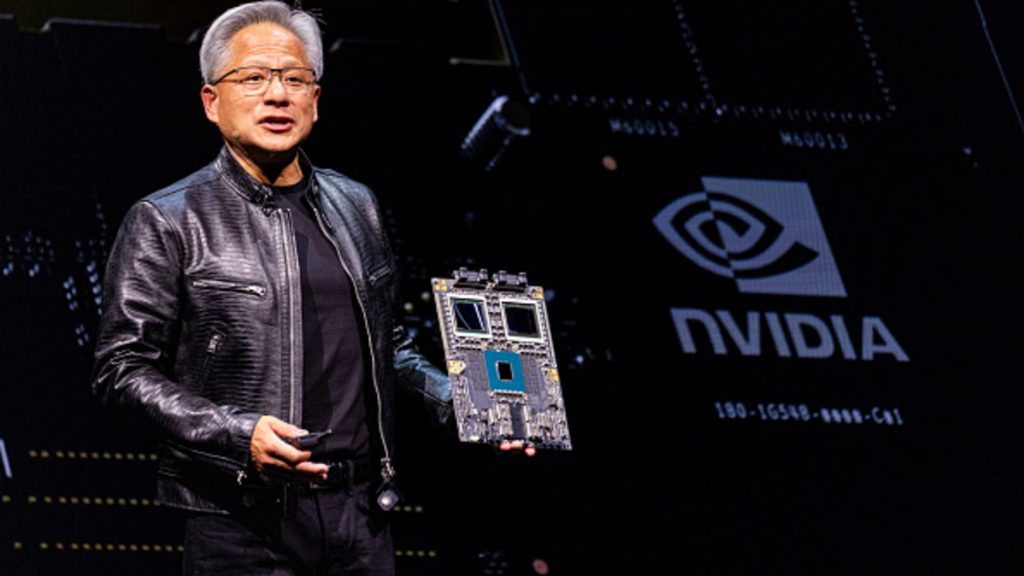

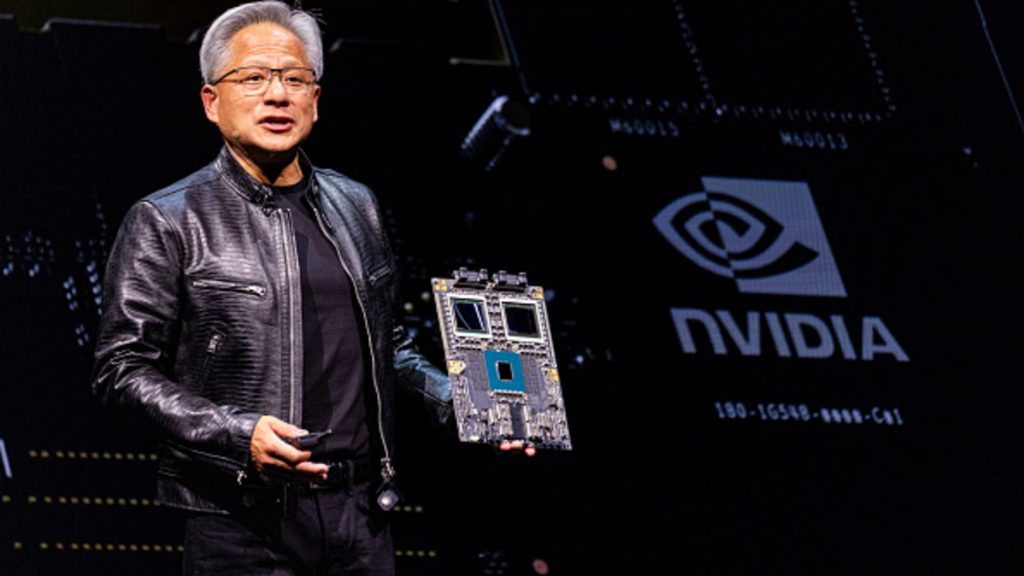

One of the most anticipated reports of the earnings season is on the horizon, as Nvidia (NVDA) could be headed toward the $180 level as Wall Street is expecting a Q3 boost. Th chipmaker is receiving a near-unanimous buy rating as the price target has only gotten increased in recent weeks.

November 20th represents the key day and could set the tone for how the AI chipmaker will perform in the coming week. Although it has had a dominant 2024, increasing more than 150%, there is debate regarding whether or not it can continue to be the premiere stock option of 2025.

Also Read: How Amazon (AMZN) is Set to Challenge Nvidia’s AI Dominance

Nvidia Looking to End 2024 Above $180?

For much of the last year, artificial intelligence has dominated Wall Street. With the arrival of OpenAI’s ChatGPT, the demand for generative AI products has surged. Moreover, it has led to increased investment in the sector from companies that are hoping to keep pace in the ongoing AI arms race.

Yet no company has benefited as much as Nvidia. With a stock price above $147, shares in the tech stock are already approaching highs. However, they are expected to only keep going higher, especially as it is the center of the most anticipated earnings announcement of the season.

Also Read: Can Nvidia (NVDA) Hit $200 Before 2025?

Specifically, Nvidia (NVDA) is expected to surge toward $180 as Wall Street is predicting a key Q3 earnings boost. Analysts have identified a $178 price target as the stock should end the year on a high note. The most important driver of the price increase is the stock’s youth. Indeed, it is still in its early stages of satisfying growing demand.

During its last quarter, Nvidia reported 122% growth year over year in revenue. More importantly, that situates the company out in front of the popular semiconductor business. Estimates are saying the company will post a 125% revenue boost, increasing 44% for next year. That could be enough to push the company’s overall value even higher than its current position.