The first hybrid Bitcoin-Ethereum ETFs got SEC approval on December 19, 2024. The Securities and Exchange Commission cleared two new funds that combine both cryptocurrencies: Hashdex’s Nasdaq Crypto Index US ETF and Franklin Templeton’s Crypto Index ETF.

Senior Bloomberg ETF analyst Eric Balchunas stated, “They’re market cap weight so 80/20 BTC/ETH approx. Notable that Hashdex & Frankie are first. Good for them.”

The spot bitcoin/ether combo ETFs have been approved by SEC (as predicted). Launch likely in January. They’re mkt cap weight so 80/20 btc/eth approx. Notable that Hashdex & Frankie are first. Good for them. https://t.co/o2ri3XpqZi

— Eric Balchunas (@EricBalchunas) December 20, 2024

Also Read: Cardano Price Prediction For The End Of 2024: Can ADA Breach $1.5?

How SEC-Approved Bitcoin-Ethereum ETFs Address Market Volatility & Security Risks

Regulatory Framework and Security Measures

The SEC spent six months reviewing the hybrid Bitcoin-Ethereum ETFs. The SEC filing states, “The proportion of bitcoin and ether to be held by each Trust will be based on free-float market capitalizations.” These cryptocurrency ETFs must be transparent about their holdings and prices. Like regular stocks, they update their values every 15 seconds during trading.

Market Impact and Trading Dynamics

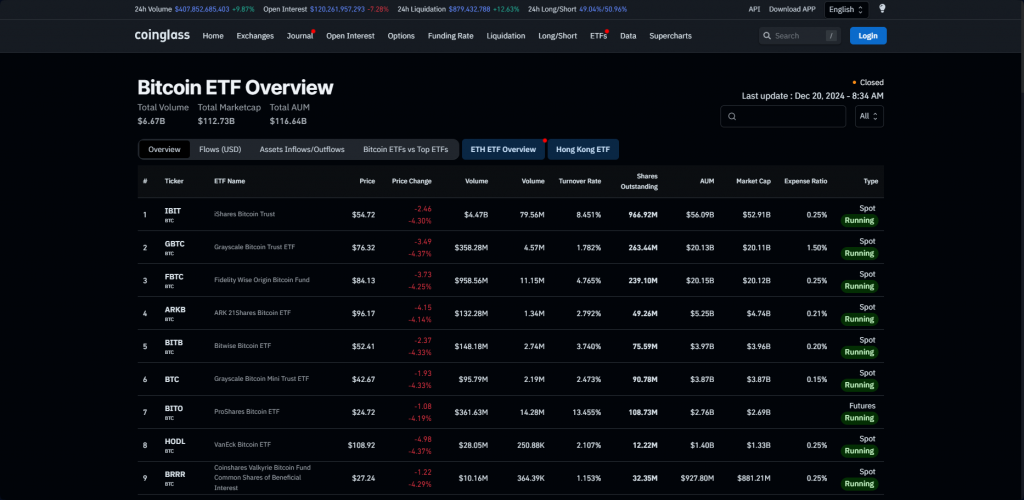

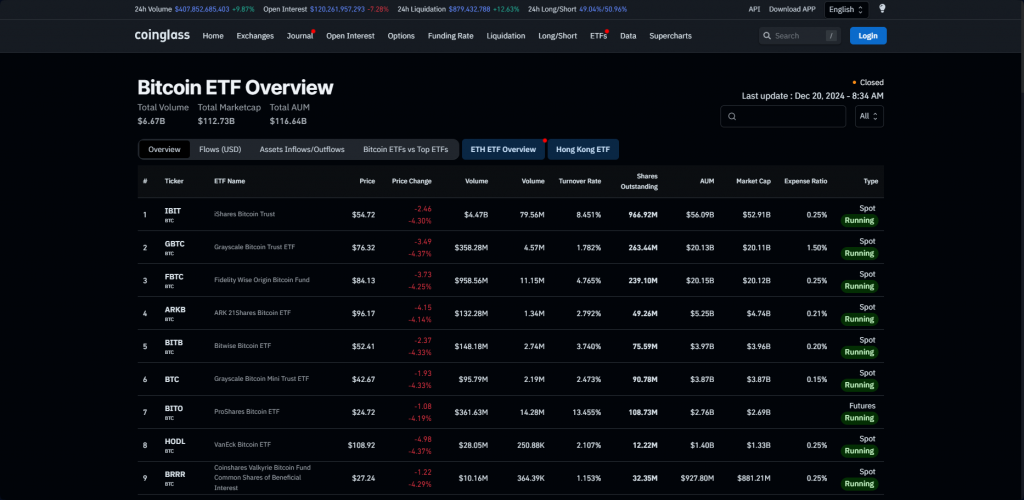

In the Bitcoin ETF space, BlackRock’s IBIT leads with $56 billion. Both Fidelity’s FBTC and Grayscale’s GBTC manage $20 billion each. Recent numbers show investors pulled $671 million from major funds on December 19. Meanwhile, the Ethereum ETF sector keeps drawing in big investors.

Also Read: Quantum Stock (QUBT) Surge Outshines Nvidia (NVDA)

Investment Structure and Oversight

Will be interesting to see if BlackRock or others attempt to piggyback on this & launch similar ETFs…

— Nate Geraci (@NateGeraci) December 19, 2024

Regardless, I expect there will be meaningful demand for these products.

Advisors LOVE diversification.

Especially in an emerging asset class such as crypto.

The SEC fast-tracked these hybrid Bitcoin-Ethereum ETFs since they work like already-approved crypto funds. Exchanges must share their trading data to spot and stop any market manipulation. This protects people who invest in these new funds.

Also Read: Avalanche AVAX Price Prediction: Can it Hit $100 by 2026?

Future Market Expectations

Experts think many people will want these hybrid cryptocurrency ETFs. Nate Geraci, president of the ETF Store, notes, “Advisors love diversification, especially in an emerging asset class such as crypto. I expect there will be meaningful demand for these products.” The SEC now accepts funds that combine two cryptocurrencies if they follow the rules.

Market Response and Implementation

The cryptocurrency ETF from Franklin Templeton shows how far crypto investing has come. When the hybrid Bitcoin-Ethereum ETFs start in January, people can invest in both major cryptocurrencies at once. This comes as big financial firms enter crypto and rules become clearer.

Also Read: Dogecoin (DOGE) Predicted to Rebound From December Fall: Here’s When