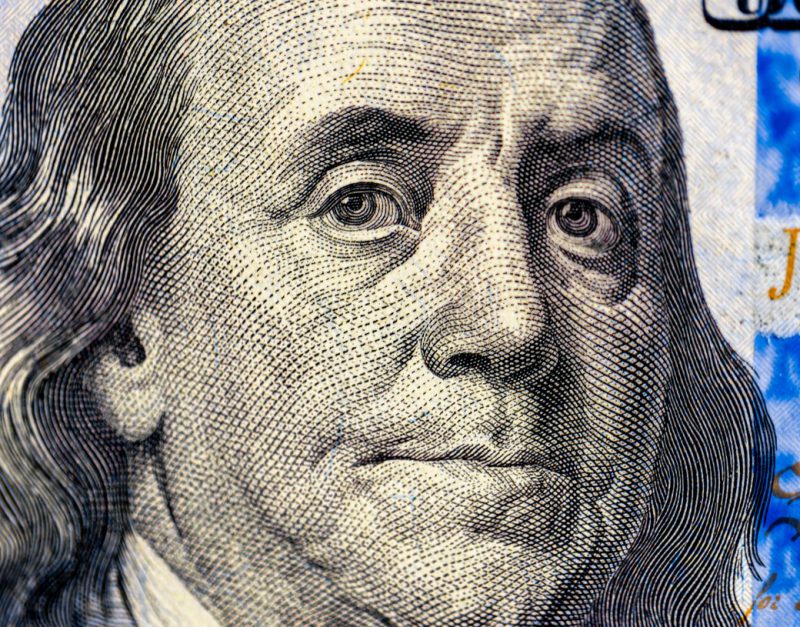

UBS, a leading financial service provider, recently shared a new analysis on the US Dollar. The firm was quick to note the recent dollar rallies, adding more power to the currency, but has also predicted a mild scope of volatility that may cause disruptions in the US dollar’s long-term scaling plans.

Also Read: $200K Bitcoin (BTC) in Sight by 2025, Predicts Bitfinex

UBS Predicts New Details About The US Dollar

UBS, in a recently released statement, has outlined striking new pointers for investors to take note of. For instance, the financial giant believes the US dollar will continue to thrive as the strong US political momentum may help the currency establish strategic control. With Trump ascending towards the White House and pledging to protect the USD in the long haul, the current sentiment is pushing the USD to scale new highs, ushering in new gains for the greenback to bask in.

“The second term of President Trump, along with the Republican Party’s control of Congress. This has led to a significant strengthening of the US dollar. The dollar index has climbed around 6% since the start of October, marking its seventh straight weekly gain.”

The US dollar has also gained immense traction due to investor expectations of dollar-positive policies that Trump may bring in the long haul.

“US dollar strength has arisen on investor expectations of dollar-positive policies such as domestic tax cuts and widespread imposition of tariffs with the aim of restoring US manufacturing competitiveness.”

UBS later predicted that with the current strategies in line, USD could gain stable ground but may encounter friction from its “European peers.”

“Markets’ expectations for a shallower path of Federal Reserve rate cuts also look overdone to us—we forecast 125 basis points of additional US rate cuts by the end of next year, as opposed to the 72 bps priced as of today. So, we think the US dollar has scope to correct this overshoot by declining. By contrast, the market expectation for 146 bps of European Central Bank easing by the end of next year looks too aggressive compared to our expectation for 125 bps of rate cuts. We therefore see a path for gradual euro appreciation.”

Also Read: Fed’s 3rd Rate Cut Due Today: What a 0.25% Drop Means for Crypto Markets

USD Gains Momentum Again

The US dollar crushed major global currencies on Tuesday as fresh commercial data revealed a positive retail sales outlook. The data has been touted as ‘better than expectations,” prompting the American currency to rise high. The US dollar is currently sitting at 106 at press time.

Per the data released by the commerce department, US retail sales surpassed expectations by soaring by 0.7% in November.

“The market is trying to debate whether it’s time to fade the dollar. Which has had an incredible run this year.” Said Marvin Loh, senior global market strategist at State Street in Boston.”

Also Read: Ripple: XRP To Surge To $3, New Analyst Boldly Predicts