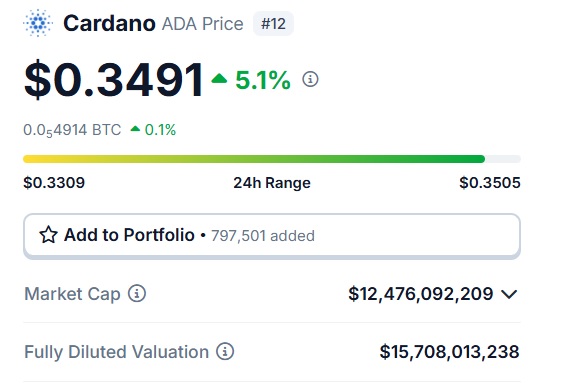

The Cardano blockchain’s native token ADA is trading at the $0.34 mark on Tuesday. The leading altcoin snapped its seven-day losing streak by surging more than 5% in the day’s trade. The spike in price comes after Bitcoin touched the $70,000 mark in the indices.

Bitcoin pushed up leading altcoins along with it, and the broader cryptocurrency market remains in the green. Check out a BTC price prediction on how high BTC will surge this week and whether you should invest in it now.

Also Read: Cryptocurrency: Top 3 Coins Under $0.10 To Stash For Major Nov’ Gains

Cardano (ADA): A Positive November 2024 Price Prediction

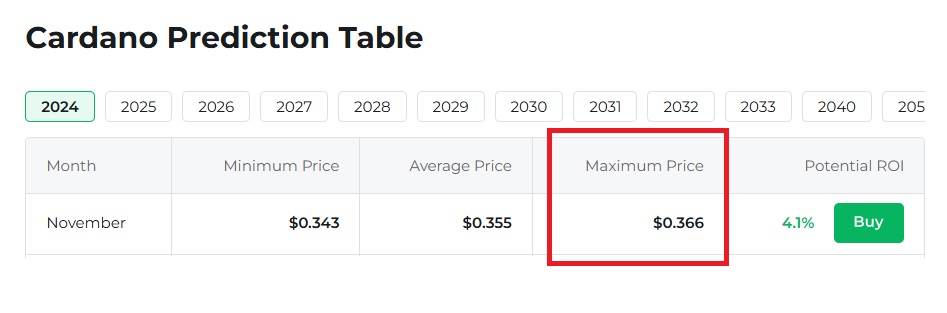

Leading on-chain metrics and price prediction firm Changelly has forecasted a rosy picture for Cardano’s ADA in November 2024. According to the price prediction, the leading altcoin could surge by nearly 4.1% in the next 30 days. The forecast estimates that ADA could reach a high of $0.366 in November next month. That’s a surge of two cents from its current price of $0.34.

Also Read: Apple (AAPL) Competes With Nvidia (NVDA) in AI Tech Showdown

Therefore, an investment of $10,000 could turn into $10,410 in November if the price prediction is accurate. That’s decent returns in a month in the cryptocurrency markets. The average trading price for Cardano’s ADA next month is $0.35.

Also Read: Tesla (TSLA) Enters Growth Phase: Musk Predicts 30% 2025 Boost

If Bitcoin maintains its momentum and breaches its all-time high of $73,737, Cardano’s ADA has more chances of going higher. Other leading blockchains, such as Solana (SOL) and Ripple (XRP), have surged 5% and 3% today. Altcoins mostly move in tandem with Bitcoin, and the higher BTC moves, the more chances they have of printing monthly highs.

Nonetheless, the cryptocurrency market is volatile and trades according to the global markets. Since the US election is approaching, volatility could be expected across the financial sector.

Also Read: Meta Signs New Partnership as it Makes Up Ground in AI Arms Race

We recommend being cautious during this period and avoiding going full-in on cryptocurrencies. Once the market stabilizes, it is advised to take both long— and short-term positions to make the most of it.