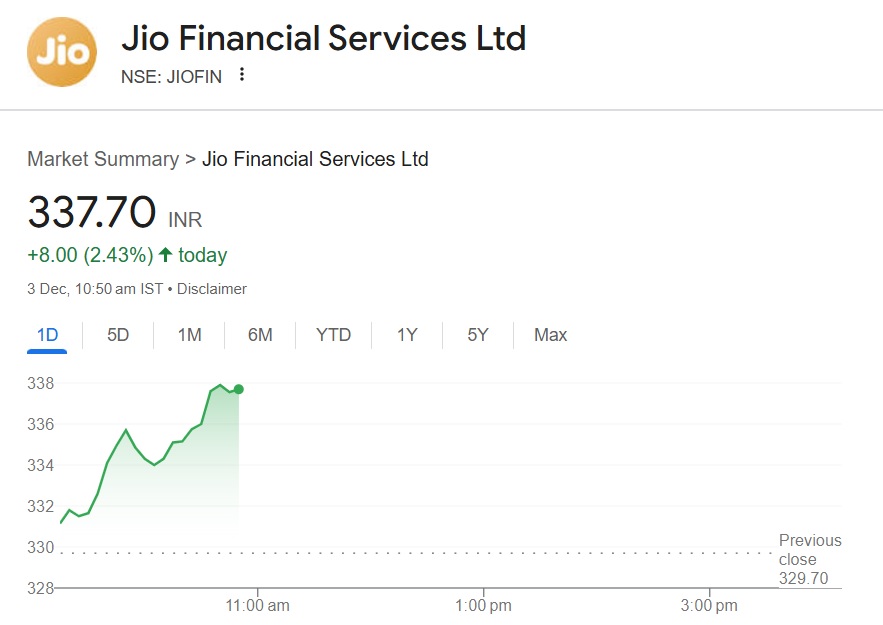

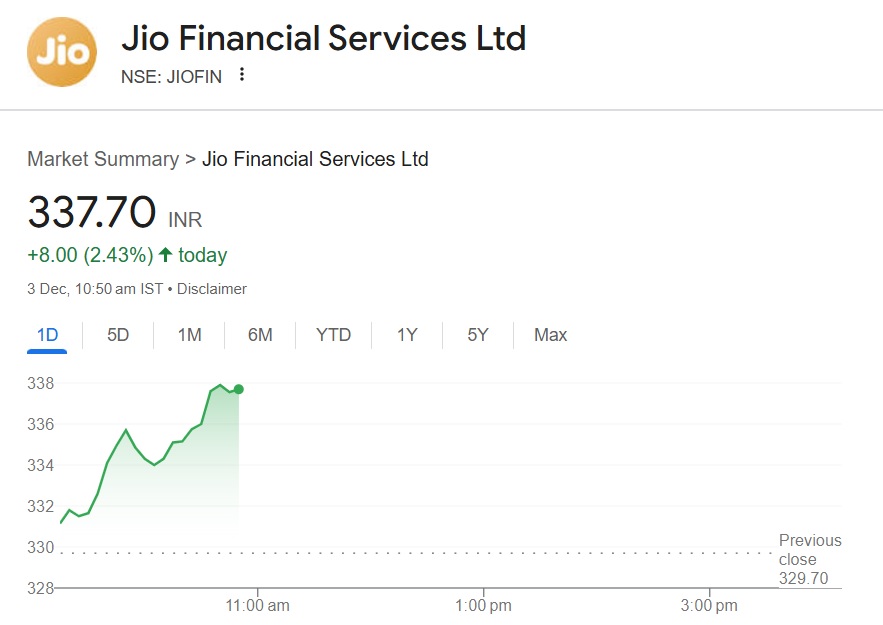

Jio Financial Services shares are slowly clawing back in the charts and reclaiming lost territory. They dipped from a high of 359 in September to a low of 299 in mid-November. They spiked nearly 2.5% on Tuesday and are trading at the Rs 337 mark. Investors who purchased the dip last month are sitting on decent profits today.

Also Read: Amazon Stock (AMZN) Outpaces Dow: Surges 20% in 3 Months

A leading stock market analyst has predicted that Jio Financial shares could reclaim its threshold this month. According to the analyst, the stock could go much higher from 337 and hover around the 355 mark. That’s an uptick and return on investment of approximately 5.5% from its current price of 337.

The analyst advised investors to accumulate the stock and hold on to it until it reaches the 355 mark. Jio Financial shares are on an upward trajectory, and traders could make the most of its rally by buying and accumulating the dips. This puts the stock in the ‘buy’ target, as another leg-up is on the cards.

Also Read: Microsoft: Could Bitcoin Shift Lead MSFT to Record 2025?

“Jio Financial shares are hovering around Rs 325 levels. One can accumulate the stock at current levels for an upside target of Rs 355, keeping a stop loss at Rs 300,” Osho Krishan, Senior Research Analyst Technical & Derivatives at Angel One, told Business Today.

Jio Financial Shares: The Next Multibagger?

Several leading analysts predict that Jio Financial shares could be the next multi-bagger that can generate massive gains. Analysts reveal that holding on to the stock for the long term could deliver mind-blowing profits. Its price could enter new territory in the next five and 10 years as its mutual funds business expands.

Also Read: META AI Could Drive $10B Revenue Growth: What it Means for the Stock

The tie-up with BlackRock is making Jio Financial shares the most sought-after stock in the markets. Analysts predict that it could climb above the 1,000 mark within the next 10 years. That’s almost tripling investors’ money in the next decade.