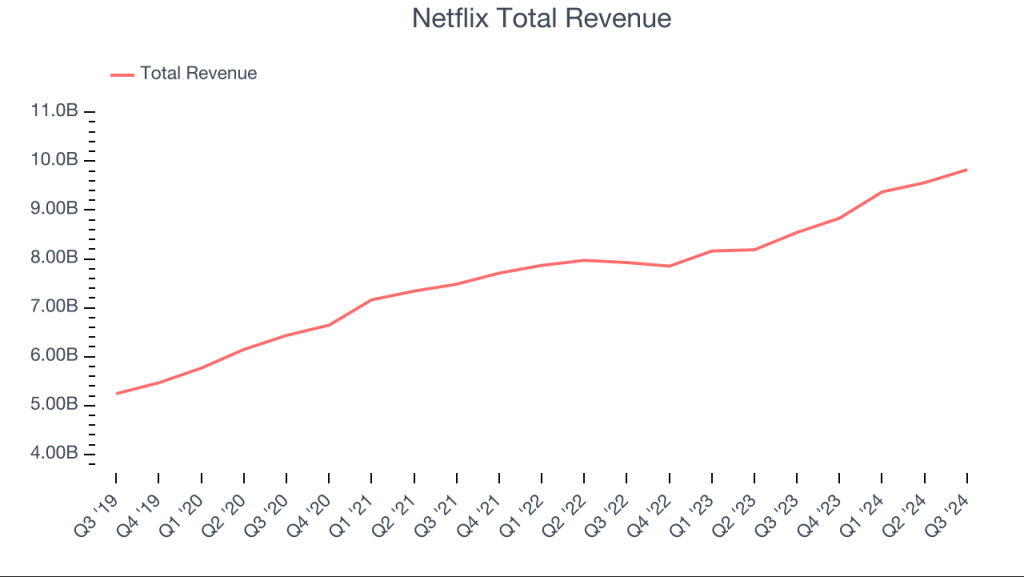

Money Matters Look Good

Netflix’s Q3 sales grew 15% from last year. Earnings rose to $5.40 per share. These numbers beat what Wall Street thought they’d be. But Dave Heger, an analyst had this to say:

“Subscriber growth does seem like it’s slowing back down.”

Below, you can also see the daily chart price for NFLX, and some other useful information:

Cheaper Plan With Ads Grows

More people are choosing Netflix’s cheaper plan with ads. It grew 35% from last quarter. Half of new sign-ups picked this plan.

Co-CEO Greg Peters said:

“We love the low price point and increased accessibility that comes with our ad plan. It represents an incredible value.”

Also Read: Shiba Inu (SHIB) DAO To Launch Soon: Will It Help SHIB Claim $0.00003?

Future Plans and Prices

Netflix thinks sales will grow 11% to 13% in 2025. They might make $44 billion. They’re changing prices in some places. Citi analyst Jason Bazinet thinks:

“Given Netflix’s low cost per viewed hour, we see scope for the firm to raise US prices by 12% in 2025.”

Challenges Ahead

Netflix did well in Q3, but it’s not all easy. The boost from stopping password sharing might not last. Ads and games aren’t making much money yet. Netflix said:

“It’s still very early for our advertising initiative. We don’t expect ads to be a primary driver of our revenue growth in 2025.”

Also Read: DogWifHat: WIF’s New Rising Wedge Pattern Signals A $3.10 Rebound

Netflix’s good Q3 made investors happy. The stock price is near its highest ever. As streaming changes, Netflix must keep adapting to stay on top. They’re trying to balance getting more subscribers with making more money. They’re also working on ads and looking for new ways to earn.