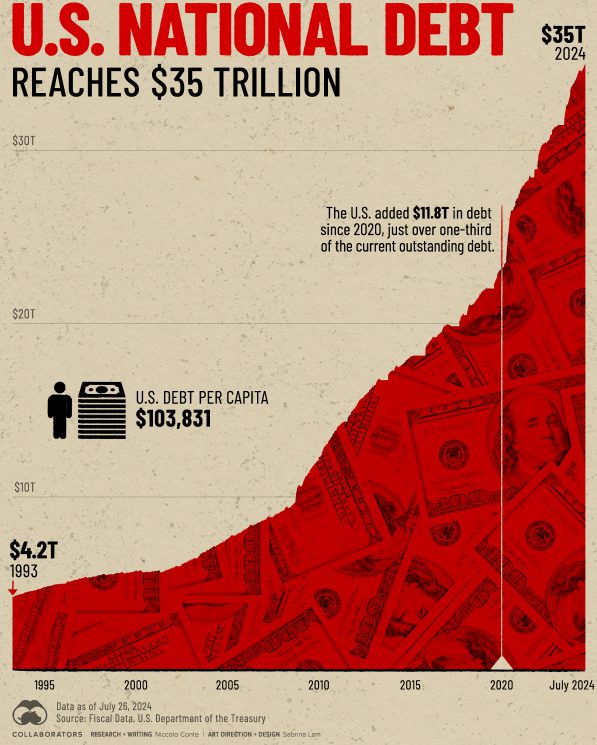

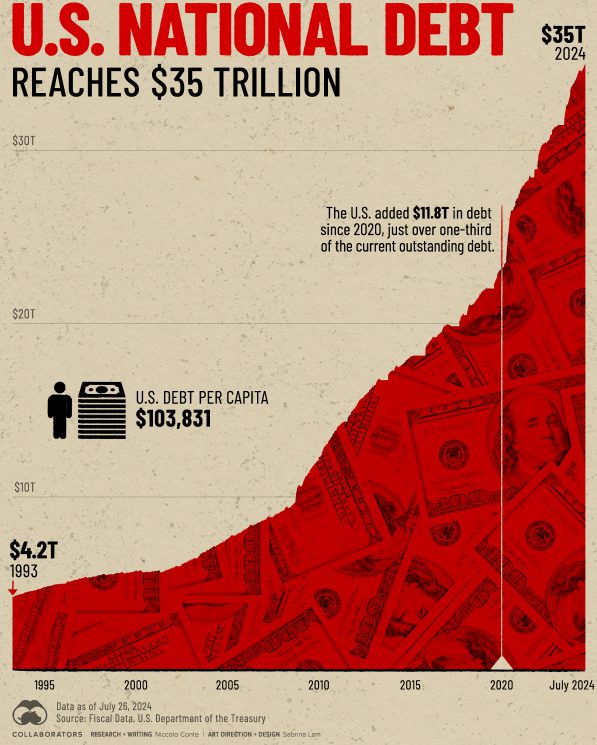

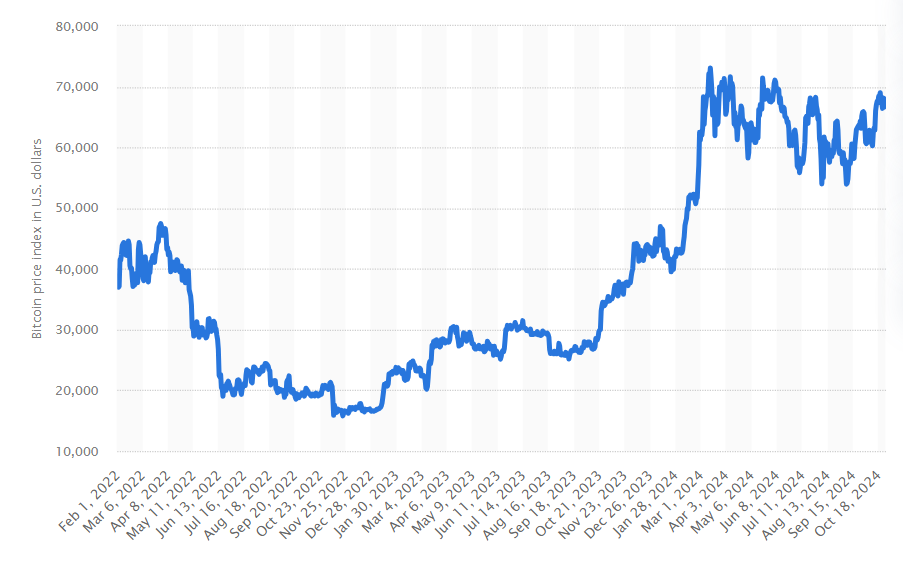

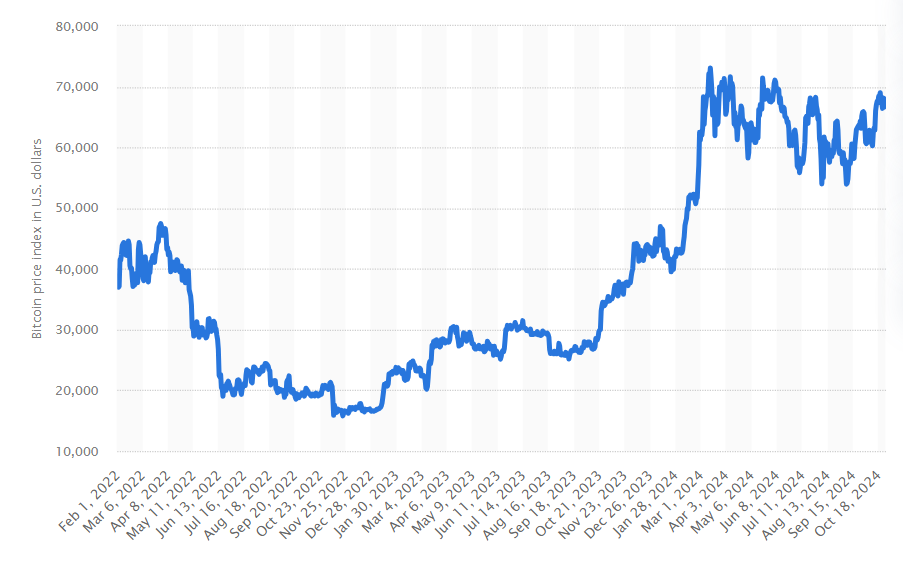

The U.S. debt has hit $35.7 trillion, pushing Elon Musk to warn of a financial emergency. Bitcoin prices have jumped above $67,000 as more investors turn to it as a safe haven.

The growing financial emergency deepens as interest payments consume more monthly tax money.

Also Read: Nvidia (NVDA) Outshines Apple, Stocks Rally Hard As Firm Targets $200

Impact of AI Chip Controversy on Nvidia’s Market Position

Musk Sounds the Debt Alarm

“Just the interest payments on the debt are 23% of all federal tax revenue,” Musk said at a Trump rally. Elon Musk emphasized that“The interest payments now exceed the Defense Department budget, which is $1 trillion a year. That’s a lot of money.”

Each American household now pays about $7,000 yearly for interest on the national debt. Musk’s warning comes as government spending hits record levels, putting the economy at risk.

Also Read: Vitalik Buterin Defends Ethereum Strategy Amid Data Bloat Concerns

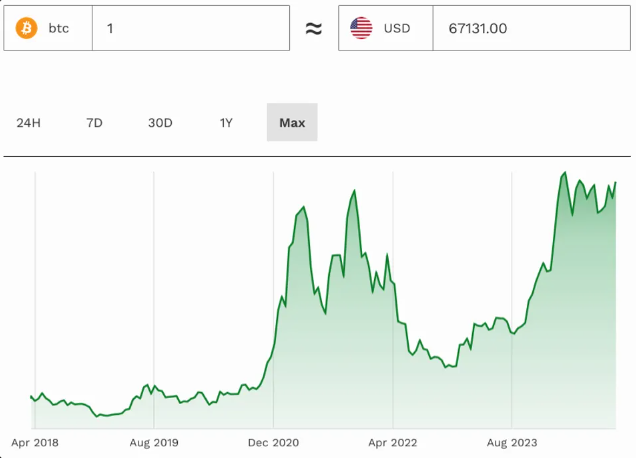

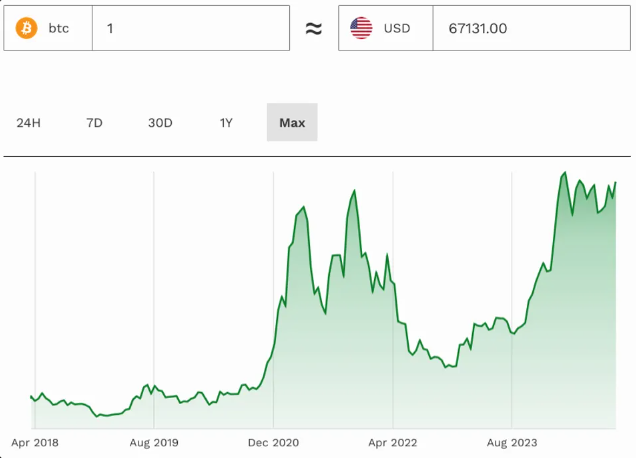

Bitcoin’s Surge Amid Economic Turmoil

Bitcoin’s value has gone up 150% since January to $67,637. Investors see it as protection from inflation. Tesla, led by Elon Musk, owns 10,000 Bitcoin worth $800 million, though recent moves of these coins between wallets have raised questions.

More big investors now buy Bitcoin because it has a fixed supply and isn’t controlled by any government.

Expert Warnings Mount

Investment expert Paul Tudor Jones, who called Bitcoin “the fastest horse to beat inflation,” sees a “debt bomb” from “fiscal recklessness.”

“Under Trump, the deficit goes up by $500 billion per year; under Harris’ plan, it goes up by an additional $600 billion per year,” Jones said, adding that “all roads lead to inflation.” Market veterans worry these spending levels can’t last, echoing Elon Musk’s concerns.

Safe Haven Status Strengthens

Bank of America says U.S. debt grows by $1 trillion every 100 days. Bitcoin’s limit of 21 million coins draws in investors looking to protect their wealth. The Federal Reserve struggles to control inflation while managing debt, making Bitcoin as valuable as gold for safety. Elon Musk’s endorsement of Bitcoin has also influenced its perception.

Also Read: People on the Streets Know More About the Economy Than Kamala Harris

More companies buying Bitcoin and clearer rules have helped it become a trusted hedge against economic problems. Recent market ups and downs show Bitcoin works like digital gold for today’s investors.