US sanctions and Russia’s trade shift have transformed the global financial system. Moscow’s move away from dollar-based trade represents one of the biggest changes in international commerce this decade.

At a recent BRICS media meeting, Putin outlined the situation: “All the countries of the world are now thinking of whether it is worth to use the dollar if the US limits the dollar use as a universal international settlement unit due to political considerations.”

Also Read: Donald Trump’s Tax Plan To Exempt 93M Americans From Income Taxes

The Economic Impact of Russia’s Move Away from the US Dollar

Russia’s New Direction

The shift in Russian trade patterns shows how sanctions can backfire. “The volume of the dollar use is slowly yet declining bit by bit—in payments and in reserves,” Putin said.

He emphasized this wasn’t Russia’s choice: “We did not give up the dollar as the universal currency; we were denied of using it.”

The transformation happened quickly. Now, according to Putin: “95% of the whole Russian foreign trade is being made with our partners in national currencies. They did it by their own hands.”

Global Effects

Other major economies face similar US sanctions pressures. China’s experience mirrors Russia’s challenges. “And what is happening with China — one sanction after another also. And this is not related to politics, this is related to the growth of the Chinese economy and to the attempt to impede this growth using various sanctions, politically motivated ones.” This pattern has pushed more countries to seek alternatives to dollar-based trade.

Also Read: Telsa (TSLA) Q3 Earnings to Arrive This Week: What to Expect

Economic Results

Western predictions about Russia’s economic collapse proved wrong. “Western countries thought that ‘everything will collapse’ in Russia when abandoning the dollar use. No, nothing collapse—[it is] developing on a new base.” Russian markets adapted to the new reality, finding alternative payment systems and trade routes.

BRICS Growth

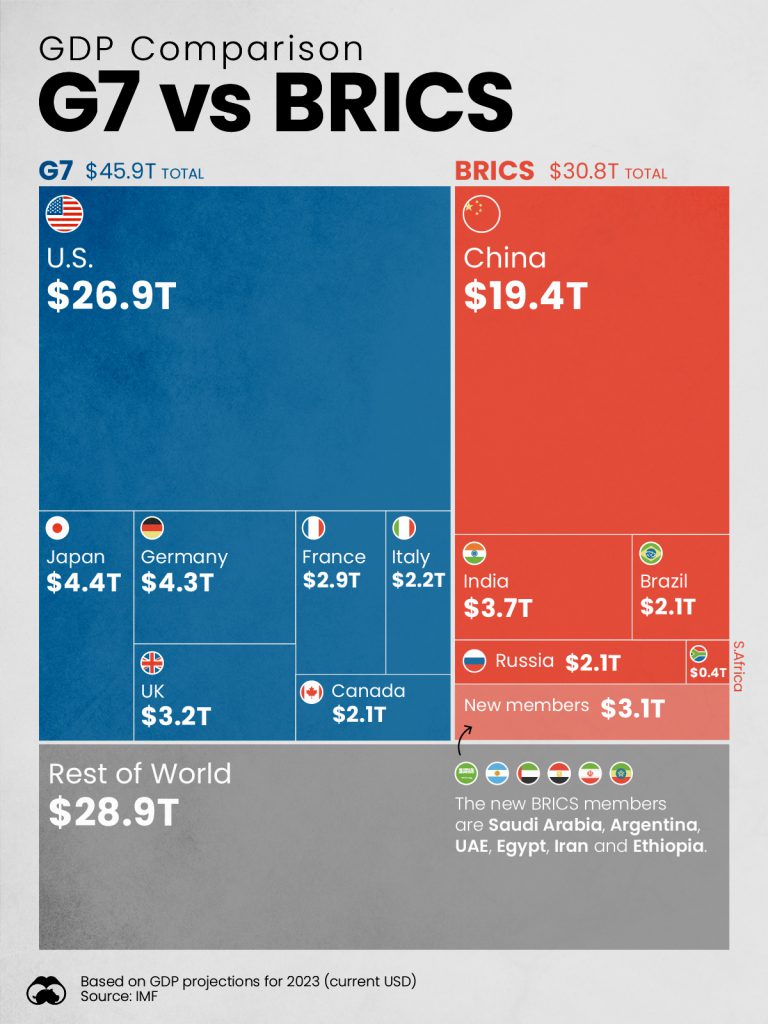

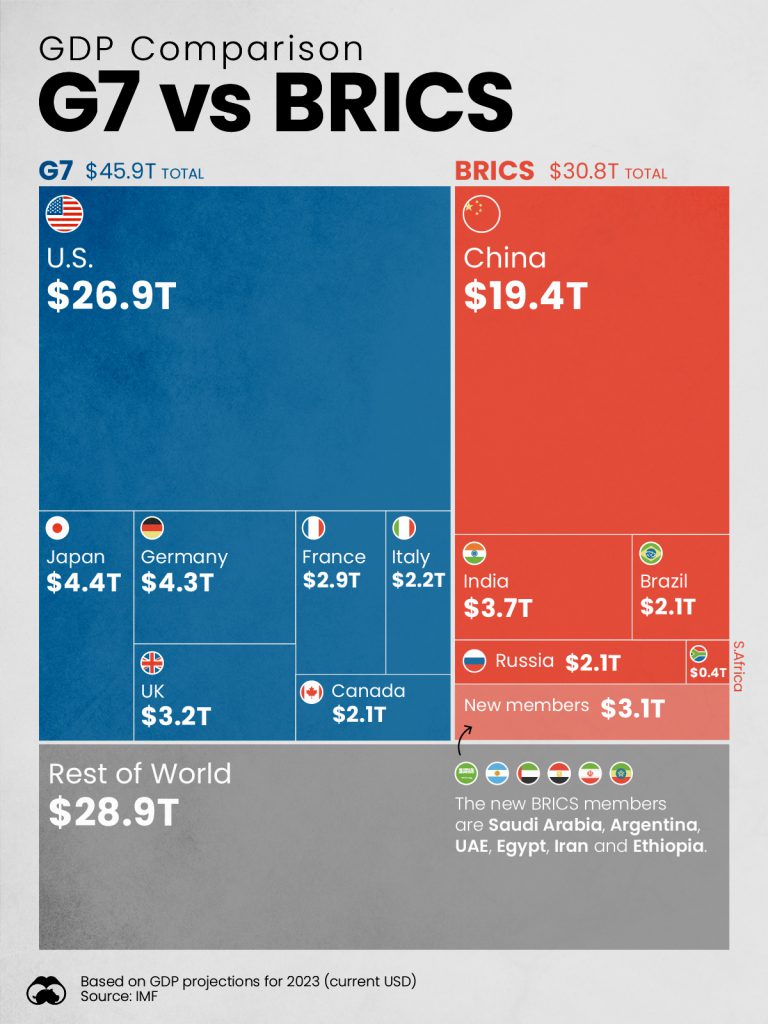

The numbers reveal a dramatic power shift in global economics. “For example, let’s take 1992—[the share of] the Group of Seven is 45.5%, and in the same year the BRICS countries [account for] 16.7% of global GDP. And now? In 2023, our association [accounts for] 37.4%, and the [share of] Group of Seven is 29.3%.”

BRICS nations now lead global growth: “This is higher than both the rates in the G7 countries—there it is only 1.7%—and the global rates. The global rates will be 3.2%.”

Looking Forward

The dollar-free trade trend shows no signs of slowing. Putin’s vision remains clear: “The gap is widening, and it will widen, this is inevitable.” Recent data supports this view, with Russian-Iranian trade now conducted almost entirely in national currencies. More countries are exploring similar arrangements, suggesting a lasting change in global trade patterns.

Also Read: Can Uber Stock Cruise to $100 After Q3 Earnings?