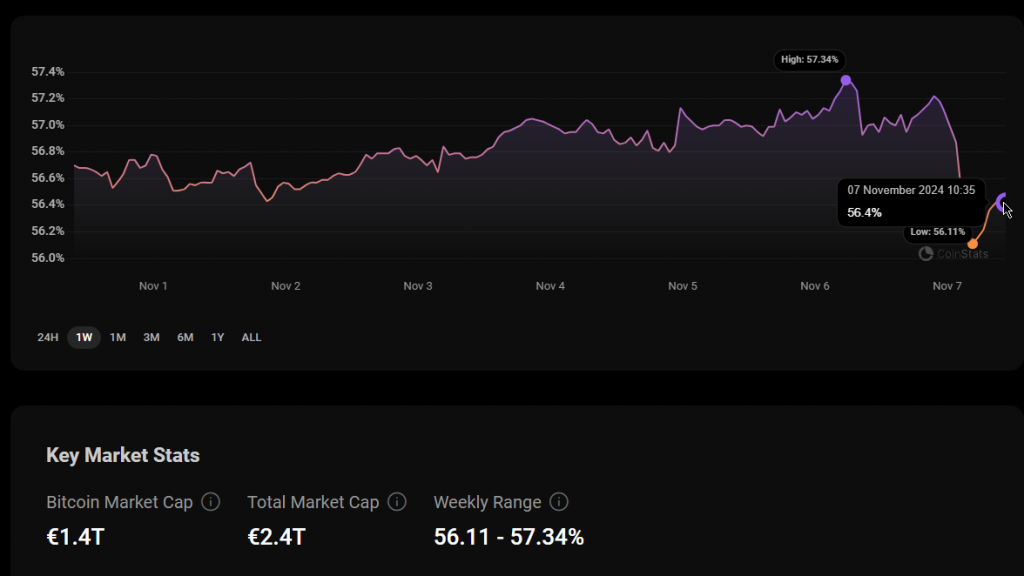

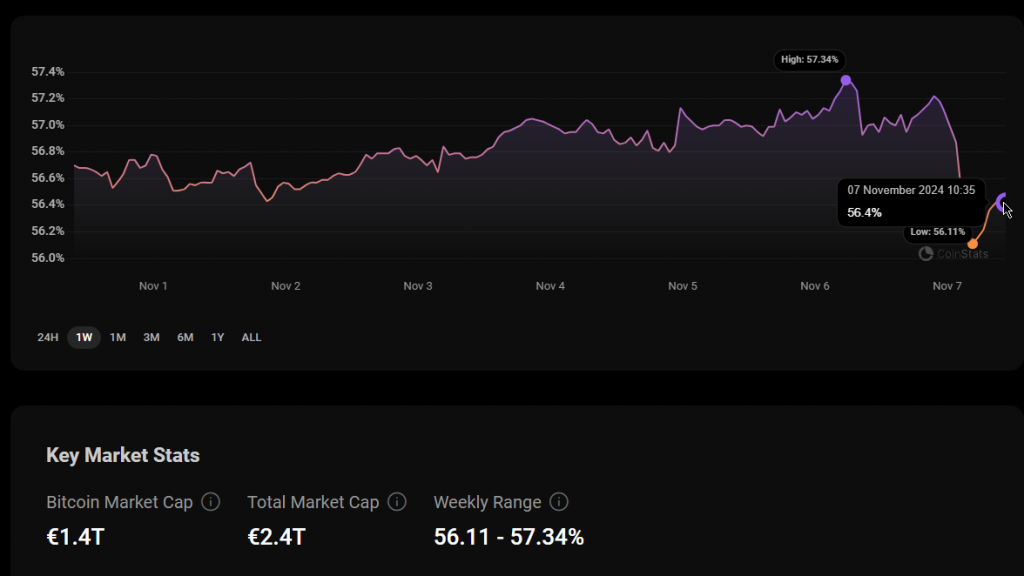

These days, a Fed rate cut Bitcoin scenario looks pretty interesting as cryptocurrency markets seem to be getting ready for some big policy changes. Bitcoin’s been hitting new highs – around $75,000 or so – and experts are kind of split on how Federal Reserve moves might shake things up with digital assets, especially with all this interest rates stuff going on.

Also Read: Russia’s Bold Bitcoin Mining: Alliances Unite for De-dollarization

Federal Reserve’s Move: How the Rate Cut Will Affect Bitcoin Prices

Expert Predictions Split on Rate Cut Impact

Right now, market analysts can’t really agree on what the Fed rate cut might do to Bitcoin. FalconX‘s Head of Research, David Lawant, stated:

“The decision will matter little, but there’s significant macro uncertainty as we enter 2025 under a Trump presidency.”

This is a pretty interesting take. It really shows how tricky it is to figure out how monetary policy affects digital assets. Who knows, it could go either way.

The Case for Bitcoin Growth

Over at Swyftx, their lead market analyst, Pav Hundal, has what looks like a more optimistic view. He argues:

“The Fed’s decision has every chance of being hotter for Bitcoin than the US election result.”

It seems he might be onto something about investors going for riskier stuff when rates are low. Those safe investments probably won’t look so great with lower yields, so maybe more money will head toward cryptocurrency markets.

Also Read: Cardano: ADA Forecasted to Spike 18% in November 2024

Economic Factors at Play

At the time of reporting, lower interest rates are still doing their usual thing – making borrowing cheaper and getting people to spend more. Hundal explains:

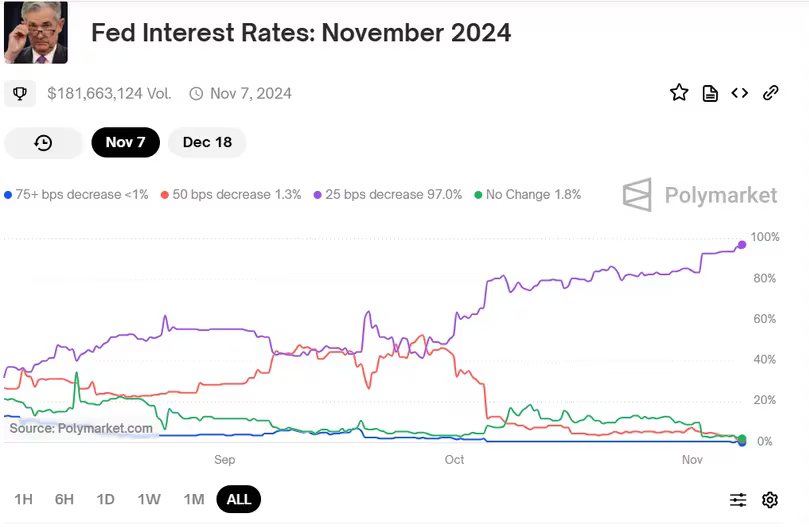

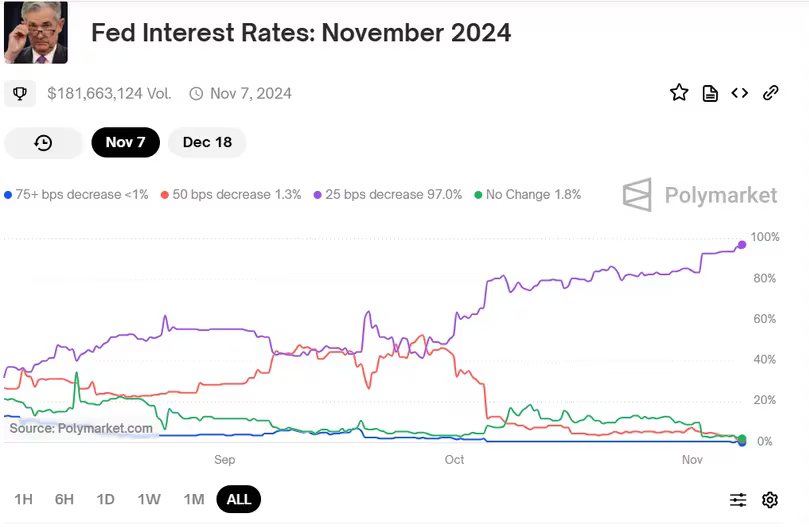

“The market is already re-risking into Bitcoin. A 25 basis point or bigger cut will just accelerate that move and make a six-figure Bitcoin price by year-end an even more likely scenario.”

For now, this whole relationship between policy and risk-taking seems to be pretty important for digital assets.

Market Momentum Building

The market’s got some interesting momentum going, with big investors probably seeing cryptocurrency as a way to hedge their bets. Hundal adds:

“It is FOMO layered on FOMO right now in the markets. We saw a clear accumulation trend immediately after the last rate cut, so it’s safe to say a 0.25% cut would be very positively received.”

It seems that Federal Reserve decisions and digital assets are becoming more connected. We’ll have to see how that plays out.

Looking Ahead

The cryptocurrency market is still trying to figure out what all these potential rate cuts might mean. Bitcoin price moves seem pretty tied to the bigger economic picture. It could work out well for digital asset growth, but it’s hard to say for sure. Traders are getting ready for some volatility around the Federal Reserve’s decision, and it looks like cryptocurrency might be becoming something of a go-to investment choice.

Also Read: Shiba Inu: What’s SHIB’s Price If Its Market Cap Hits $500 Billion?

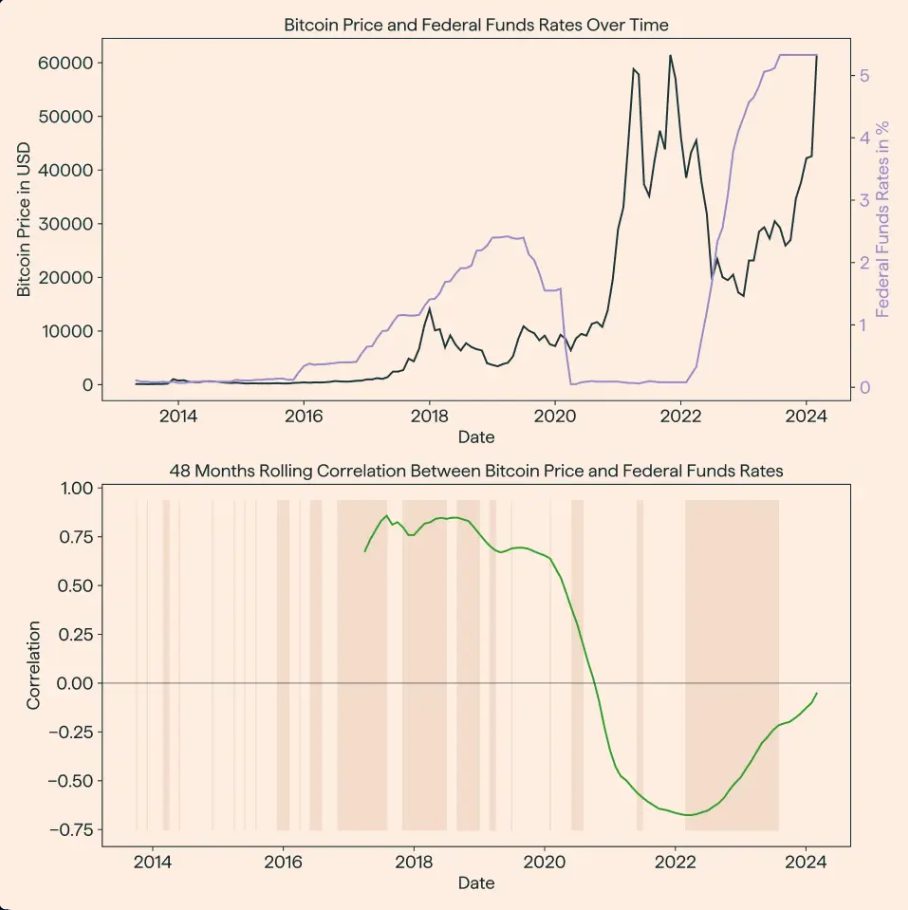

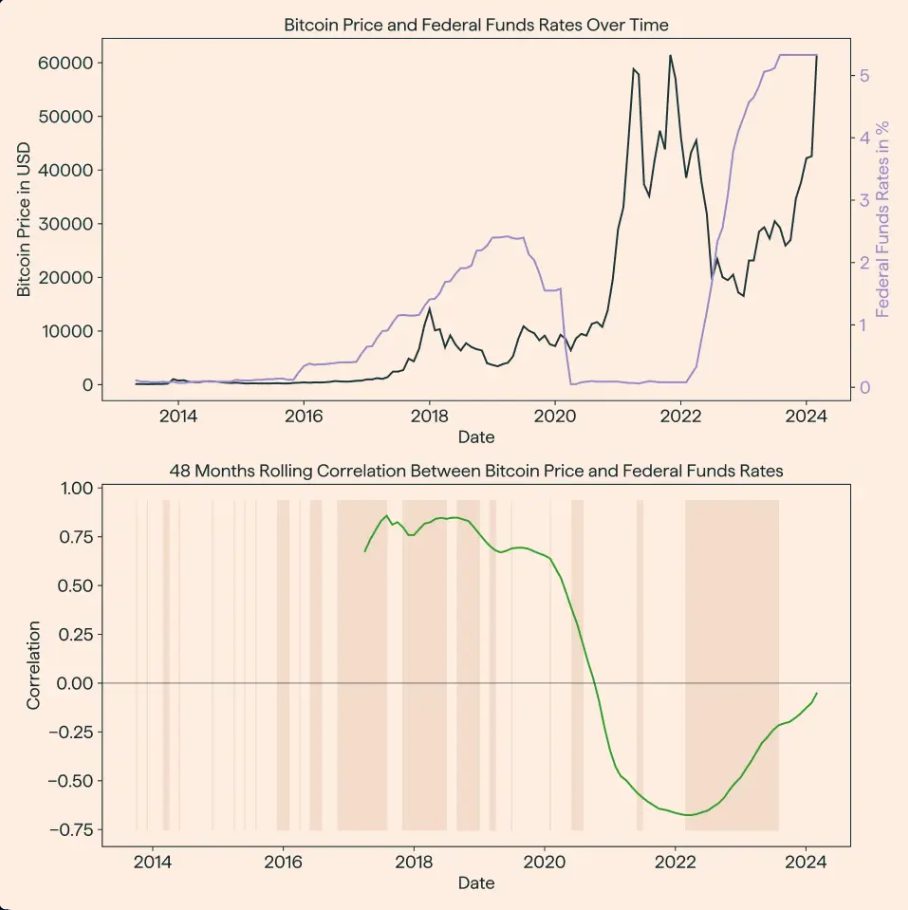

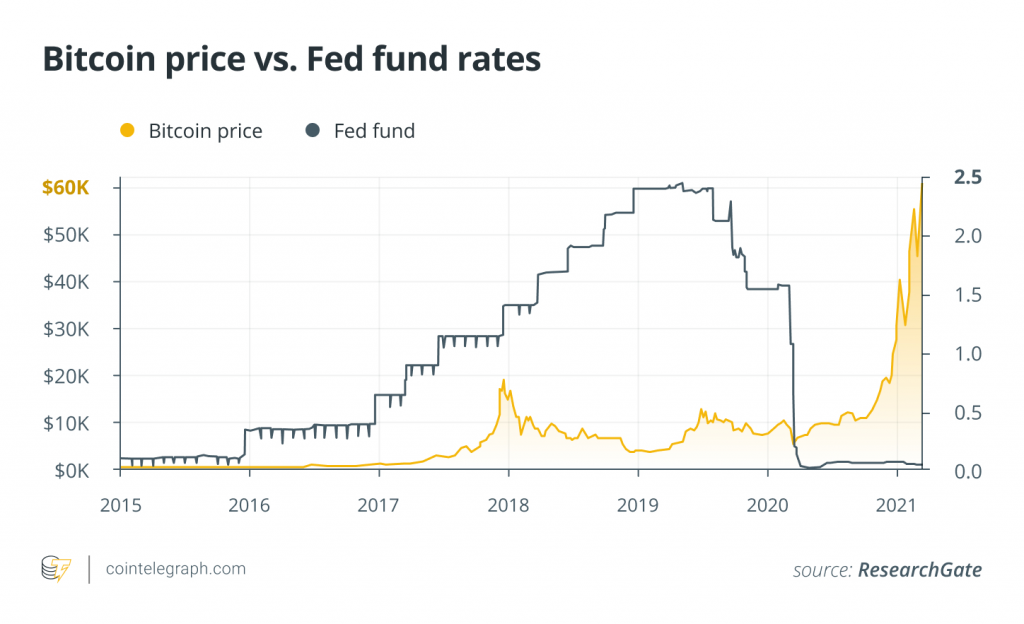

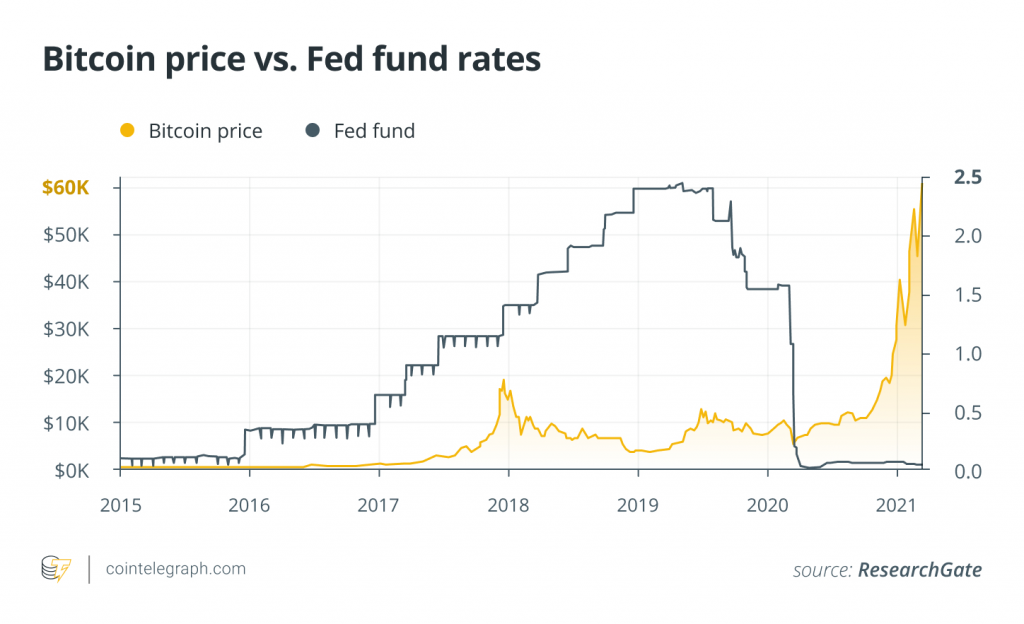

History shows that when money gets easier to borrow, people tend to take more risks – that’s just how it goes. With all these big institutions getting involved and better market tools, Bitcoin’s at an interesting spot as the Fed thinks about its next move. The whole cryptocurrency thing seems to be growing up a bit, starting to move more like traditional markets when the Federal Reserve makes decisions. We’ll see how it all shakes out.