Trump’s victory has turned global money markets upside down. Central banks are facing what looks like some huge problems, while the world’s richest people somehow got about $64 billion richer overnight—yeah, you read that right. The market impact seems intense, with stocks jumping and money changing hands faster than usual.

Let’s look at what’s happening here – who would’ve thought we’d see effects like these?

Also Read: Shiba Inu: What’s SHIB’s Price If Its Market Cap Hits $500 Billion?

Central Banks in Crisis: The Aftermath of Trump’s Victory

Central Banks Face New Problems

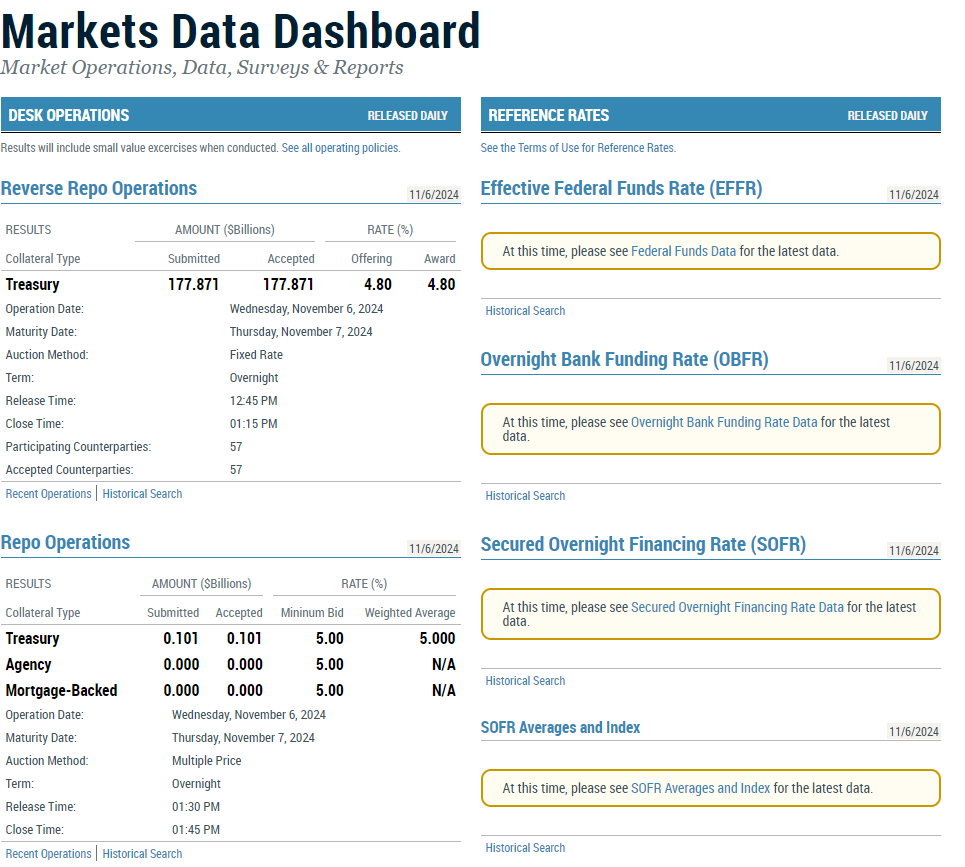

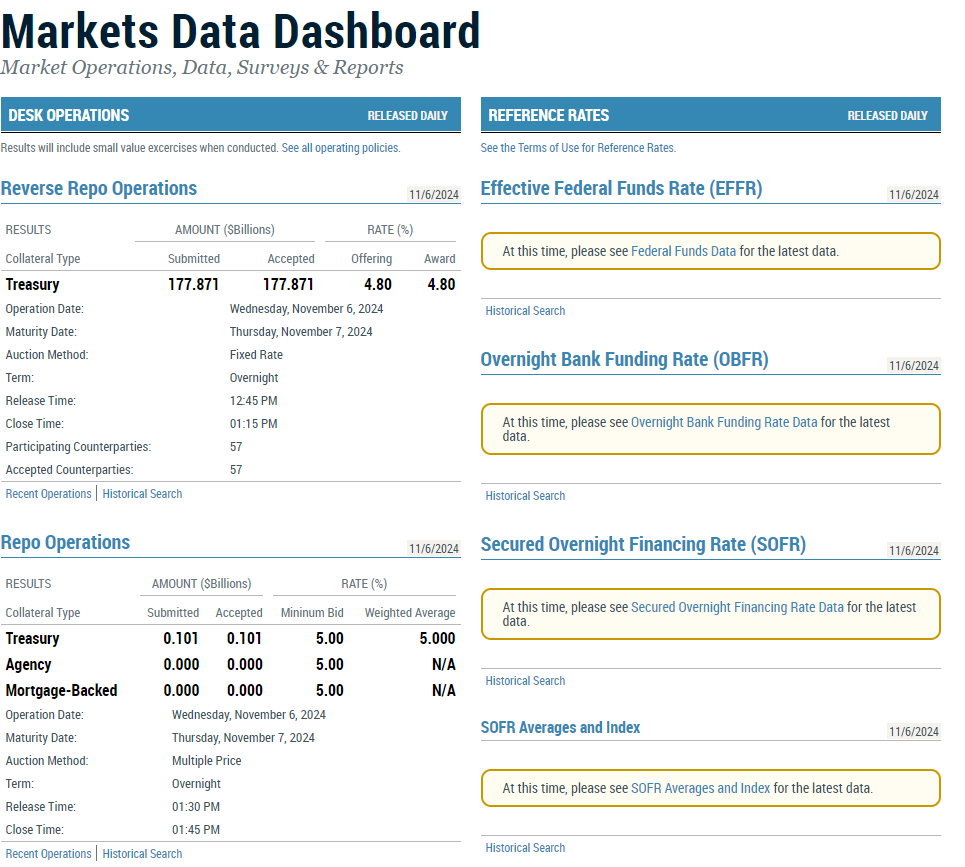

Right now, some of the biggest money banks are struggling to figure out their next move. The U.S. Fed will probably have to change pretty much all its plans, and it needs to do it quickly!

Over at the Bank of England, Bailey’s talking about wanting lower rates at the time of writing, and Fed boss Powell seems to be looking for some fast answers. Meanwhile, if you look over the other side of the world, Japan’s central banks might be having the roughest time – their money’s value has taken quite a hit lately.

Looking at all this, it seems like world banks can’t really use their old playbooks anymore, which, believe it or not, might actually be the best thing to happen this year.

It looks like every bank will have to figure out new ways to manage changing markets.

Also Read: Ripple Price Prediction Post US Elections: How High Will XRP Rise Now?

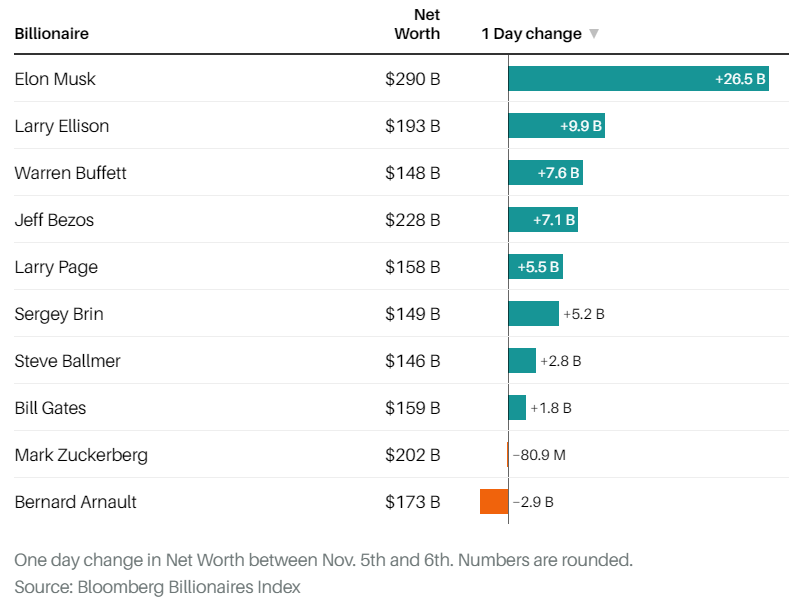

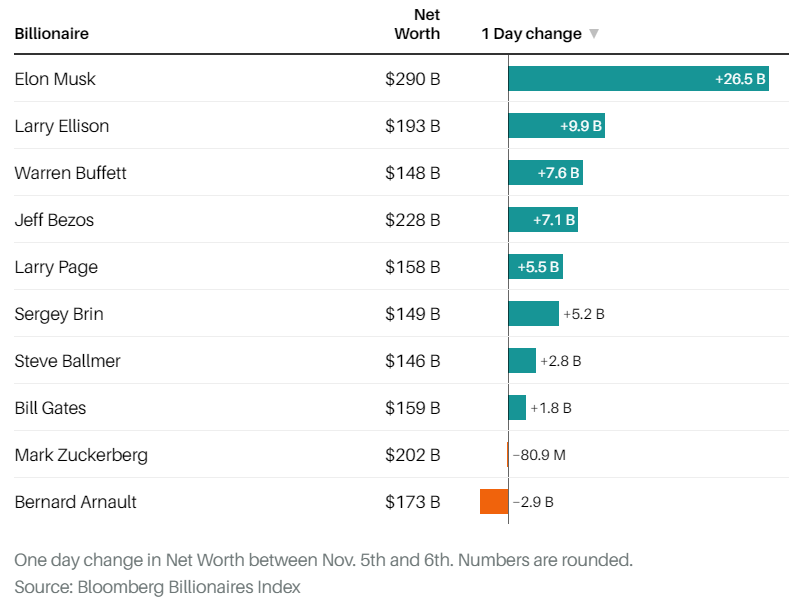

Rich Get Richer

The election numbers came in, and you wouldn’t know it – wealthy people got even wealthier. Tesla ended up with something like $26.5 billion more in just a few hours. Amazon and Oracle? They grabbed their fair share, too. Their stocks went up about 2.5%, beating any election day we’ve seen before.

The wealthiest individuals sat back and watched their money pile up. Everyone else was buying and selling like there was no tomorrow, with money moving around faster than we’ve seen in ages.

Money Markets Move Wild

The markets seem pretty excited about the possibility of fewer rules and lower taxes, which isn’t really surprising if you think about it. The dollar’s bounced back pretty well. Those crypto enthusiasts Armstrong and Zhao are sitting on billions more now, too.

Over in Japan, their money dropped about 1.7% against the dollar—and yeah, that’s having quite an impact almost everywhere. Trading has broken just about every record we have. Well, these sure are some interesting times we’re living in!

Also Read: Why Is META Stock Falling Today?