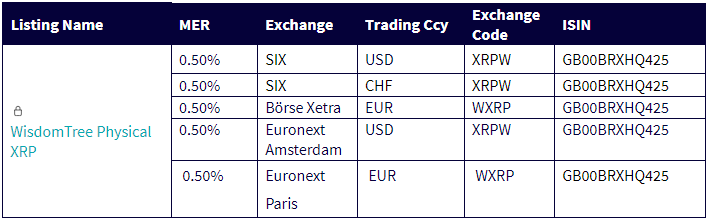

WisdomTree has introduced a new XRP ETP on the SIX Swiss Exchange. This launch gives crypto investors a regulated way to invest in digital assets. The product trades under XRPW:SW. It helps reduce market volatility through professional custody services. Both small and large investors can now access XRP through a secure platform.

Also Read: Ripple: 3 Reasons Why XRP Could Surge To $5

How XRP ETP Impacts Crypto Investors, Market Volatility, and Security Risks

WisdomTree’s Strategic Entry into the XRP Market

The Physical XRP ETP from WisdomTree costs less than any similar European product. The company now offers this service in 15 European nations.

Major markets include Germany, France, and Switzerland. This XRP ETP launch shows how digital assets are joining traditional finance. It combines standard investment methods with new blockchain systems.

Enhanced Security and Regulatory Compliance

The ETP backs each investment with real XRP, and professional custody services protect these assets. This setup cuts down security risks that often worry cryptocurrency holders. Crypto investors get protection through WisdomTree’s security systems. The company has built strong safeguards for digital assets.

Also Read: Crypto Chaos: PNUT Token Owner Sparks Lawsuit Against the Community

Market Performance and Accessibility

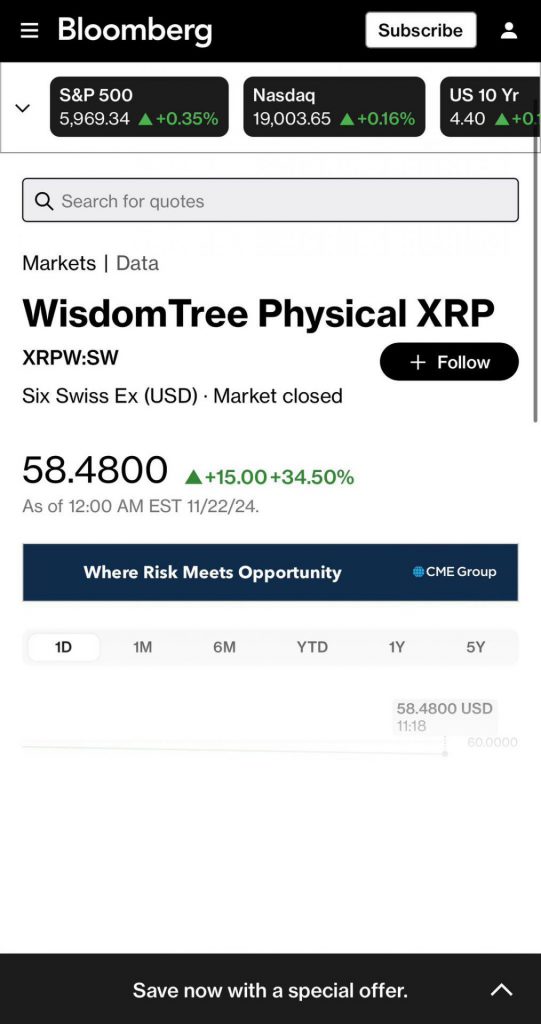

The XRP ETP’s price jumped 34.50% to $58.48 on November 22, 2024. This rise shows strong demand despite market volatility. Investors can buy it on major exchanges like Deutsche Börse Xetra and Euronext. The ETP helps investors manage their portfolios better. Big institutions now trust cryptocurrency markets more.

Future Implications for Digital Asset Investment

Cryptocurrency markets are changing. New U.S. rules may soon arrive. WisdomTree’s XRP ETP leads the way in regulated products. Ripple’s wins against the SEC have helped the market grow. More investors now choose regulated ways to buy cryptocurrency. The product’s success shows growing trust in these investments.

Also Read: Trump’s 25% Tariffs on Canada, Mexico, and China: What it Means for Global Stocks