Trump tariffs shook money markets worldwide. The president-elect plans “to charge Mexico and Canada a 25% Tariff on ALL products coming into the United States.” He’s also putting a 10% tax on Chinese goods. This caused worries about trade fights and changed how money moves between countries. These big taxes will change how countries buy and sell goods. Markets everywhere are getting ready for big changes in trade.

Also Read: Could Dogecoin Reach $1 by 2025? Here’s What Might Propel It

Understanding the Ripple Effects of Trump’s Tariffs on Global Stock Markets and Trade

Market Response to Trump Tariffs

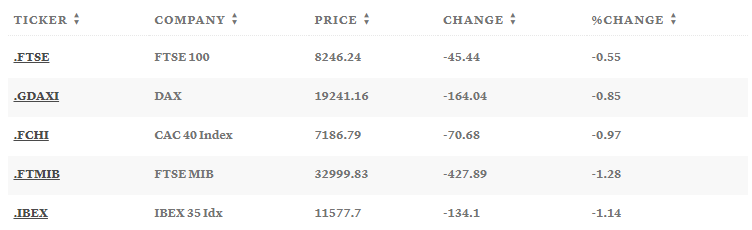

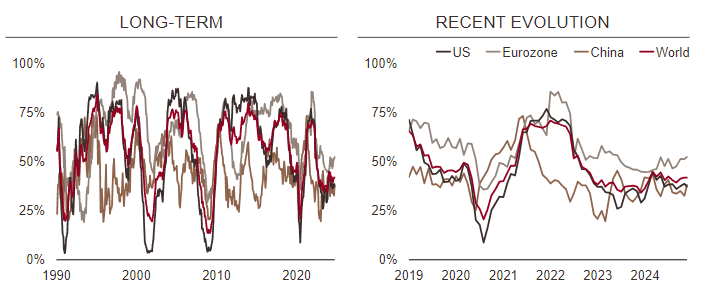

Stock prices fell fast. “Share markets in Asia falling, as did European equity futures. S&P 500 futures fell 0.3%.” The U.S. dollar got stronger, going up 1% against Canada’s money and 2% against Mexico’s money.

People who invest money worry about steady trade and growth. Many money managers are changing where they put their money. Market watchers think prices will keep moving up and down. More people are buying and selling as they move their money around.

North American Trade Disruption

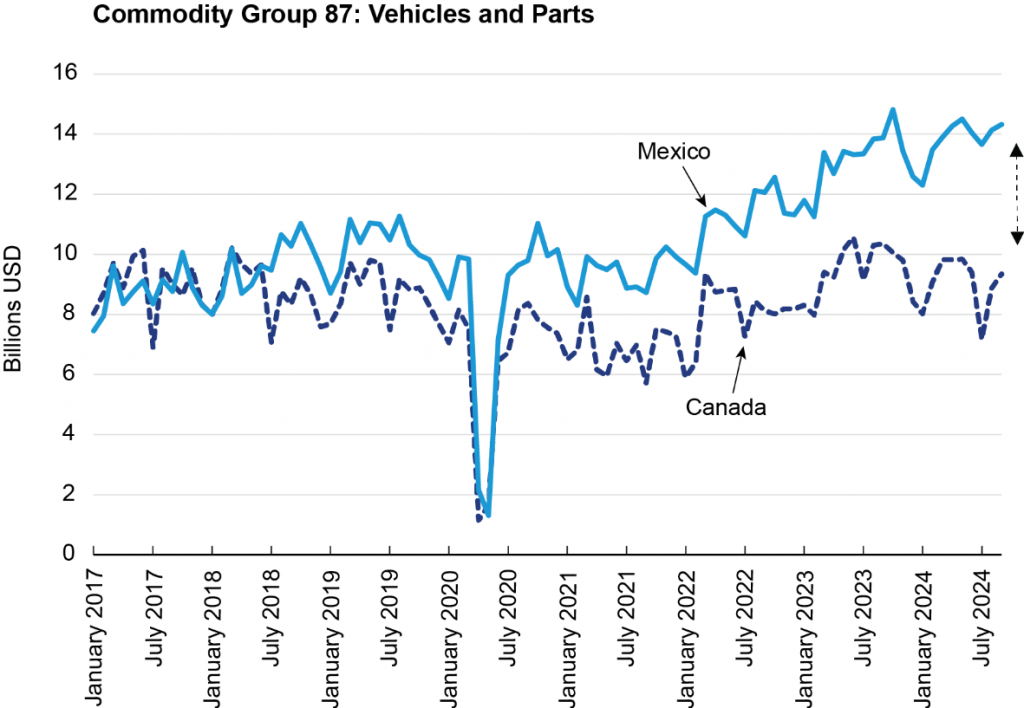

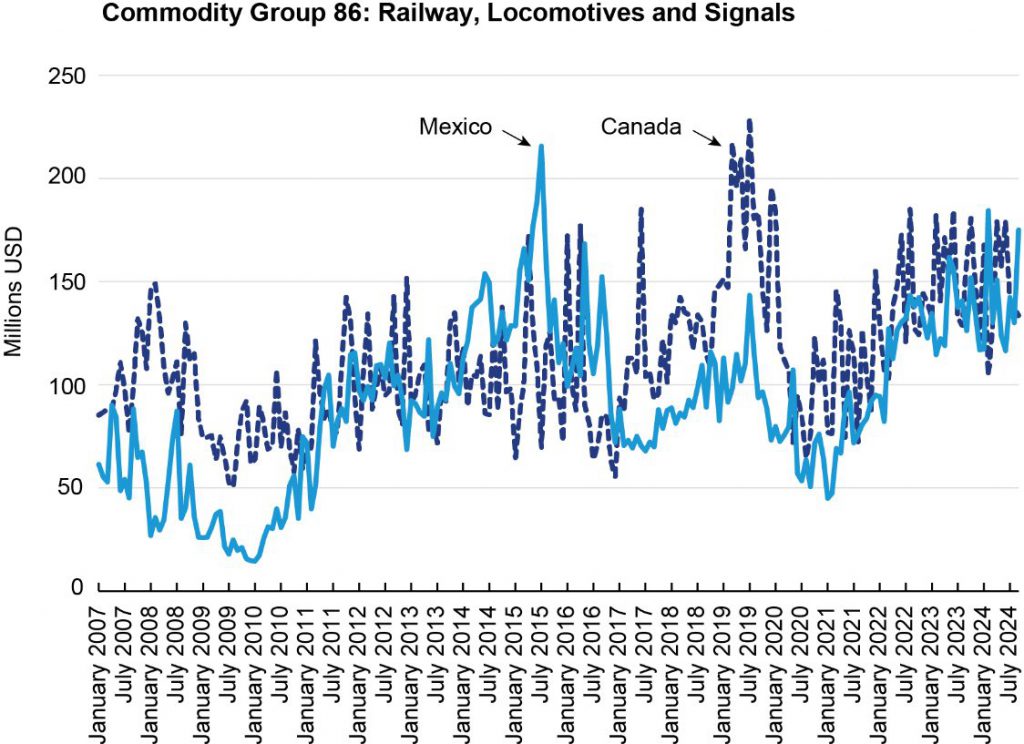

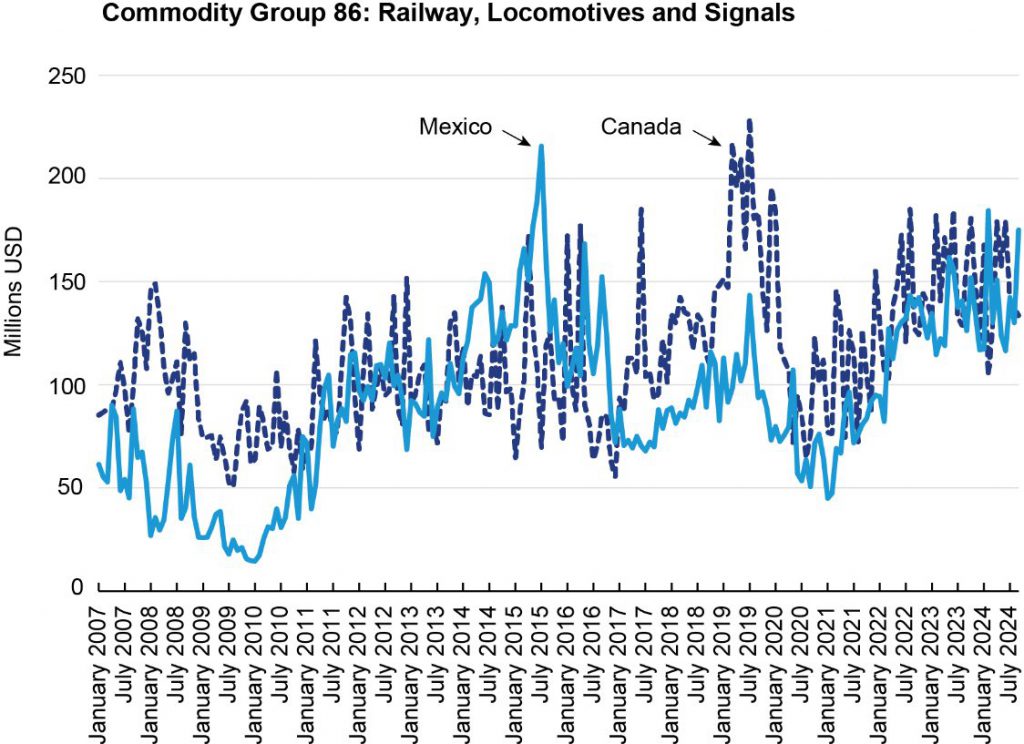

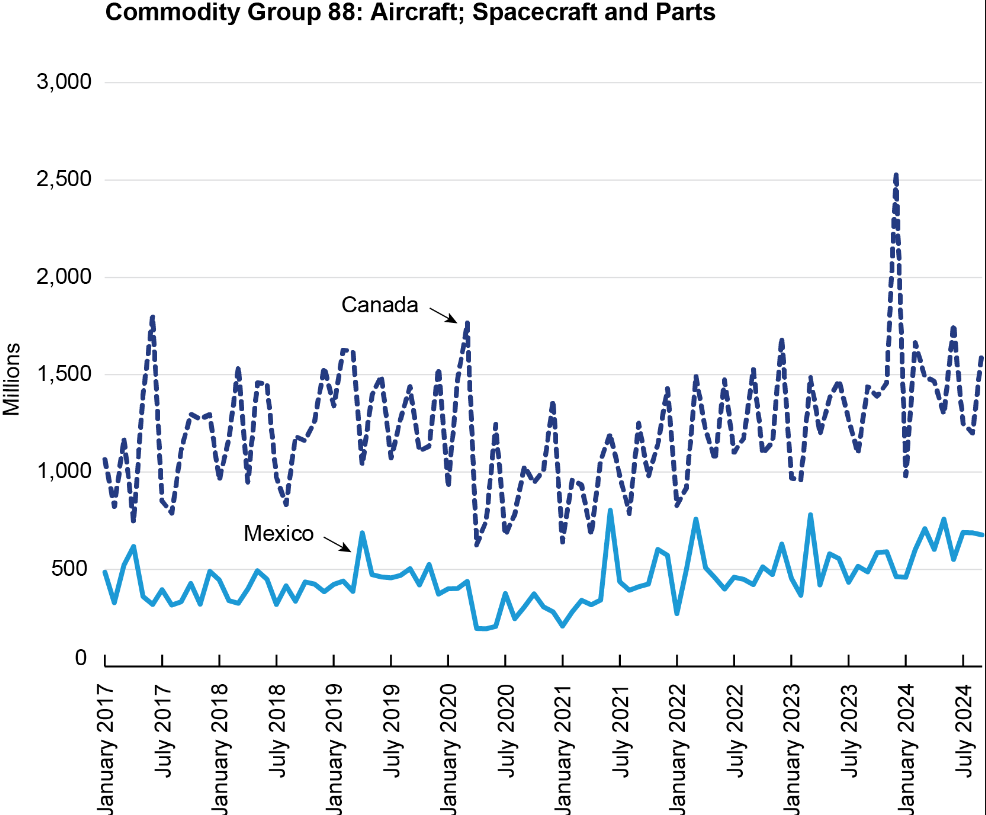

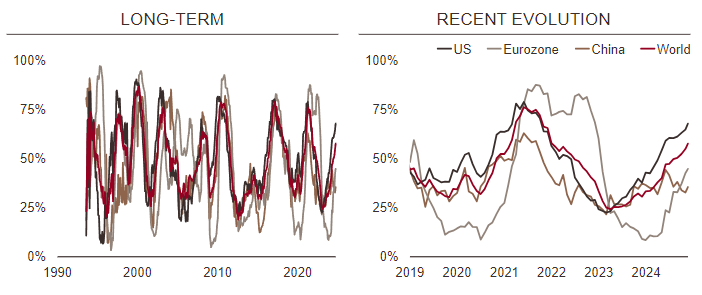

These Trump tariffs might break trade rules. The numbers tell the story: “83% of exports from Mexico went to the U.S. in 2023 and 75% of Canadian exports go to the country.”

This means big changes are coming. Car makers and tech companies must get ready to pay more. They need new ways to make and move their products. Companies in North America must change how they work. Both small shops and big companies rush to adapt.

Also Read: DogWifHat: How High Will WIF Rise After Robinhood Listing?

Chinese Market Impact

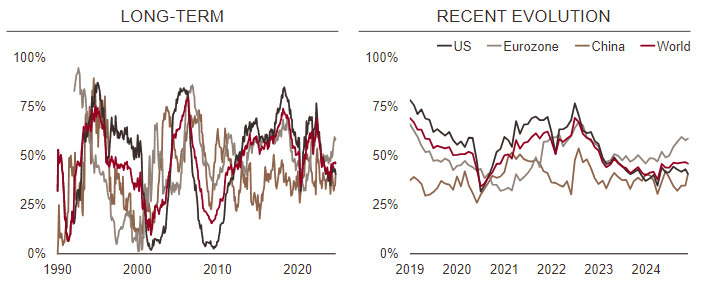

China says plainly: “No one will win a trade war or a tariff war.” These new taxes hit when “the Chinese economy is now in a much more vulnerable position given the country’s prolonged property downturn, debt risks, and weak domestic demand.”

This mix of trouble could shake Asian markets and change world trade. Chinese factory stocks might lose value as they make less money. Nearby countries worry about problems spreading. Market experts think Asian stock markets will swing up and down more.

Economic Implications for Global Markets

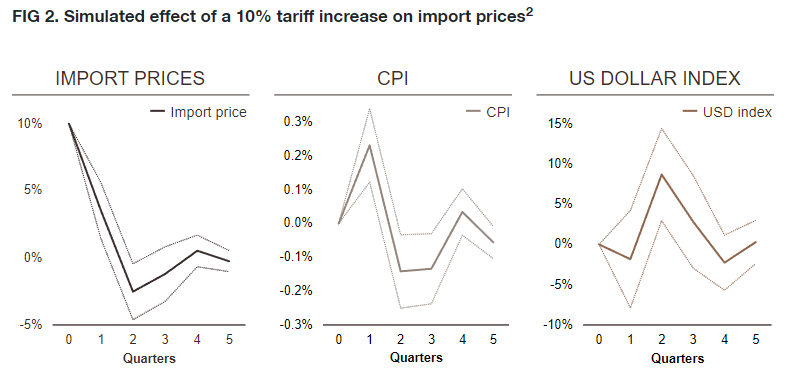

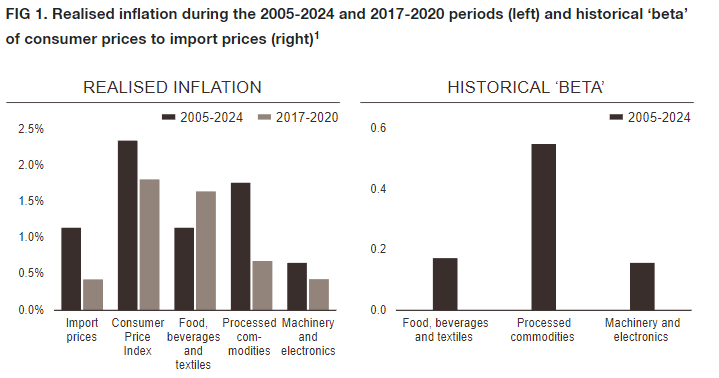

Financial experts say these trade fights will change world business. “Trump’s overall tariff plans would push U.S. import duty rates back up to 1930s-era levels, stoke inflation, collapse U.S.-China trade, draw retaliation and drastically reorder supply chains.”

The effects go beyond today’s drops in price. They could change business forever. Markets that need trade will take time to adjust. Money managers must make new plans. World supply chains face pressure to change.

Also Read: Expert Analysis: Pepe Poised To Outshine SHIB & Doge

Global Stock Market Outlook

Finance watchers say “tariffs are paid by the companies that import the products subject to the duties, and they either pass on the costs to consumers or accept lower profits.” Companies will make less money in many areas. Investors might like companies that make things in their own countries better now.

Money markets show early signs of bigger changes coming. Bond and raw material prices might change too. Stock markets must get used to these new trade rules, showing a big shift in world money flows.

Trading looks more at home markets now. Groups of nearby countries might make new trade deals. Money advisors say to spread investments to stay safer.