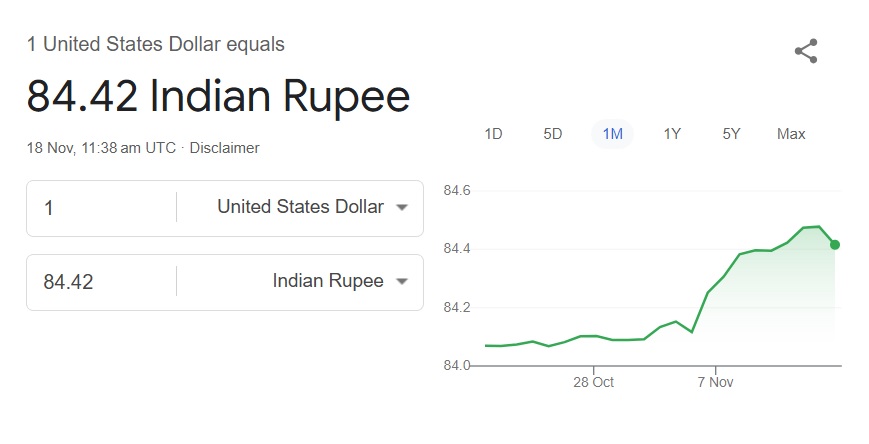

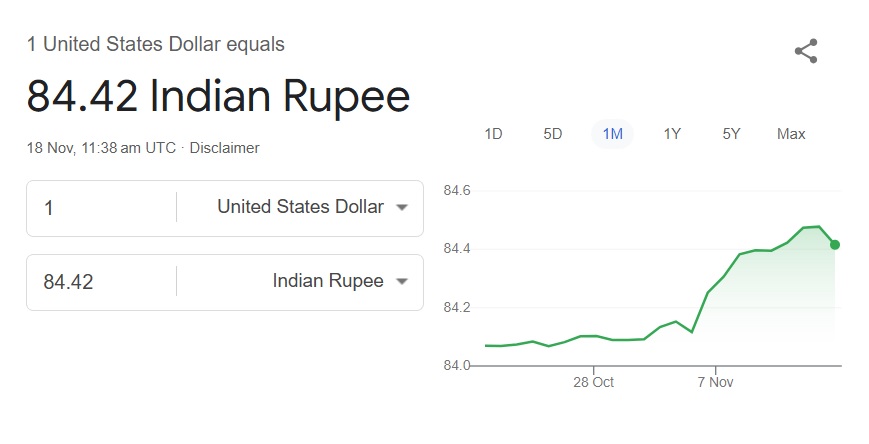

The Indian rupee is on a downward trend in the currency market against the US dollar. The INR opened Monday’s bell at 84.42 and slipped 0.2 points minutes after the trade resumed. The unending dip is worrisome as the import and export sector in the country is facing the brunt of the stronger US dollar.

Also Read: Cryptocurrency Trader Turns $33K Into $12.2 Million In 24 Days

The DXY index, which tracks the performance of the US dollar against a basket of leading currencies, touched a 52-week high of 107.06 last week. However, its price saw a dip this week and is currently hovering around the 106.73 mark on Monday. It surged 0.04 points in the day’s trade with a spike of 0.04% in the charts. The rising US dollar is making the Indian rupee fall to new lows in the currency markets.

Also Read: Dogecoin Rally Imminent: Experts Predict 50% Surge Ahead

Currency: Indian Rupee Could Fall Further Against the US Dollar

Leading financial analysts predict that the US dollar could further push the Indian rupee down in the currency markets. Vinod Nair, Geojit Financial Services Head of Research revealed to Mint that investors will have to bear with market corrections. A record $12 billion in funds has exited the Indian stock market from foreign institutional investors.

Also Read: After XRP, Cardano’s ADA Predicted to Breach $1

Both October and November saw the highest exodus and peaked after Trump reclaimed the White House. FII’s dumped the stocks after making record profits and are now focusing on profits in the upcoming Trump economy. This puts the Indian rupee at risk against the US dollar as the reserve currency is receiving maximum inflows.

The Reserve Bank of India (RBI) tried to intervene by dumping US dollars worth millions to protect the rupee. While that briefly helped the INR sustain the onslaught of the USD, it could not continue safeguarding it. “The market would not favor an RBI rate cut at this time due to a new challenge that was previously unaccounted for: the strengthening USD. If rates are cut now, the INR could face further depreciation,” said Nair.