De-dollarization has hit new records in 2024. The US dollar’s share of global reserves has dropped 15% since 2016. The influence of the BRICS currency grows stronger as more countries join their economic partnerships. IMF numbers show the dollar now holds 58% of global reserves, down from 73%. Countries actively move toward other reserve currencies as financial structures transform worldwide. The decline in Dollar dominance reflects broader shifts in global reserve currency trends.

Also Read: Shiba Inu’s Influence Blooms As 45000 Businesses Globally Deploy SHIB

BRICS and Beyond: How De-dollarization Is Reshaping Global Finance

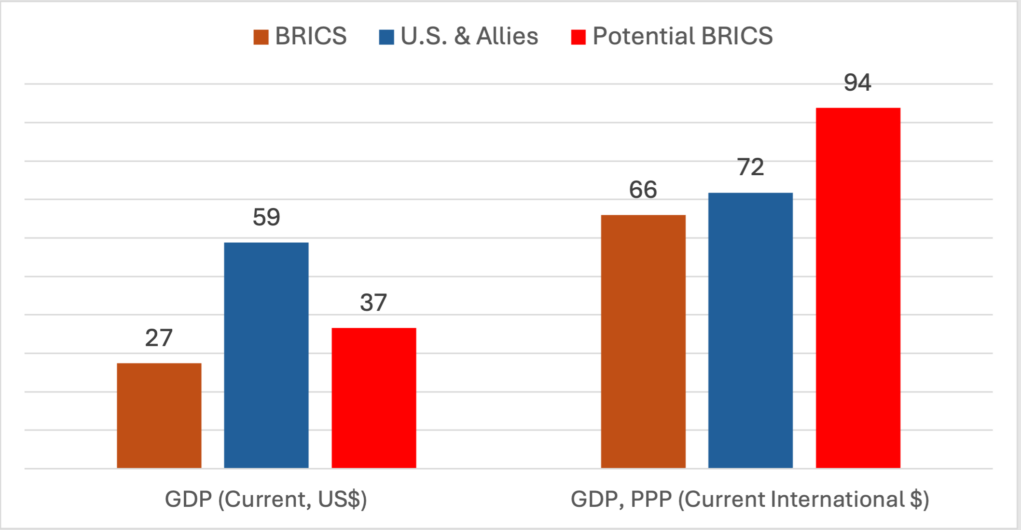

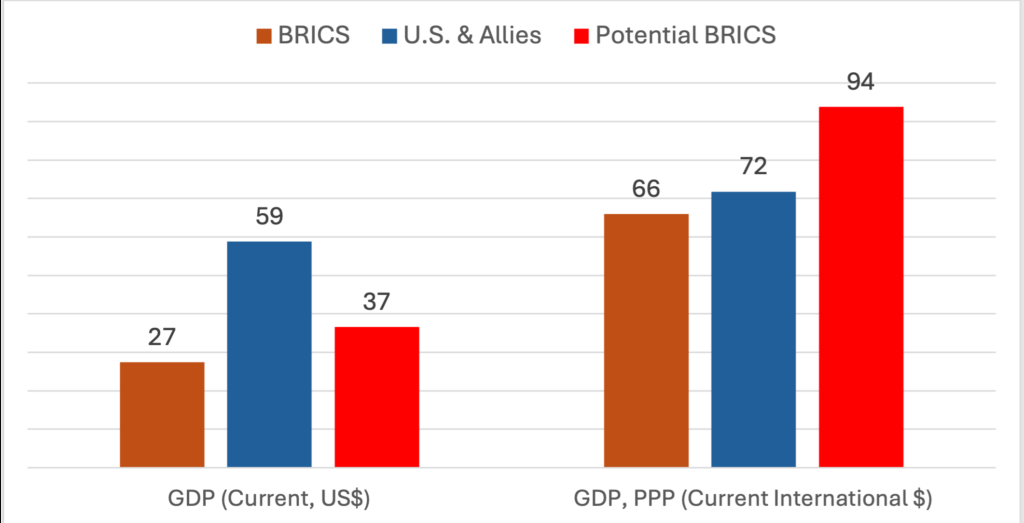

Current Economic Power

BRICS countries now hold major economic power. Their combined GDP equals 66% of US & Allies when measured in PPP. New members could push this above 90%, speeding up the dollar’s decline. This momentum is crucial to de-dollarization as alternative reserve currencies gain ground.

De-dollarization Geographic Distribution

BRICS influence now reaches across all major economic zones. Current members (green) and possible new allies (yellow) form a strong network. They challenge US-aligned economies (blue) and change how global currency reserves work. This expansion further promotes de-dollarization and reshapes traditional financial relationships.

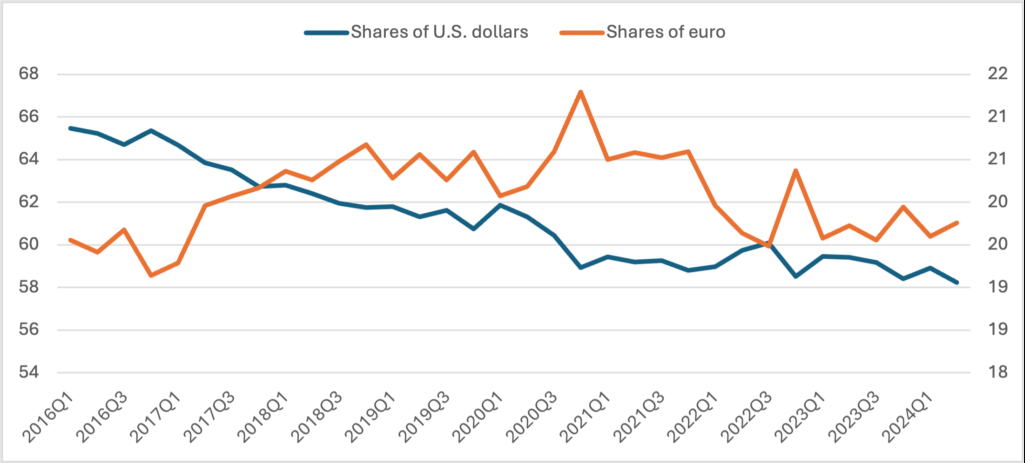

Currency Reserve Shifts

“Currency optionality is now a matter of economic and national security,” states Kathleen Tyson. Dollar reserves keep falling. The euro stays at 20%, while other currencies gain ground in world trade. Central banks actively diversify their holdings, furthering the de-dollarization trend.

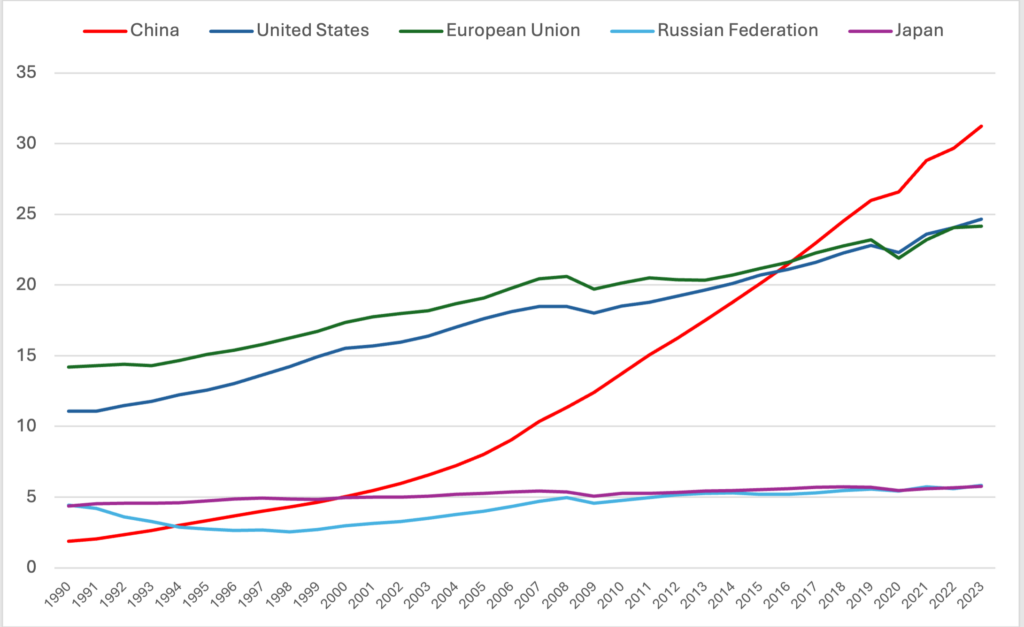

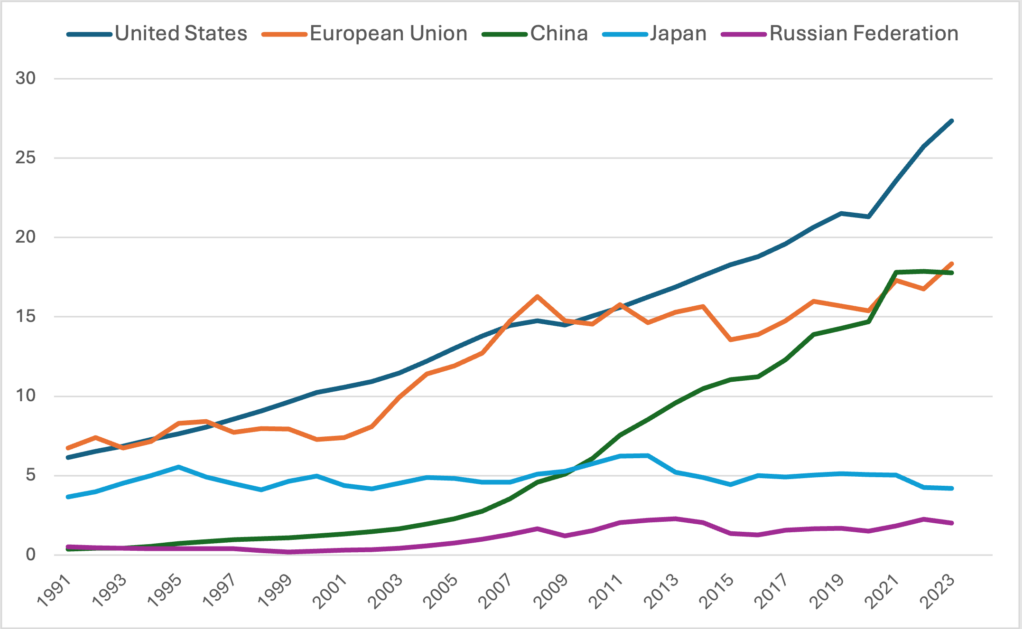

Economic Growth Patterns

China’s growth since 1990 shows what emerging markets can achieve. It has passed the EU and neared US levels. This has pushed central banks worldwide to diversify their currencies, marking a fundamental change in global finance.

Standard GDP numbers still show US leadership. However, BRICS nations are growing fast and challenging this position. “The Pax Americana is undergoing serious erosion,” notes Peter Isackson. De-dollarization accelerates as economic power balances shift.

Also Read: Top 3 Cryptocurrencies for Healthy Gains In December 2024

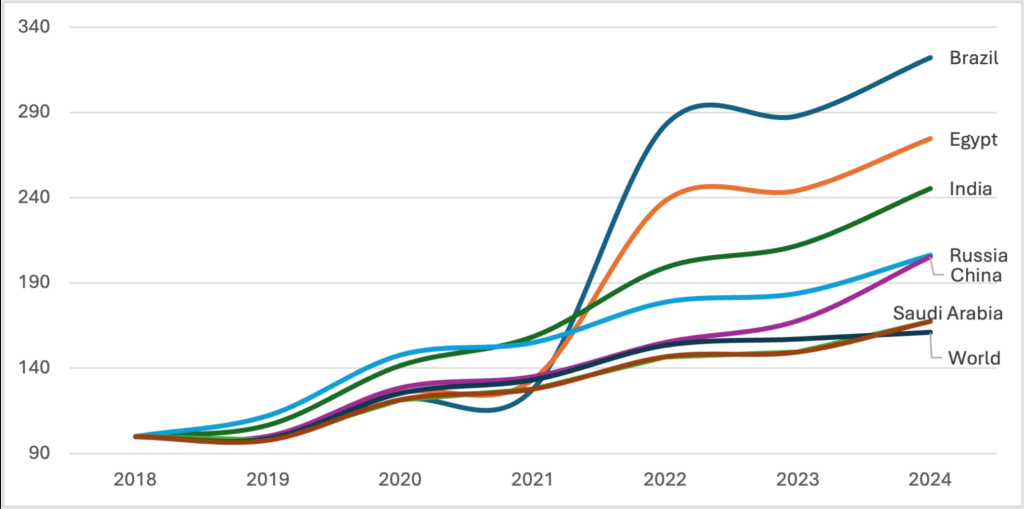

Emerging Market Impact

Emerging economies have grown rapidly since 2018. Brazil tops the list with a 300-point rise, and Egypt and India continue growing steadily. This pushes de-dollarization forward and strengthens alternative reserve currencies in these regions.

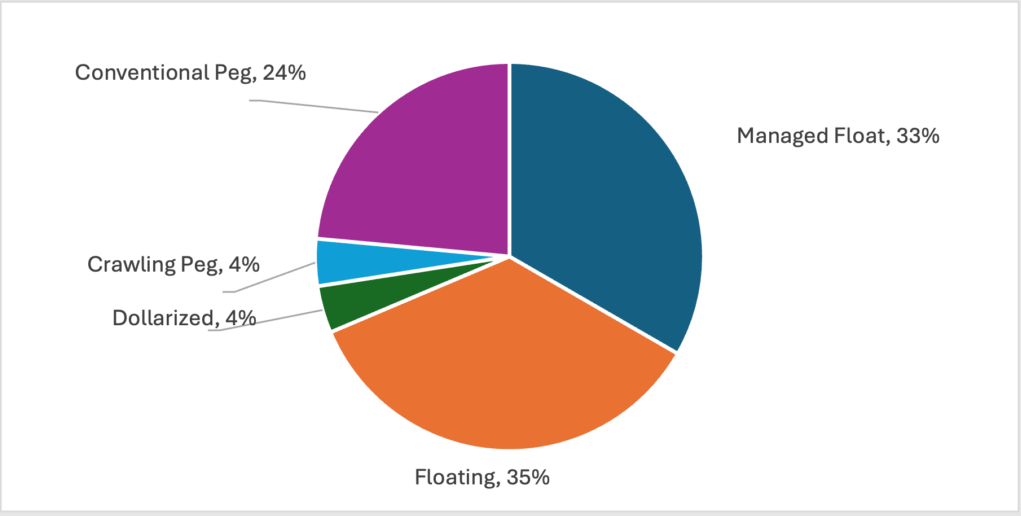

Monetary De-dollarization Framework Evolution

Countries now choose different money systems: 35% use floating rates, 33% managed float, and 24% fixed pegs. This shows growing resistance to dollar-based rules. De-dollarization is evident as global reserve currency trends point toward a multipolar future.

Also Read: Ripple: After Reaching $1, XRP Predicted to Hit $2: Here’s How

De-dollarization marks a basic shift in global finance. BRICS influence grows through new members and partnerships. Other reserve currencies gain strength as nations cut dollar dependence. This trend won’t reverse. Experts say these changes will speed up, reshaping world trade and investment for decades. The decline in Dollar dominance continues as countries embrace currency diversity and new economic alliances form.